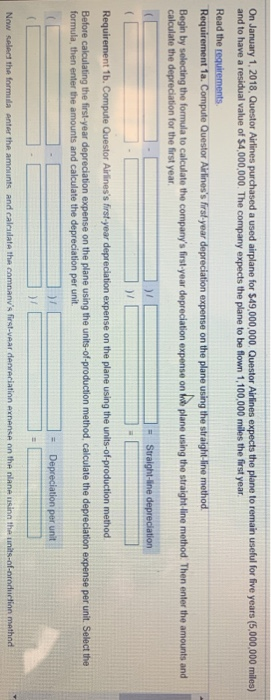

pls answer all 4 question below in the pictures ASAP!! 1a.

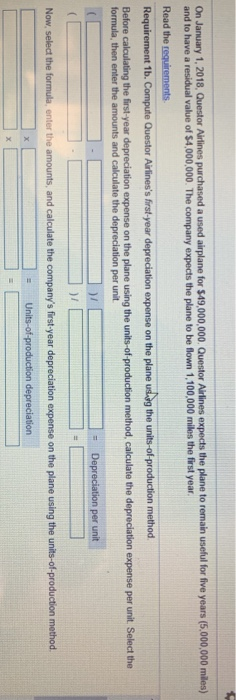

1b.

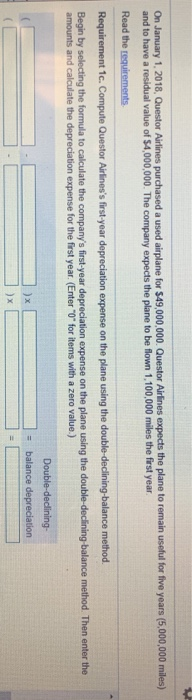

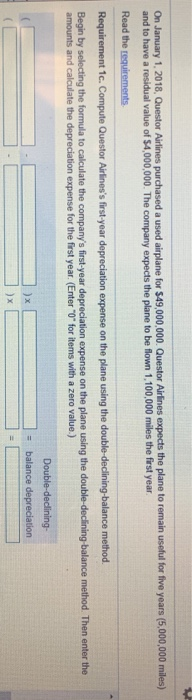

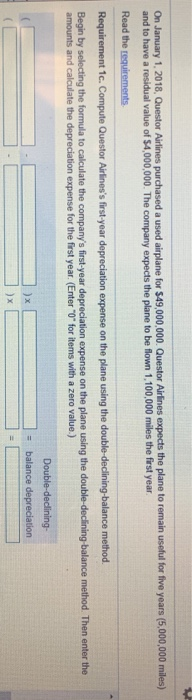

1c.

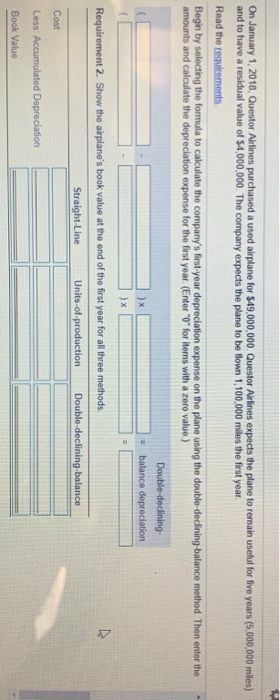

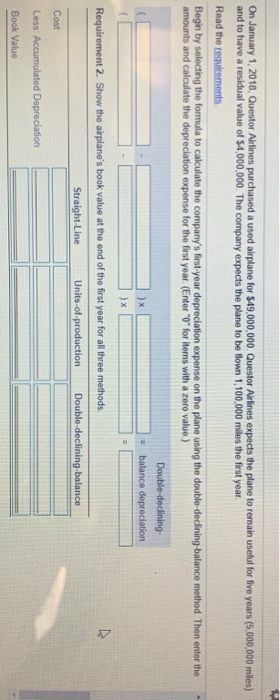

2.

