Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plesse help begin{tabular}{|c|c|c|c|c|c|} hline multicolumn{6}{|c|}{ Model Assumptions } hline & & multirow{2}{*}{multicolumn{4}{|c|}{ Federal Tax Rate Tables }} hline # regular hours in Pay

plesse help

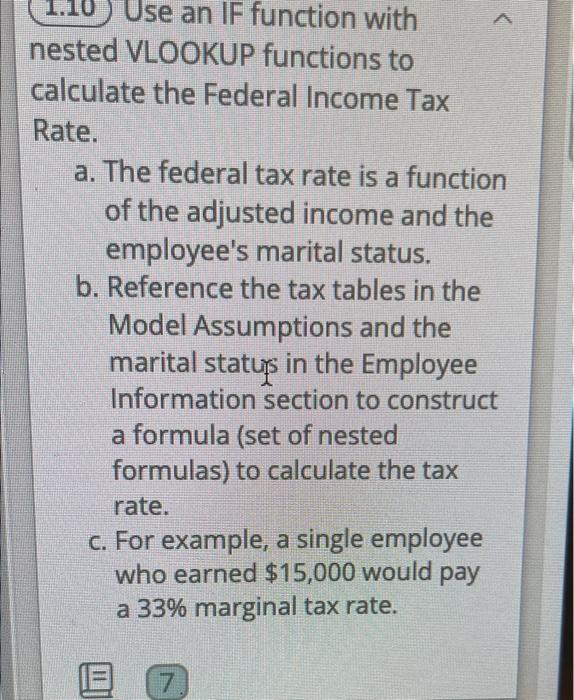

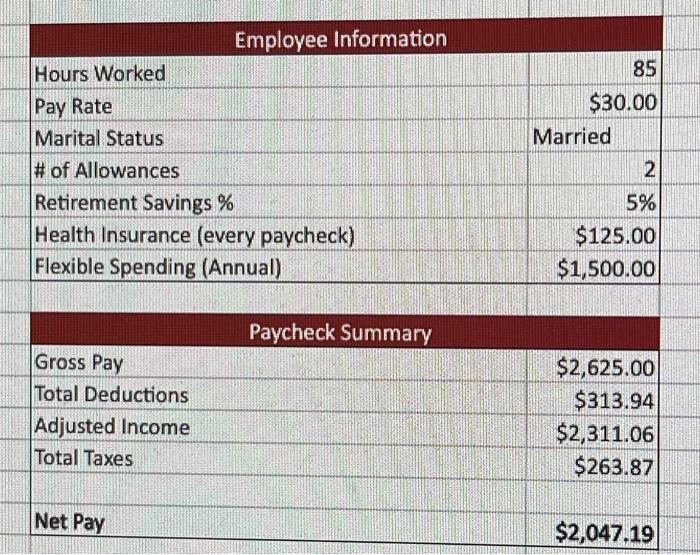

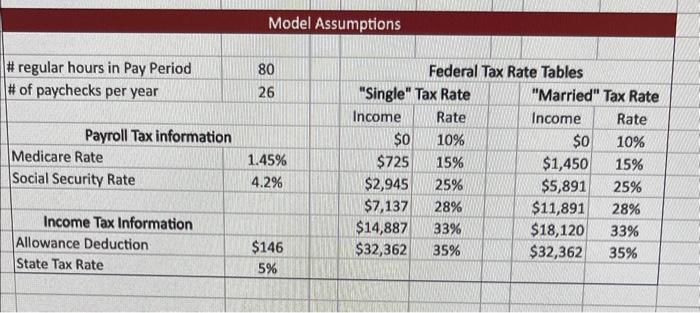

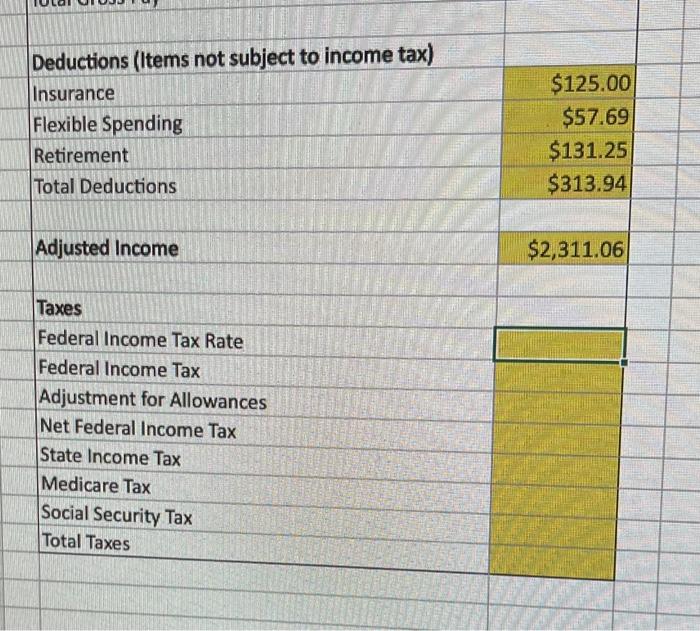

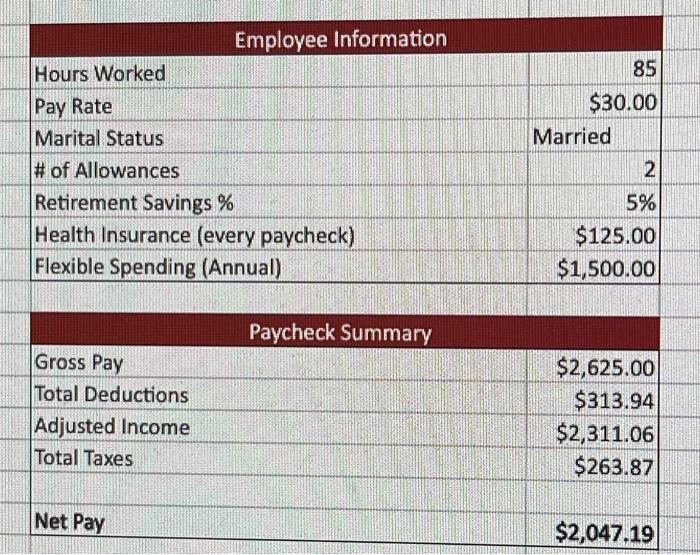

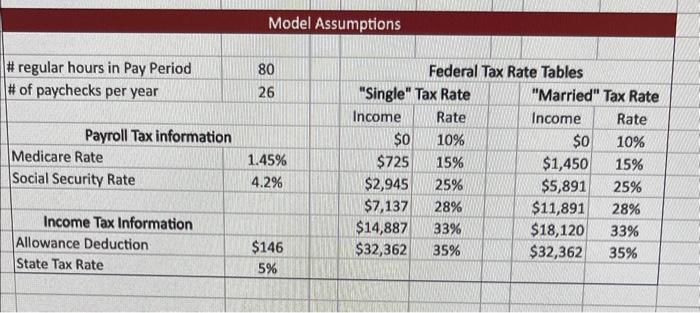

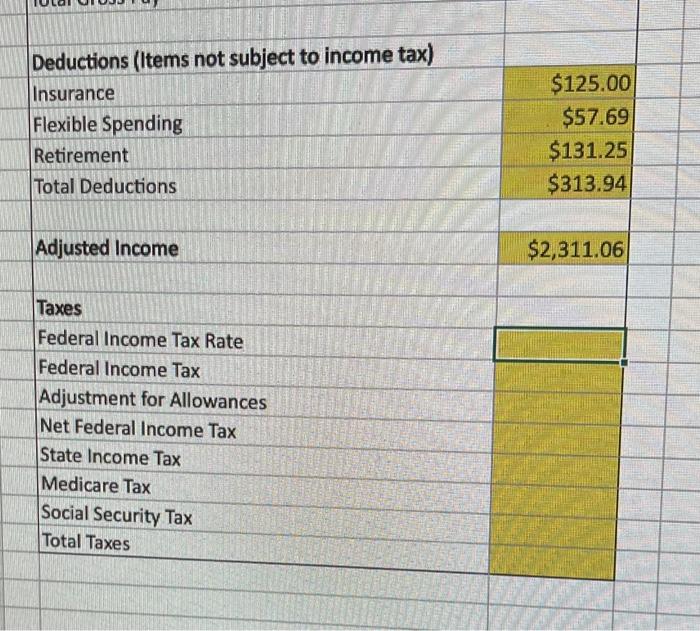

\begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Model Assumptions } \\ \hline & & \multirow{2}{*}{\multicolumn{4}{|c|}{ Federal Tax Rate Tables }} \\ \hline \# regular hours in Pay Period & 80 & & & & \\ \hline \# of paychecks per year & 26 & \multicolumn{2}{|c|}{ "Single" Tax Rate } & \multicolumn{2}{|c|}{ "Married" Tax Rate } \\ \hline & & Income & Rate & Income & Rate \\ \hline \multicolumn{2}{|c|}{ Payroll Tax information } & $0 & 10% & $0 & 10% \\ \hline Medicare Rate & 1.45% & $725 & 15% & $1,450 & 15% \\ \hline \multirow[t]{2}{*}{ Social Security Rate } & 4.2% & $2,945 & 25% & $5,891 & 25% \\ \hline & & $7,137 & 28% & $11,891 & 28% \\ \hline Income Tax Information & & $14,887 & 33% & $18,120 & 33% \\ \hline Allowance Deduction & $146 & $32,362 & 35% & $32,362 & 35% \\ \hline State Tax Rate & 5% & & & & \\ \hline & & & & & \\ \hline \end{tabular} 1.10 Use an IF function with nested VLOOKUP functions to calculate the Federal Income Tax Rate. a. The federal tax rate is a function of the adjusted income and the employee's marital status. b. Reference the tax tables in the Model Assumptions and the marital staturs in the Employee Information section to construct a formula (set of nested formulas) to calculate the tax rate. c. For example, a single employee who earned $15,000 would pay a 33% marginal tax rate. Deductions (Items not subject to income tax) Insurance Flexible Spending Retirement Total Deductions $125.00 $57.69 $131.25 $313.94 Adjusted Income $2,311.06 Taxes Federal Income Tax Rate Federal Income Tax Adjustment for Allowances Net Federal Income Tax State Income Tax Medicare Tax Social Security Tax Total Taxes \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Employee Information } \\ \hline Hours Worked & 85 \\ \hline Pay Rate & $30.00 \\ \hline Marital Status & Married \\ \hline \# of Allowances & 2 \\ \hline Retirement Savings \% & 5% \\ \hline Health Insurance (every paycheck) & $125.00 \\ \hline Flexible Spending (Annual) & $1,500.00 \\ \hline \multicolumn{2}{|c|}{ Paycheck Summary } \\ \hline Gross Pay & $2,625.00 \\ \hline Total Deductions & $313.94 \\ \hline Adjusted Income & $2,311.06 \\ \hline Total Taxes & $263.87 \\ \hline Net Pay & $2,047,19 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started