Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pleease help. I need help with D, E, G, and 1 and 2 and three..PLEASE ONLY HELP IF YOU CAN DO IT ALL THANK U

Pleease help. I need help with D, E, G, and 1 and 2 and three..PLEASE ONLY HELP IF YOU CAN DO IT ALL THANK U I AM CONFUSED

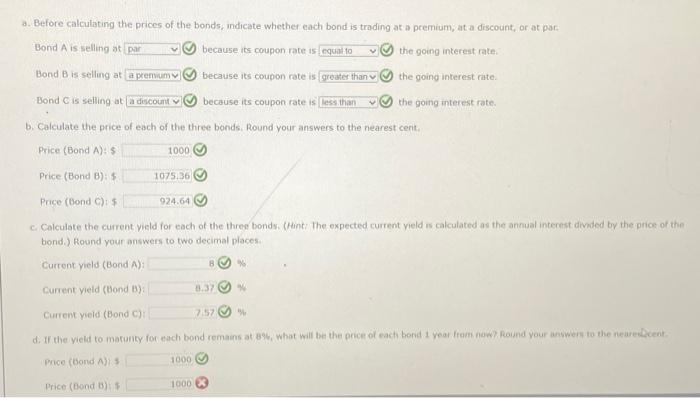

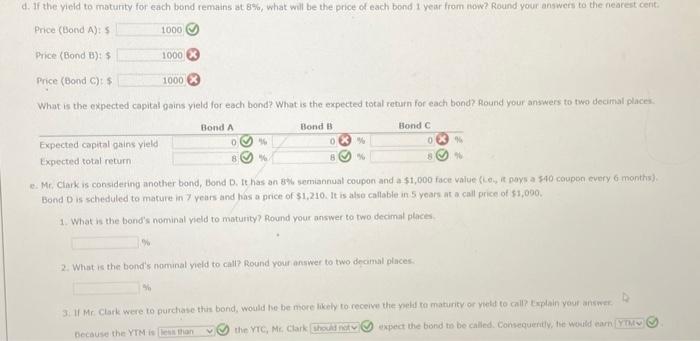

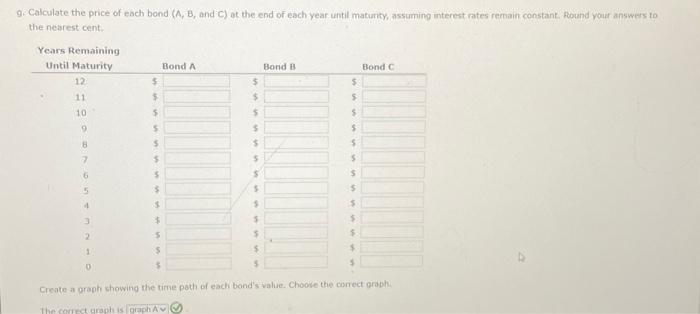

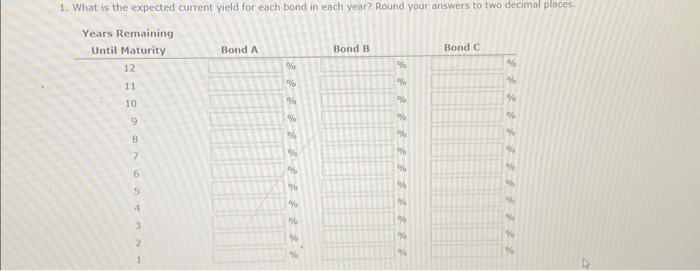

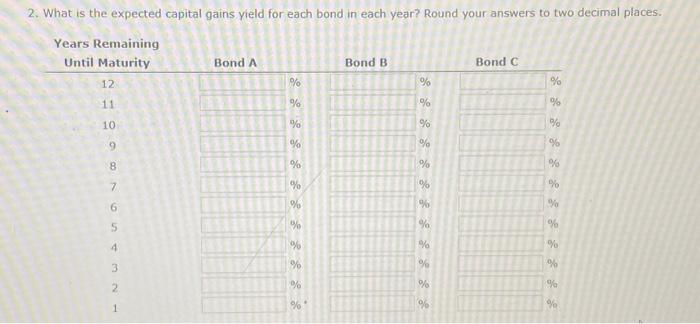

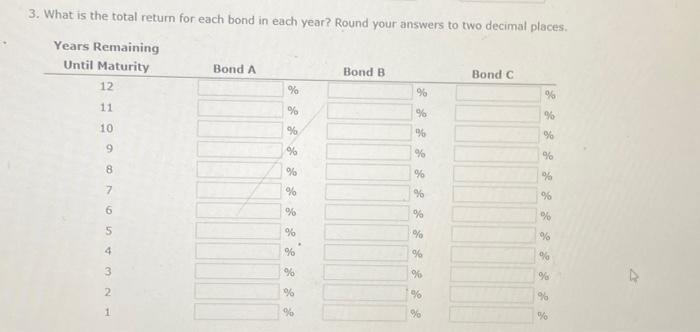

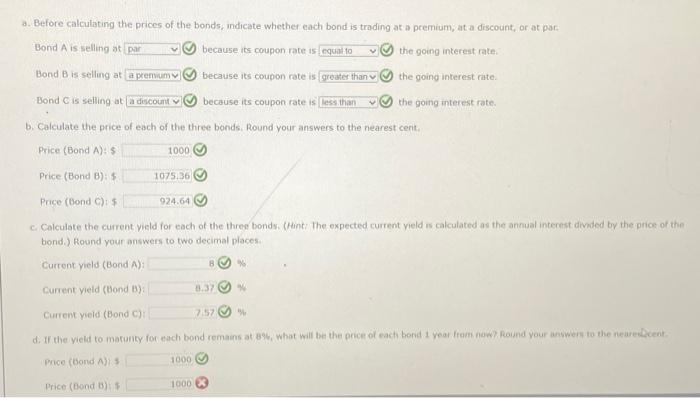

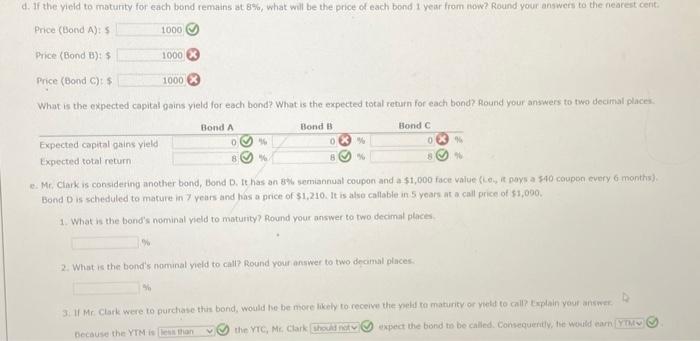

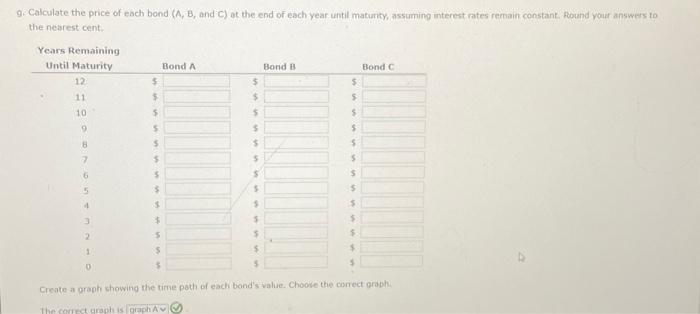

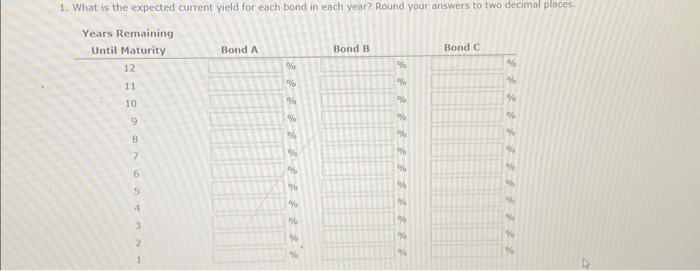

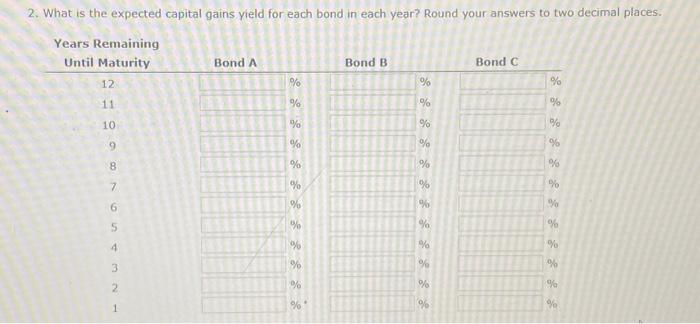

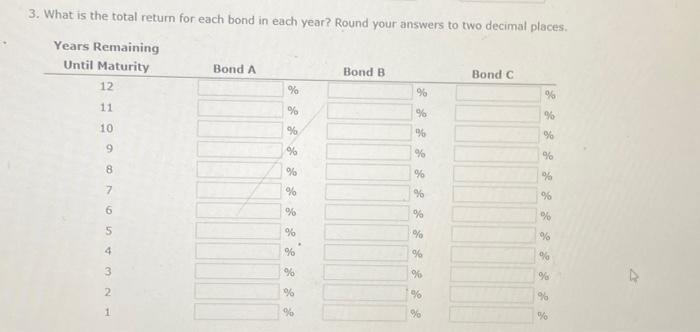

9. Calculate the price of each bond (A,B, and C) at the end of each year until maturity, assuming interest rates remain constaint. Pound your answers to the nearest cent. Create a oraph showing the time path of each bond's valie. Choose the conect groph. Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has sugpested the following bonds: - Bond A has an 8% onnual coupon, matures in 12 years, and has a $1,000 face value. - Bond 8 has a 9% annual coupon, matures in 12 years, and has a $1,000 face yalue. - Bond C has a 7% annual coupon, matures in 12 vears, and has o 51,000 face value. Each bond has a yield to maturity of 8%. The data has been collected in the Microsolt Excel file below. Download the spreadsheet and perform the requared analysis to answer the quentinns below. Bo 2. What is the expected capital gains yield for each bond in each year? Round your answers to two decimal places. a. Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par: Bond A is selling at (5) because its coupon rate is (5) the going interest rate. Bond B is selling at because its coupon rate is (5) the going interest rate. Bond C is selling at because its coupon rate is (5 the going interest rate. b. Calculate the price of each of the three bonds. Round your answers to the nearest cent. Price (Bond A):$ Price (Bond 8 ) : $. Price (Bond C) i $ c. Calculate the current vield for each of the three bonds. (Hint: The expected current veld is calculated as the annual interest divided by the price of the bond.) flound your answers to two decimal places. Current vield (Bond A) : Current yield (Bond B): Cument yeld (Bond C): Price ( oond A)} Price (Eond b) is 1. What is the expected current yield for each bond in each year? Round your answers to two decimal places: Years Remaining Mr, Clark is considering another bond, Bond D, te has an Bw, semiannual coupon and a \$1,000 face value (ce, it poys a $40 coupon cvery 6 months). Bond 0 is scheduled to mature in 7 years and has a price of $1,210. It is also callable in 5 years at a call price of $1,090. 1. What is the bond's nominal vield to maturity? Round your answer to two decimal place 2. What is the bond's nominal veld to call? Round your answer to two decimal places: Because the YTM is (6) expect the biond to be called. Consequerativ, the wontd cam 3. What is the total return for each bond in each year? Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started