Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASS DO ALL REQUIREMENTS MegaTron produces jes bridges for many domestic and intermationab aiports. Cost information tor Megatron's jet bridges it as folows: (Cick the

PLEASS DO ALL REQUIREMENTS

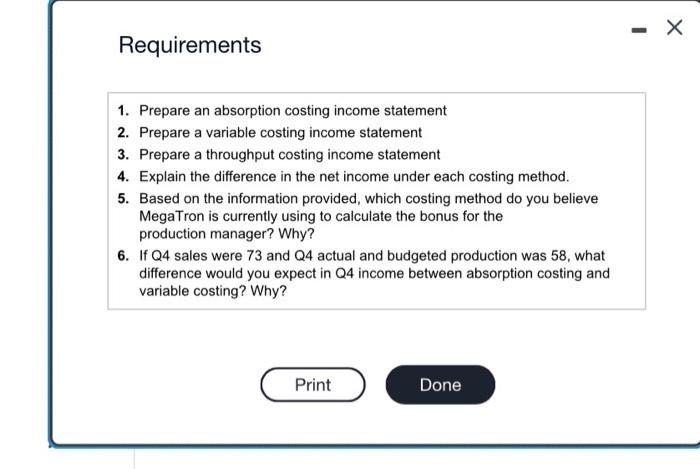

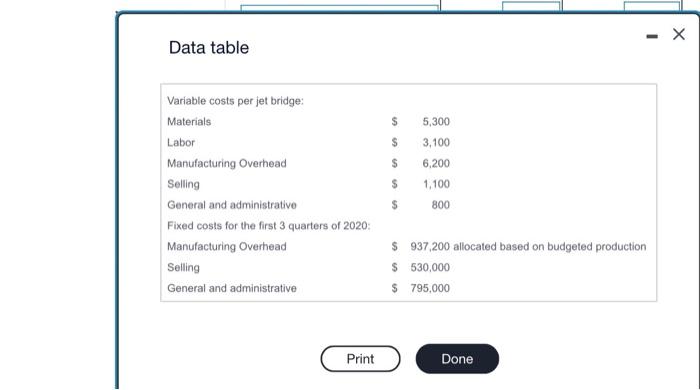

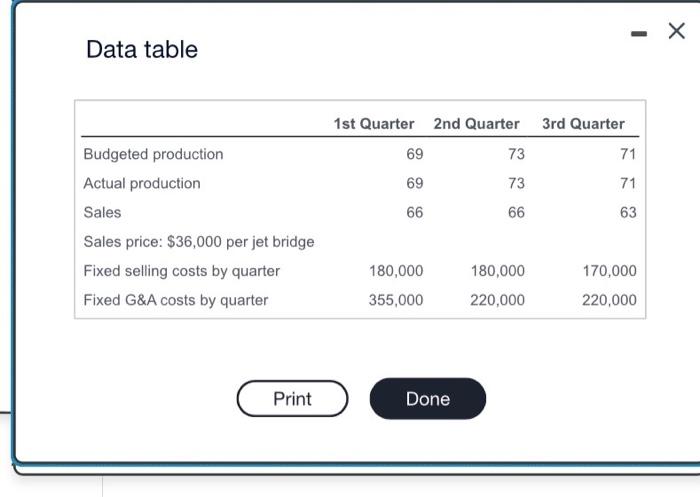

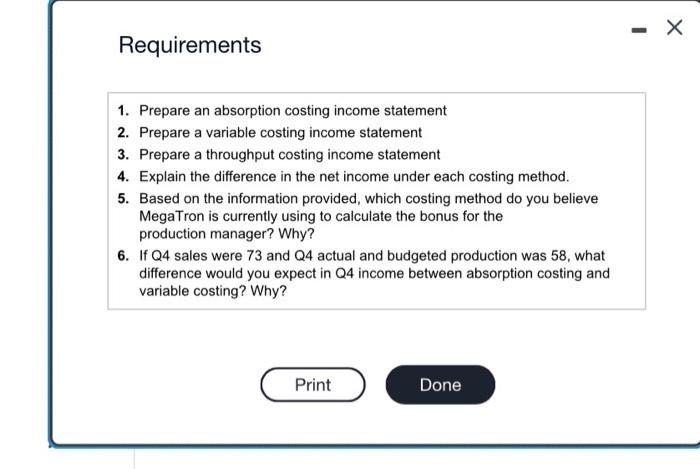

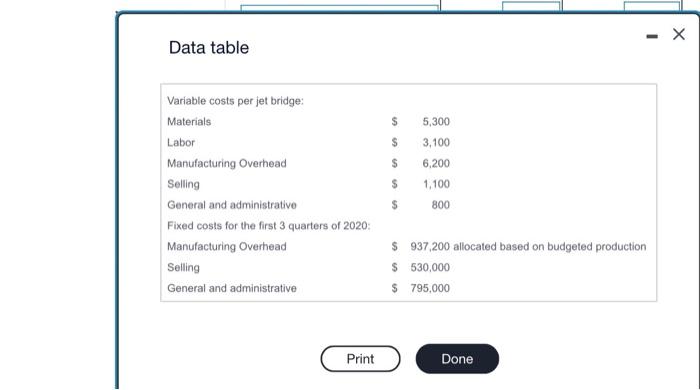

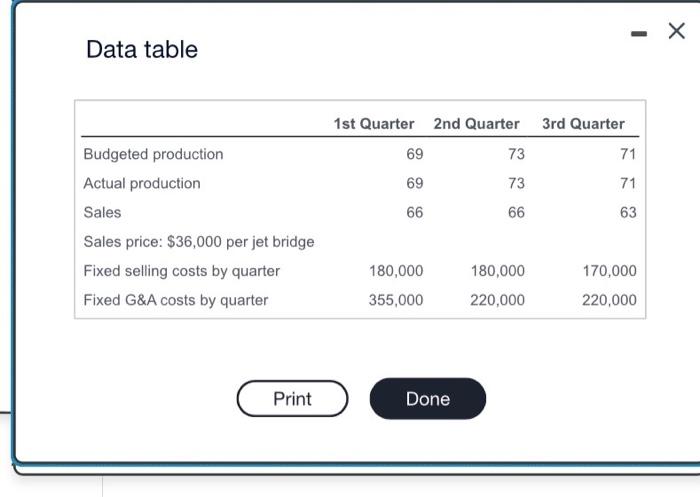

MegaTron produces jes bridges for many domestic and intermationab aiports. Cost information tor Megatron's jet bridges it as folows: (Cick the iogn to viewe the cost intomations) Addifonal indoemation for the first three quaders of 2060 lor MegaTroa we shown beicw: (Cick the icon lo vien the adistionak inlamation for the frst the ouaners.) MegaTron's controler, Poul wishes bo arslyce the diflesence ia the ineome stalemecte tetineter troughput casfing. absorption corfing, and variable costing for the find 3 quertes of 20es. Asscme no begining inventory. Feiad the teauitements. selling, geseral and administrablve) Requirements 1. Prepare an absorption costing income statement 2. Prepare a variable costing income statement 3. Prepare a throughput costing income statement 4. Explain the difference in the net income under each costing method. 5. Based on the information provided, which costing method do you believe MegaTron is currently using to calculate the bonus for the production manager? Why? 6. If Q4 sales were 73 and Q4 actual and budgeted production was 58 , what difference would you expect in Q4 income between absorption costing and variable costing? Why? Data table Data table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started