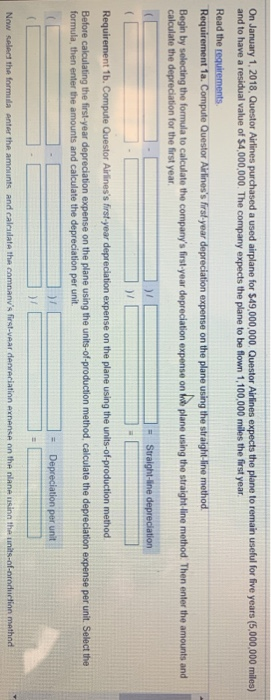

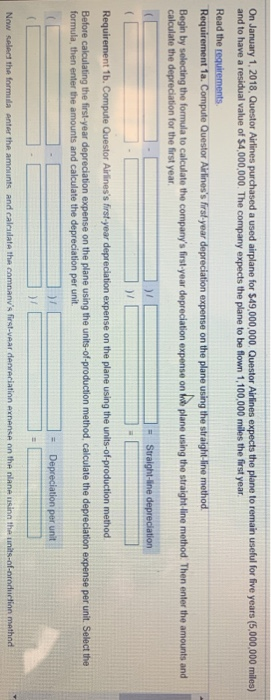

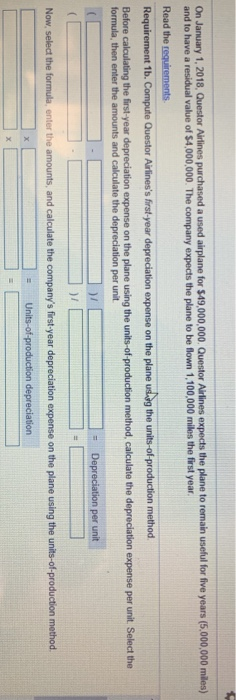

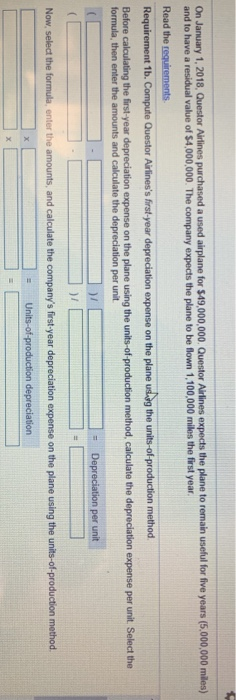

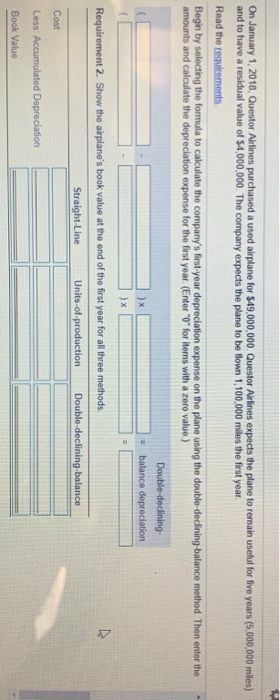

On January 1, 2018, Questor Airlines purchased a used airplane for $49,000,000. Questor Airlines expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,000,000. The company expects the plane to be flown 1,100,000 miles the first year. Read the requitements Requirement 1a. Compute Questor Airlines's first-year depreciation expense on the plane using the straight-line method Begin by selecting the formula to calculate the company's first-year depreciation expense on fb plane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year Straight-ine depreciation Requirement 1b. Compute Questor Airlines's first-year depreciation expense on the plane using the units-of-production method Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation per unit Depreciation per unit Now select the formula anter the amniunts and calculate the comnanv's first-vear denreciatinn axnense on the nlane usinn the units-of-oroduction mathnd On January 1, 2018, Questor Airlines purchased a used airplane for $49,000,000. Questor Airlines expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,000,000 The company expects the plane to be flown 1,100,000 miles the first year. Read the requirements Requirement 1b. Compute Questor Airlines's first-year depreciation expense on the plane useg the units-of-production method. Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation per unit Depreciation per unit Now, select the formula, enter the amounts, and calculate the company's first-year depreciation expense on the plane using the units-of-production method Units-of-production depreciation On January 1, 2018, Questor Airlines purchased a used airplane for $49,000,000. Questor Airlines expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,000,000. The company expects the plane to be flown 1,100,000 miles the first year Read the requirements Requirement 1c. Compute Questor Airlines's first-year depreciation expense on the plane using the double-declining-balance method Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the first year. (Enter "0" for items with a zero value.) Double-declining- )x balance depreciation ) x On January 1, 2018, Questor Airlines purchased a used airplane for $49,000,000. Questor Airlines expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,000,000. The company expects the plane to be flown 1,100,000 miles the first year Read the requitements Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the first year. (Enter "0" for items with a zero value) Double-declining- ) x balance depreciation ) x Requirement 2. Show the airplane's book value at the end of the first year for all three methods. 4P Straight-Line Units-of-production Double-declining-balance Cost Less: Accumulated Depreciation Book Value