plese solve this two question

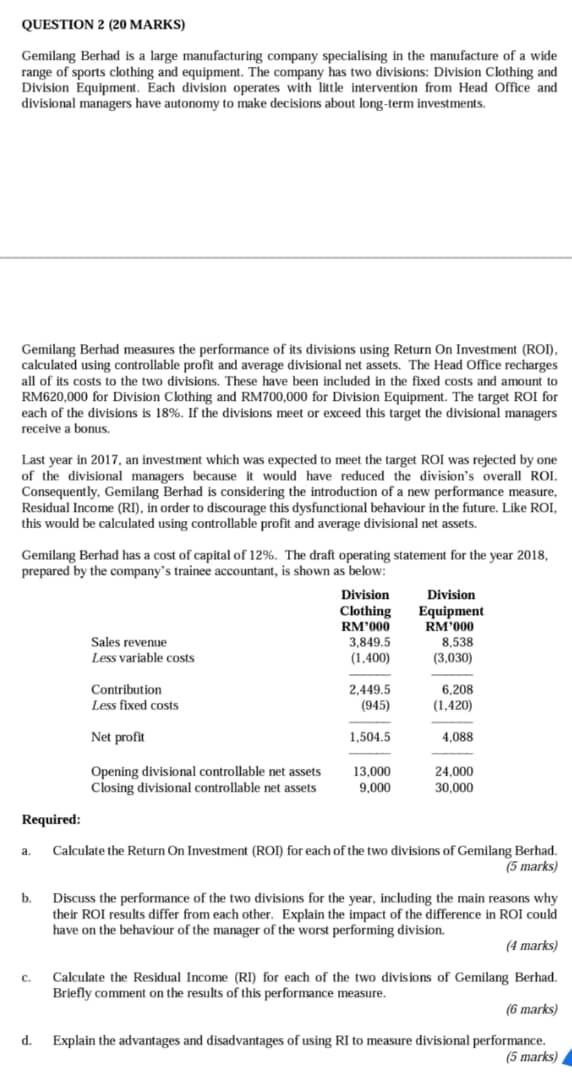

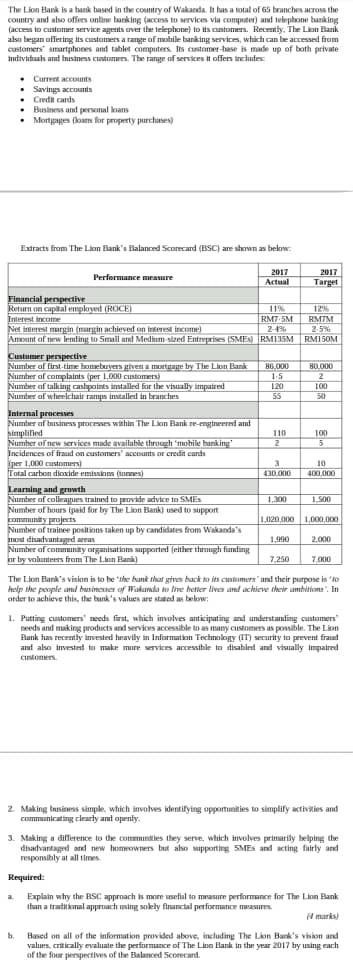

QUESTION 2 (20 MARKS) Gemilang Berhad is a large manufacturing company specialising in the manufacture of a wide range of sports clothing and equipment. The company has two divisions: Division Clothing and Division Equipment. Each division operates with little intervention from Head Office and divisional managers have autonomy to make decisions about long-term investments. Gemilang Berhad measures the performance of its divisions using Return On Investment (ROD), calculated using controllable profit and average divisional net assets. The Head Office recharges all of its costs to the two divisions. These have been included in the fixed costs and amount to RM620,000 for Division Clothing and RM700,000 for Division Equipment. The target ROI for each of the divisions is 18%. If the divisions meet or exceed this target the divisional managers receive a bonus. Last year in 2017, an investment which was expected to meet the target ROI was rejected by one of the divisional managers because it would have reduced the division's overall ROL. Consequently, Gemilang Berhad is considering the introduction of a new performance measure, Residual Income (RI). in order to discourage this dysfunctional behaviour in the future. Like ROI, this would be calculated using controllable profit and average divisional net assets. Gemilang Berhad has a cost of capital of 12%. The draft operating statement for the year 2018, prepared by the company's trainee accountant, is shown as below: Division Division Clothing Equipment RM'000 RM'000 Sales revenue 3,849.5 8.538 Less variable costs (1.400) (3,030) Contribution 2,449.5 6.208 Less fixed costs (945) (1,420) Net profit 1,504.5 4.088 Opening divisional controllable net assets 13.000 24.000 Closing divisional controllable net assets 9,000 30.000 Required: a. Calculate the Return On Investment (ROD) for each of the two divisions of Gemilang Berhad. (5 marks) b. Discuss the performance of the two divisions for the year, including the main reasons why their ROI results differ from each other. Explain the impact of the difference in ROI could have on the behaviour of the manager of the worst performing division. (4 marks) C. Calculate the Residual Income (RI) for each of the two divisions of Gemilang Berhad. Briefly comment on the results of this performance measure. (6 marks) d. Explain the advantages and disadvantages of using RI to measure divisional performance. (5 marks)The Lion Blank is a bank based in the country of Wakanda. It has a total of 65 branches across the country and she offers online barking (access to services via conquer) and telephone banking (access to customer service agents over the telephone) to its customers. Recently, The Lion Bank also began offering his customers a range of mobile banking services, which