Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plesse answer both questions and show the work for the answers. if you use excel please include formulas so I can follow. thank you 6.1

plesse answer both questions and show the work for the answers. if you use excel please include formulas so I can follow. thank you

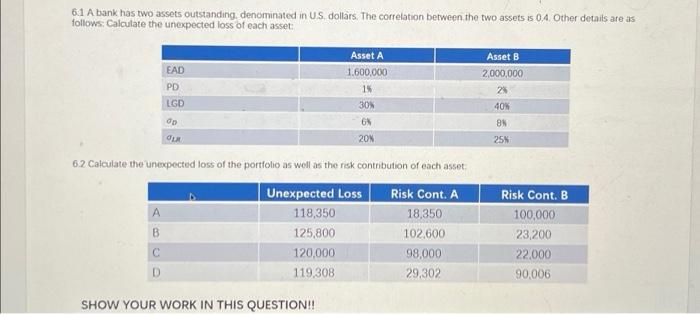

6.1 A bank has two assets outstanding, denominated in U.S. dollars. The correlation between the two assets is 0.4. Other details are as follows: Calculate the unexpected loss of each asset: EAD PD LGD A B C D OD OLR 6.2 Calculate the unexpected loss of the portfolio as well as the risk contribution of each asset: Unexpected Loss 118,350 125,800 120,000 119,308 Asset A 1,600,000 1% 30% 6% 20% SHOW YOUR WORK IN THIS QUESTION!! Risk Cont. A 18,350 102,600 98,000 29,302 Asset B 2,000,000 2% 40% 8% 25% Risk Cont. B 100,000 23,200 22,000 90,006

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started