Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pleese only on excel Formative 1 week 2 Find the solutions for the below exercises using Excel, at the end of the assessment you have

Pleese only on excel

Formative week

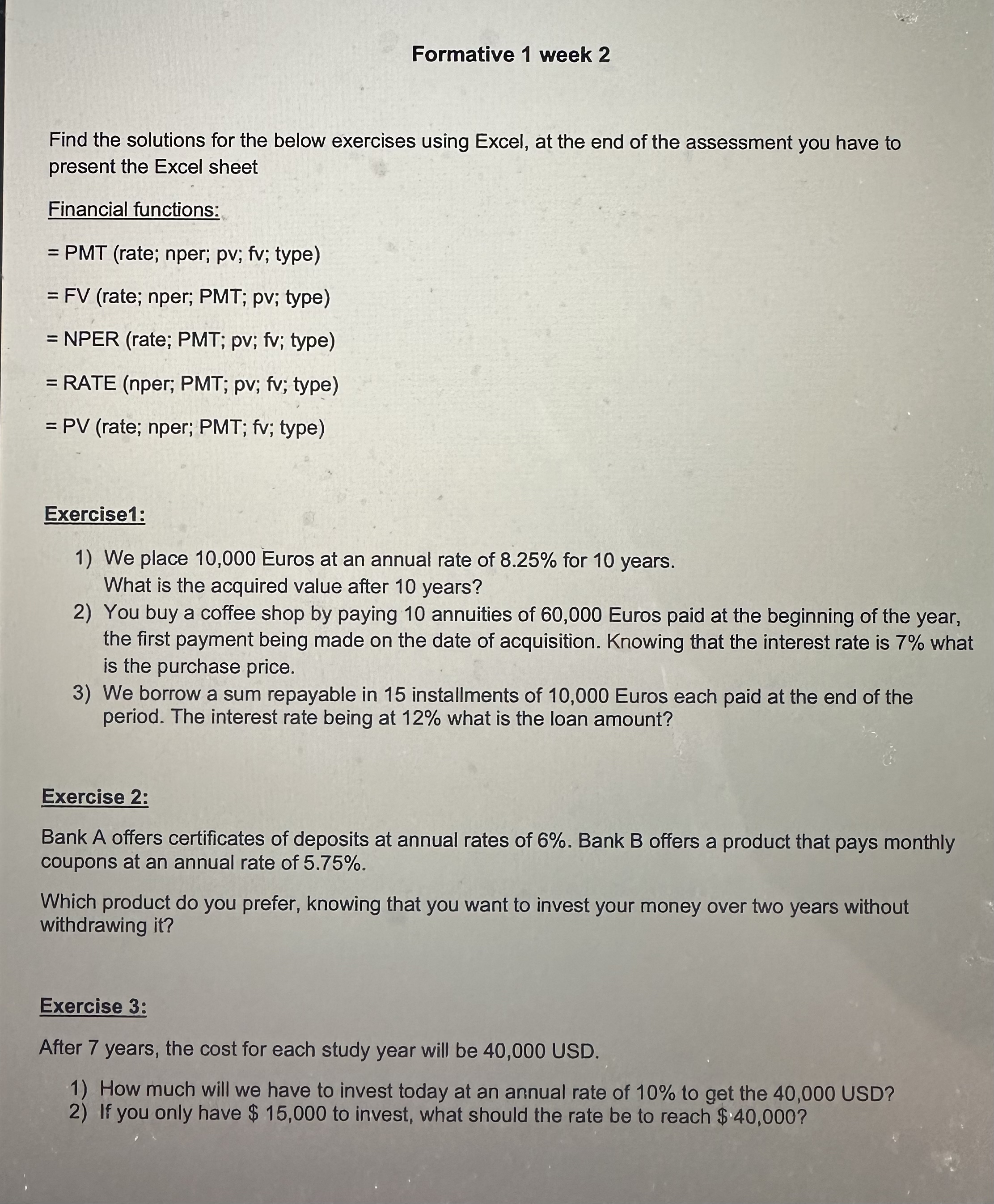

Find the solutions for the below exercises using Excel, at the end of the assessment you have to present the Excel sheet

Financial functions:

PMT rate; nper; pv; fv; type

FV rate; nper; PMT; pv; type

NPER rate; PMT; pv; fv; type

RATE nper; PMT; pv; fv; type

PV rate; nper; PMT; fv; type

Exercise:

We place Euros at an annual rate of for years. What is the acquired value after years?

You buy a coffee shop by paying annuities of Euros paid at the beginning of the year, the first payment being made on the date of acquisition. Knowing that the interest rate is what is the purchase price.

We borrow a sum repayable in installments of Euros each paid at the end of the period. The interest rate being at what is the loan amount?

Exercise :

Bank A offers certificates of deposits at annual rates of Bank B offers a product that pays monthly coupons at an annual rate of

Which product do you prefer, knowing that you want to invest your money over two years without withdrawing it

Exercise :

After years, the cost for each study year will be USD.

How much will we have to invest today at an annual rate of to get the USD?

If you only have $ to invest, what should the rate be to reach $

Exercise :

For how long must a sum be deposited in an account paying compound interest in order to double in value?

Exercise :

At the end of each quarter, a yearoldwoman puts $ in a retirement account that pays interest compounded quarterly. When she reaches she withdraws the entire amount and places it in a mutual fund that pays interest compounded monthly. From then on she deposits $ in the mutual fund at the end of each month. Howmuch is in the account when she reaches age

Exercise :

Mateo sells some land in Malta. She will be paid a lump sum of $ in years. Until then, the buyer pays simple interest quarterly.

Find the amount of each quarterly interest payment on the $

The buyer sets up a sinking fund so that enough money will be present to pay off the $ The buyer will make semiannual payments into the sinking fund; the account pays compounded semiannually. Find the amount of each payment into the fund.

Formative week

Find the solutions for the below exercises using Excel, at the end of the assessment you have to present the Excel sheet

Financial functions:

PMT rate; nper; pv; fv; type

FV rate; nper; PMT; pv; type

NPER rate; PMT; pv; fv; type

RATE nper; PMT; pv; fv; type

PV rate; nper; PMT; fv; type

Exercise:

We place Euros at an annual rate of for years. What is the acquired value after years?

You buy a coffee shop by paying annuities of Euros paid at the beginning of the year, the first payment being made on the date of acquisition. Knowing that the interest rate is what is the purchase price.

We borrow a sum repayable in installments of Euros each paid at the end of the period. The interest rate being at what is the loan amount?

Exercise :

Bank A offers certificates of deposits at annual rates of Bank B offers a product that pays monthly coupons at an annual rate of

Which product do you prefer, knowing that you want to invest your money over two years without withdrawing it

Exercise :

After years, the cost for each study year will be USD.

How much will we have to invest today at an annual rate of to get the USD?

If you only have $ to invest, what should the rate be to reach $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started