Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer all 3 P6-52 (similar to) Question Help (Present value of complex cash flows) How much do you have to deposit today so that

pls answer all 3

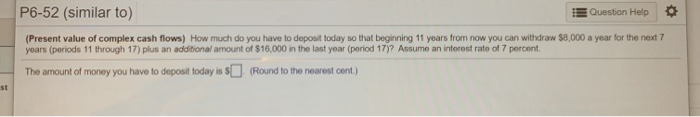

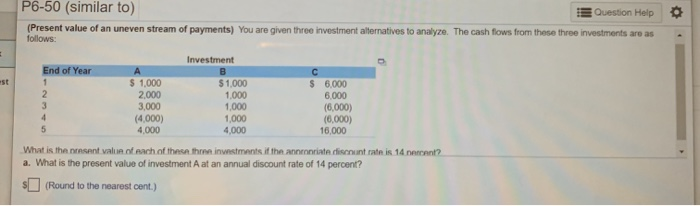

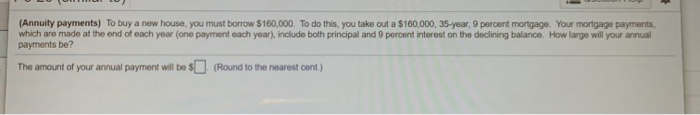

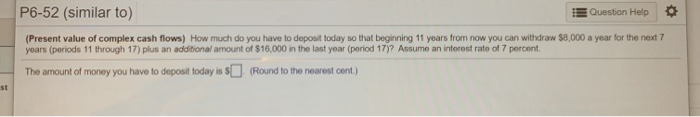

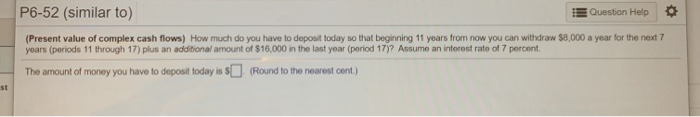

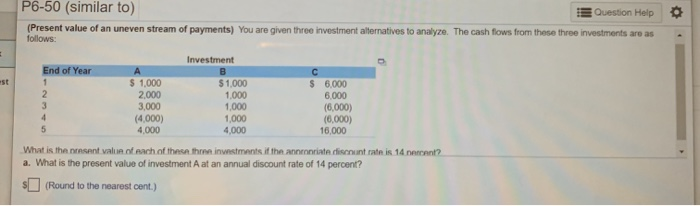

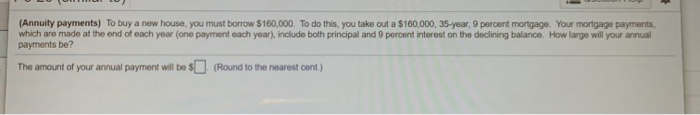

P6-52 (similar to) Question Help (Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $8,000 a year for the next 7 years (periods 11 through 17) plus an additional amount of $16.000 in the last year (period 17)? Assume an interest rate of 7 percent The amount of money you have to deposit today is (Round to the nearest cont.) P6-50 (similar to) (Present value of an uneven stream of payments) You are given three investment alternatives to follows Question Help analyze. The cash flows from these three investments are as Investment End of Year $ A $ 1,000 2.000 3,000 (4.000) 4.000 $1,000 1.000 1,000 1.000 4,000 6.000 6.000 (6,000) (6.000) 16,000 What is the persent value of each of these three investments it the rate discount rate is 14. a. What is the present value of investment A at an annual discount rate of 14 percent? S (Round to the nearest cont.) (Annuity payments) To buy a new house, you must borrow $160,000. To do this, you take out a $160,000, 35-year, 9 percent mortgage. Your mortgage payments which are made at the end of each year (one payment each year), include both principal and 9 percent interest on the declining balance. How large will your annual payments be? The amount of your annual payment will be $ (Round to the nearest cent)

P6-52 (similar to) Question Help (Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $8,000 a year for the next 7 years (periods 11 through 17) plus an additional amount of $16.000 in the last year (period 17)? Assume an interest rate of 7 percent The amount of money you have to deposit today is (Round to the nearest cont.) P6-50 (similar to) (Present value of an uneven stream of payments) You are given three investment alternatives to follows Question Help analyze. The cash flows from these three investments are as Investment End of Year $ A $ 1,000 2.000 3,000 (4.000) 4.000 $1,000 1.000 1,000 1.000 4,000 6.000 6.000 (6,000) (6.000) 16,000 What is the persent value of each of these three investments it the rate discount rate is 14. a. What is the present value of investment A at an annual discount rate of 14 percent? S (Round to the nearest cont.) (Annuity payments) To buy a new house, you must borrow $160,000. To do this, you take out a $160,000, 35-year, 9 percent mortgage. Your mortgage payments which are made at the end of each year (one payment each year), include both principal and 9 percent interest on the declining balance. How large will your annual payments be? The amount of your annual payment will be $ (Round to the nearest cent)

pls answer all 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started