can be accessed from customers" smartphones and tablet computers. his customer-hase is made up of both private individuals and bustores customers. The range of services It offers includes Current accounts Savings accounts Credit cards Business and perumal bians Mortgages (nam for property purchases) Extracts from The Lion Bank's Balanced Scorecard (BSC) are shown as below. Performance meswire 2017 2017 Actual Target Financial perspective Return on captal employed (ROCE) Interest Income RMT.5M RMIM Not holmest margin tourgin achieved on interest income) 2.5% An mint of twe lending to Small and Medium sized Entreprises (SME) RMIISM |RM150M Number of first time bomkebuyers given a mortgage by The Lion Bank Number of complaints (per 1 900 customers 1.5 2 Number of talking cashpoints installed for the visually impaired 100 Number of wheelchair ramps installed in branches 55 Inirmal process Number of business processes within The Lion Bank ce-moineernt and simplified 110 Number of new services made available through 'mobile banking' 5 Incidences of fraud on customers" accounts or credit cards put 1,010 customers 10 Total carbon dioxide emission (inme) 430.000 400.000 I corning and growth Number of colleagues trained to provide advice to SMEs 1,300 1-500 Number of hours toold for by The Lion Bank) used to support community projects L.020.000 1.000.004 Number of trainee pooltions taken up by candidates from Wekanda's 1.9OO 2.000 Number of community organisations supported feither through funding or boy volunteers from The Lion Bank) 7.250 70800 The Lion Flank's vision is to be "the bank that gives back to its customers" and their purpose is *to help the people and business of Budanda to the better lives and achieve their ambitions . In order to achieve this, the bank's values are stated as below: I. Putting customers' needs first, which involves anticipating and understanding customers' needs and making products and services accessible to as many customers as possible. The Lion Bank has recently invested heavily in Information Technology (II) security to prevent fraud and also invested to make mure services accessible in disabled and visually impaired cindomer .Making business simple. which involves identifying opportunities to simplify activities and communicating clearly and openly- Making a difference to the courminities they serve, which involves primarily helping the disadvantaged and new homeowners but abo supporting SMEs and acting fairly and responsibly at all times. Required: Explain why the BSC approach is more useful to measure performance for The Lion Bank than a traditional approach using solely financial performance measures. Based on all of the information provided above, Including The Lian Bank's whin and values, critically evaluate the performance of The Lion Bank in the year 2017 by using each of the four perspectives of the Balanced Scorecard