Question: PLEASER HELPPP MEEE Dollar cost averaging is a strategy where you purchase in an asset at ________. This strategy helps you to avoid trying to

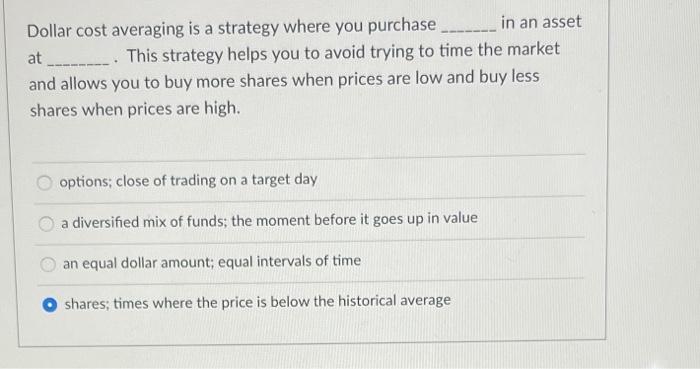

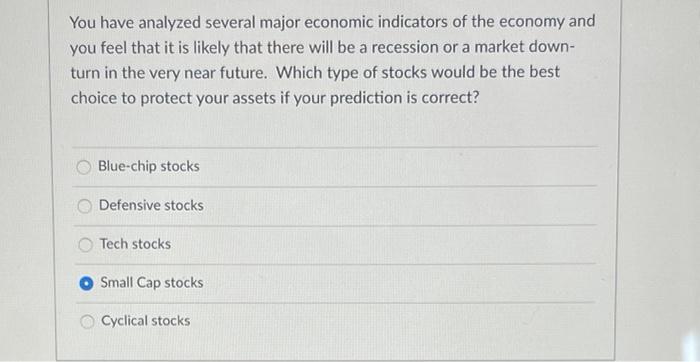

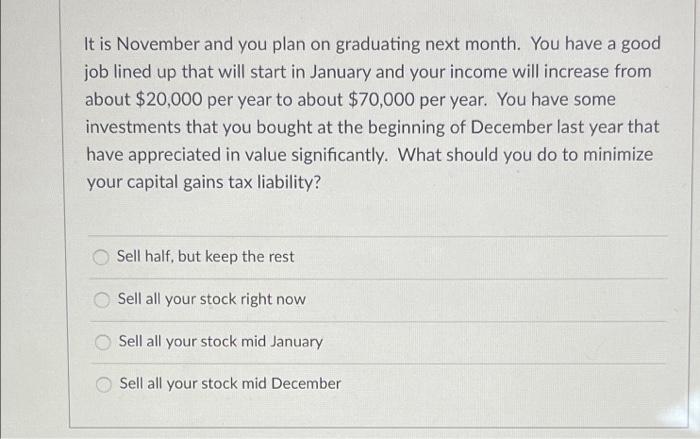

Dollar cost averaging is a strategy where you purchase in an asset at ________. This strategy helps you to avoid trying to time the market and allows you to buy more shares when prices are low and buy less shares when prices are high. options: close of trading on a target day a diversified mix of funds; the moment before it goes up in value an equal dollar amount; equal intervals of time shares; times where the price is below the historical average You have analyzed several major economic indicators of the economy and you feel that it is likely that there will be a recession or a market down- turn in the very near future. Which type of stocks would be the best choice to protect your assets if your prediction is correct? Blue-chip stocks Defensive stocks Tech stocks Small Cap stocks Cyclical stocks It is November and you plan on graduating next month. You have a good job lined up that will start in January and your income will increase from about $20,000 per year to about $70,000 per year. You have some investments that you bought at the beginning of December last year that have appreciated in value significantly. What should you do to minimize your capital gains tax liability? Sell half, but keep the rest Sell all your stock right now Sell all your stock mid January Sell all your stock mid December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts