pls answer all question ASAP, thank you

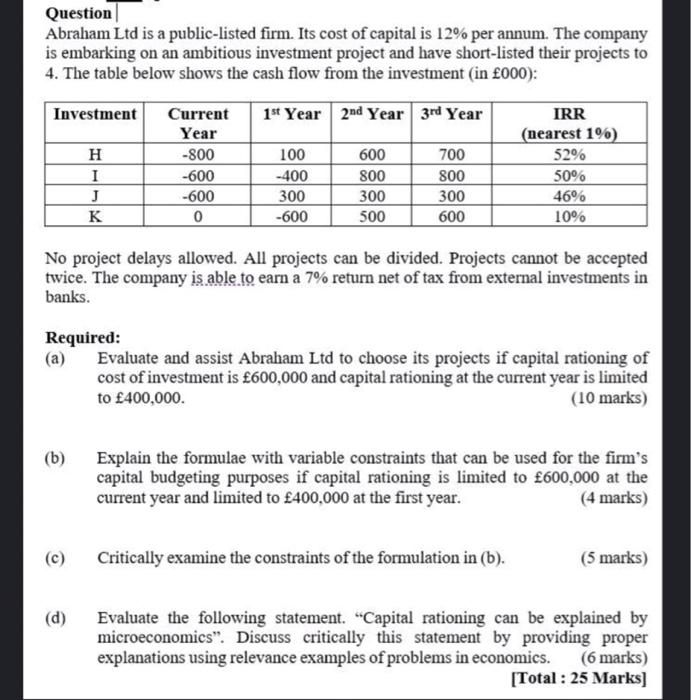

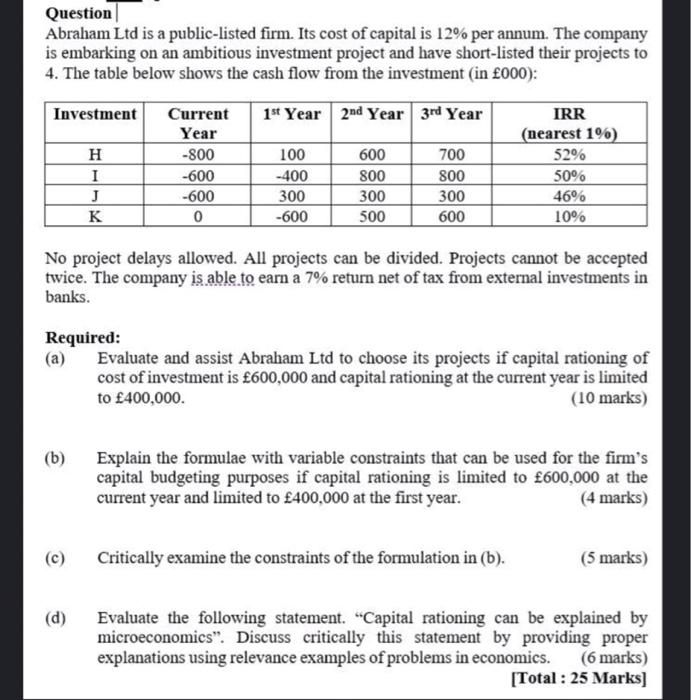

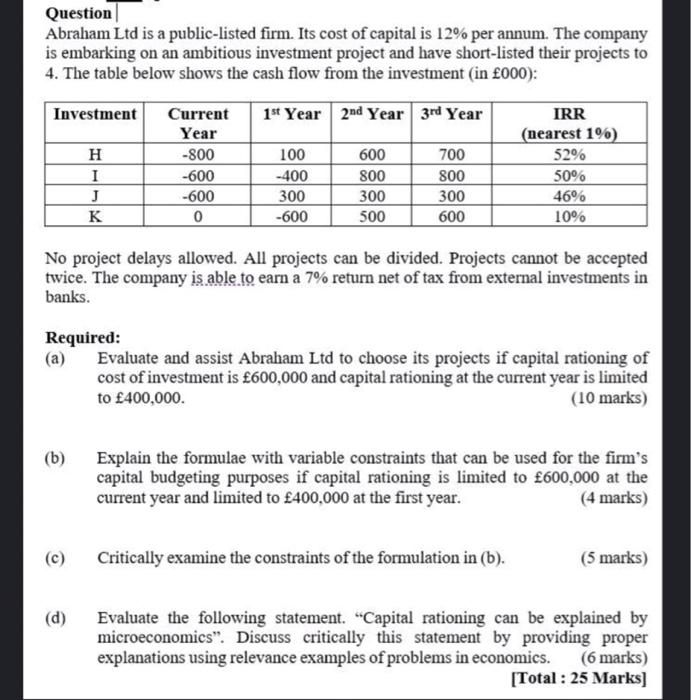

Question Abraham Ltd is a public-listed firm. Its cost of capital is 12% per annum. The company is embarking on an ambitious investment project and have short-listed their projects to 4. The table below shows the cash flow from the investment (in 000): Investment 1st Year 2nd Year 3rd Year H I J K Current Year -800 -600 -600 0 100 -400 300 -600 600 800 300 500 700 800 300 600 IRR (nearest 19) 52% 50% 46% 10% No project delays allowed. All projects can be divided. Projects cannot be accepted twice. The company is able to earn a 7% return net of tax from external investments in banks. Required: Evaluate and assist Abraham Ltd to choose its projects if capital rationing of cost of investment is 600,000 and capital rationing at the current year is limited to 400,000 (10 marks) (b) Explain the formulae with variable constraints that can be used for the firm's capital budgeting purposes if capital rationing is limited to 600,000 at the current year and limited to 400,000 at the first year. (4 marks) Critically examine the constraints of the formulation in (b). (5 marks) (d) Evaluate the following statement. "Capital rationing can be explained by microeconomics". Discuss critically this statement by providing proper explanations using relevance examples of problems in economics. (6 marks) [Total: 25 Marks] Question Abraham Ltd is a public-listed firm. Its cost of capital is 12% per annum. The company is embarking on an ambitious investment project and have short-listed their projects to 4. The table below shows the cash flow from the investment (in 000): Investment 1st Year 2nd Year 3rd Year H I J K Current Year -800 -600 -600 0 100 -400 300 -600 600 800 300 500 700 800 300 600 IRR (nearest 19) 52% 50% 46% 10% No project delays allowed. All projects can be divided. Projects cannot be accepted twice. The company is able to earn a 7% return net of tax from external investments in banks. Required: Evaluate and assist Abraham Ltd to choose its projects if capital rationing of cost of investment is 600,000 and capital rationing at the current year is limited to 400,000 (10 marks) (b) Explain the formulae with variable constraints that can be used for the firm's capital budgeting purposes if capital rationing is limited to 600,000 at the current year and limited to 400,000 at the first year. (4 marks) Critically examine the constraints of the formulation in (b). (5 marks) (d) Evaluate the following statement. "Capital rationing can be explained by microeconomics". Discuss critically this statement by providing proper explanations using relevance examples of problems in economics. (6 marks) [Total: 25 Marks]