Answered step by step

Verified Expert Solution

Question

1 Approved Answer

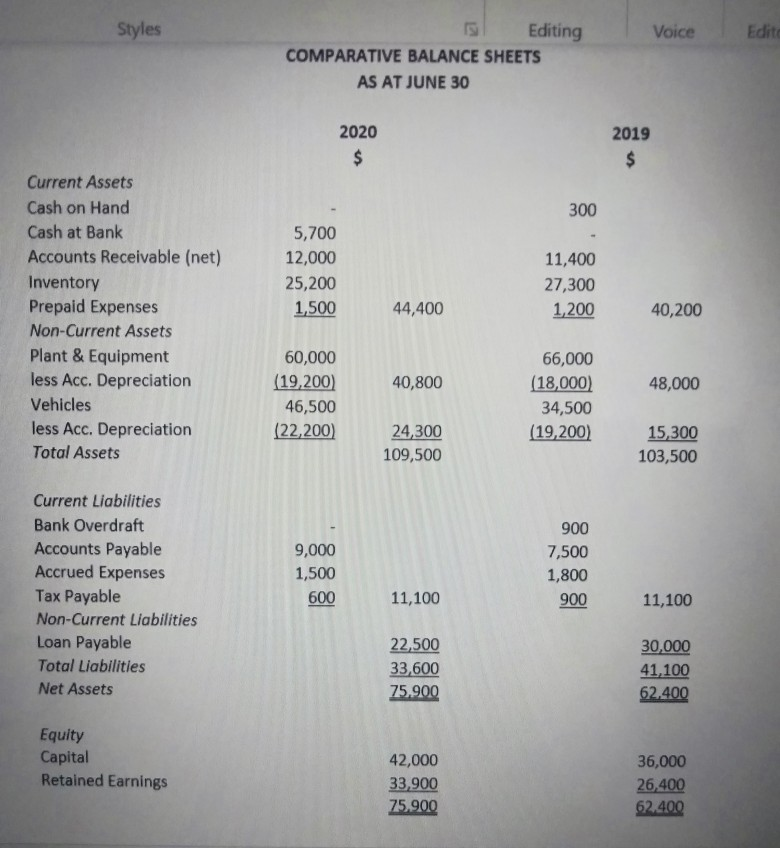

pleasr make cash flow statement of following with their calculation using this format Styles Voice Edite Editing COMPARATIVE BALANCE SHEETS AS AT JUNE 30 2020

