pls answer all 11 questions

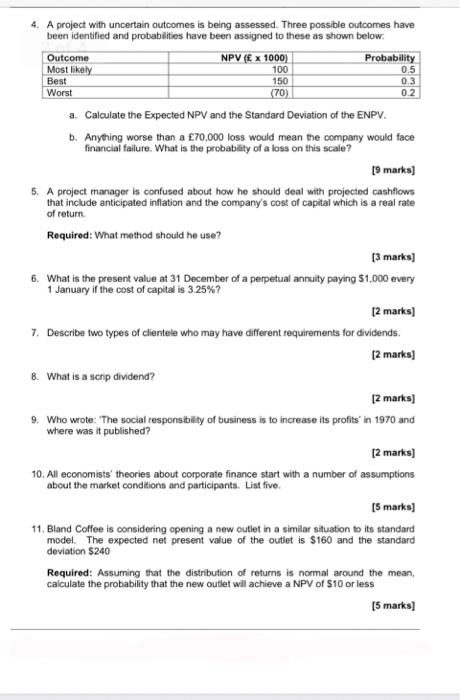

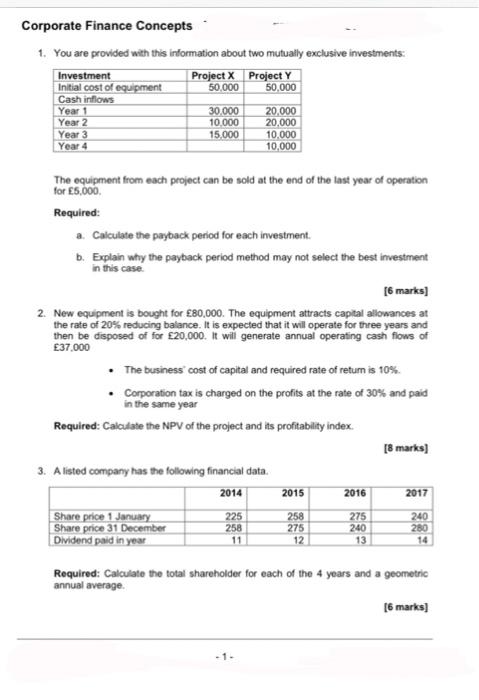

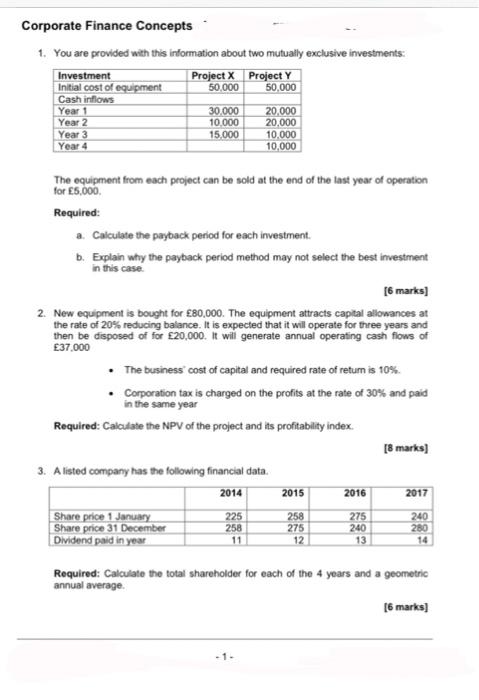

Corporate Finance Concepts 1. You are provided with this information about two mutually exclusive investments: Investment Project X Project Y Initial cost of equipment 50,000 50,000 Cash inflows Year 1 30,000 20,000 Year 2 10.000 20,000 Year 3 15.000 10.000 Year 4 10,000 in this case. The equipment from each project can be sold at the end of the last year of operation for 5,000 Required: a. Calculate the payback period for each investment b. Explain why the payback period method may not select the best investment [6 marks] 2. New equipment is bought for 80,000. The equipment attracts capital allowances at the rate of 20% reducing balance. It is expected that it will operate for three years and then be disposed of for 20,000. It will generate annual operating cash flows of 37.000 The business' cost of capital and required rate of return is 10% Corporation tax is charged on the profits at the rate of 30% and paid in the same year Required: Calculate the NPV of the project and its profitability index [8 marks) 3. A listed company has the following financial data. 2014 2015 2016 2017 Share price 1 January Share price 31 December Dividend paid in year 225 258 11 258 275 12 275 240 13 240 280 14 Required: Calculate the total shareholder for each of the 4 years and a geometric annual average [6 marks) 4. A project with uncertain outcomes is being assessed. Three possible outcomes have been identified and probabilities have been assigned to these as shown below Outcome NPV (E x 1000) Probability Most likely 100 0.5 Best 150 0.3 Worst (70) 0.2 a. Calculate the Expected NPV and the Standard Deviation of the ENPV. b. Anything worse than a 70,000 loss would mean the company would face financial failure. What is the probability of a loss on this scale? 19 marks) 5. A project manager is confused about how he should deal with projected cashflows that include anticipated inflation and the company's cost of capital which is a real rate of return Required: What method should ho use? [3 marks] 6. What is the present value at 31 December of a perpetual annuity paying $1,000 every 1 January if the cost of capital is 3.25%? [2 marks] 7. Describe two types of clientele who may have different requirements for dividends. [2 marks] 8. What is a scnp dividend? [2 marks) 9. Who wrote: "The social responsibility of business is to increase its profits in 1970 and where was it published? [2 marks] 10. All economists' theories about corporate finance start with a number of assumptions about the market conditions and participants. List five [5 marks) 11. Bland Coffee is considering opening a new outlet in a similar situation to its standard model . The expected net present value of the outlet is $160 and the standard deviation $240 Required: Assuming that the distribution of returns is normal around the mean, calculate the probability that the new outlet will achieve a NPV of $10 or less [5 marks)

pls answer all 11 questions

pls answer all 11 questions