pleasr make cash flow statement of following with their calculation

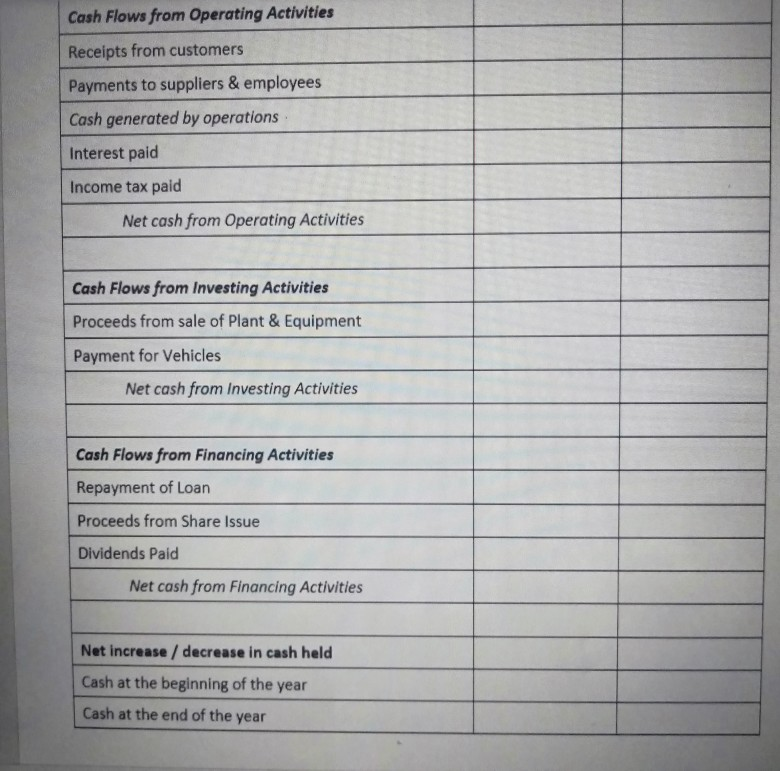

using this format

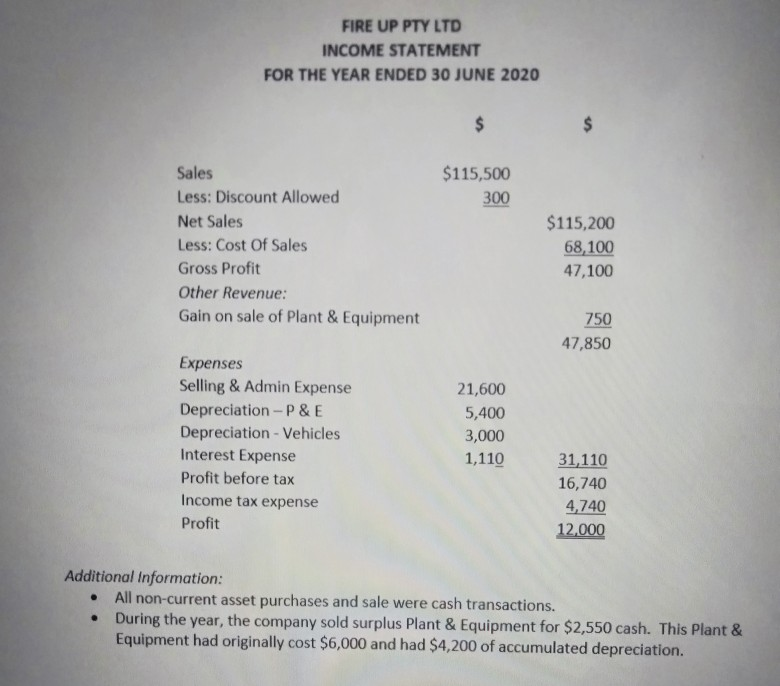

Styles Voice Edite Editing COMPARATIVE BALANCE SHEETS AS AT JUNE 30 2020 2019 $ $ $ 300 Current Assets Cash on Hand Cash at Bank Accounts Receivable (net) Inventory Prepaid Expenses Non-Current Assets Plant & Equipment less Acc. Depreciation Vehicles less Acc. Depreciation Total Assets 5,700 12,000 25,200 1,500 11,400 27,300 1,200 44,400 40,200 40,800 48,000 60,000 (19,200) 46,500 (22,200) 66,000 (18,000) 34,500 (19,200) 24,300 109,500 15,300 103,500 Current Liabilities Bank Overdraft Accounts Payable Accrued Expenses Tax Payable Non-Current Liabilities Loan Payable Total Liabilities Net Assets 9,000 1,500 600 900 7,500 1,800 900 11,100 11,100 22,500 33,600 75.900 30,000 41,100 62.400 Equity Capital Retained Earnings 42,000 33,900 75.900 36,000 26,400 62.400 FIRE UP PTY LTD INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2020 $115,500 300 Sales Less: Discount Allowed Net Sales Less: Cost Of Sales Gross Profit Other Revenue: Gain on sale of Plant & Equipment $115,200 68,100 47,100 750 47,850 Expenses Selling & Admin Expense Depreciation - P&E Depreciation - Vehicles Interest Expense Profit before tax Income tax expense Profit 21,600 5,400 3,000 1,110 31,110 16,740 4,740 12.000 Additional information: All non-current asset purchases and sale were cash transactions. . During the year, the company sold surplus Plant & Equipment for $2,550 cash. This Plant & Equipment had originally cost $6,000 and had $4,200 of accumulated depreciation. Cash Flows from Operating Activities Receipts from customers Payments to suppliers & employees Cash generated by operations Interest paid Income tax paid Net cash from Operating Activities Cash Flows from Investing Activities Proceeds from sale of Plant & Equipment Payment for Vehicles Net cash from Investing Activities Cash Flows from Financing Activities Repayment of Loan Proceeds from Share Issue Dividends Paid Net cash from Financing Activities Net increase / decrease in cash held Cash at the beginning of the year Cash at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started