Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer all questions within 1 hour, will upvote instantly once all items are solved, thank you! Question 6 Brandon Production is a small firm

pls answer all questions within 1 hour, will upvote instantly once all items are solved, thank you!

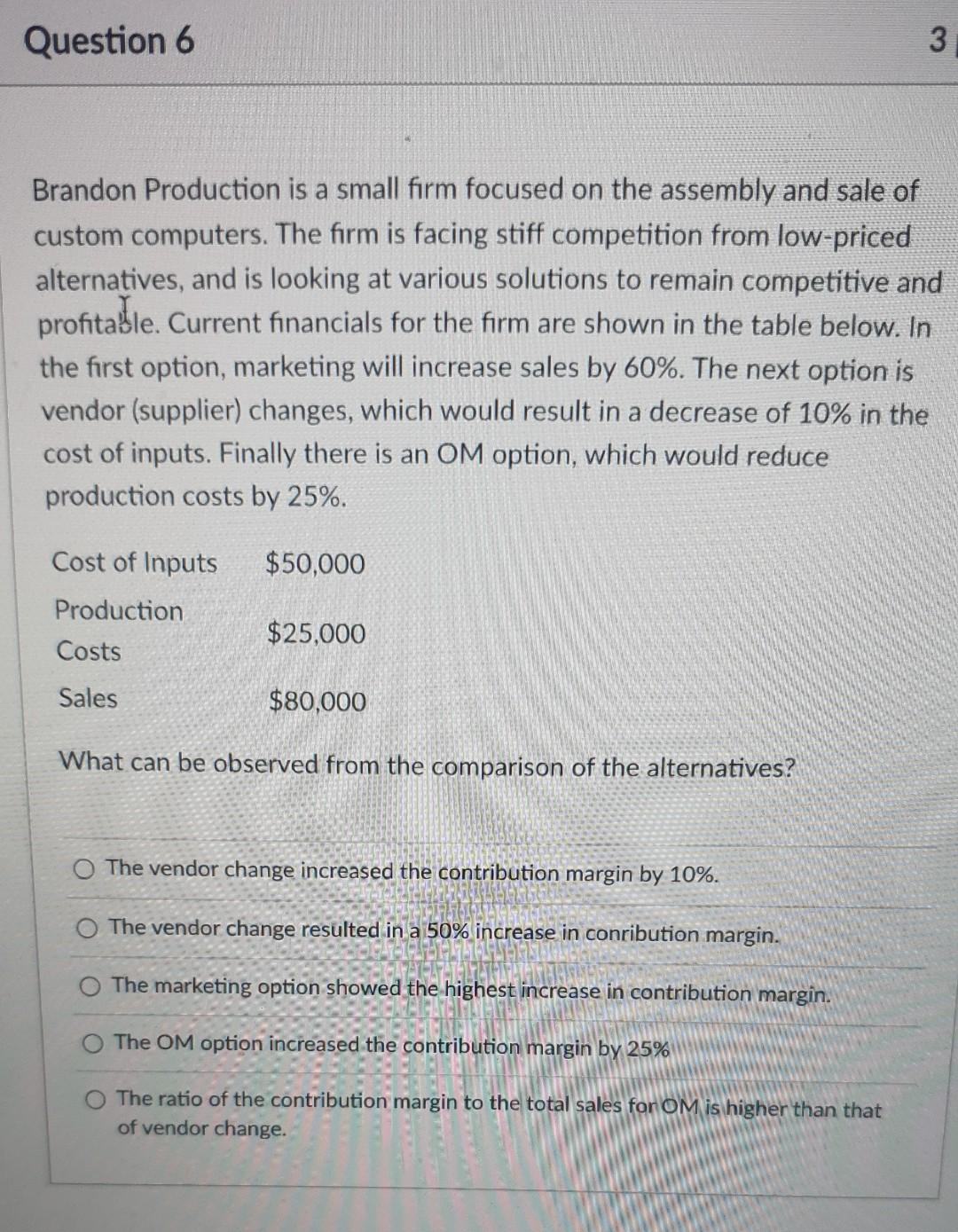

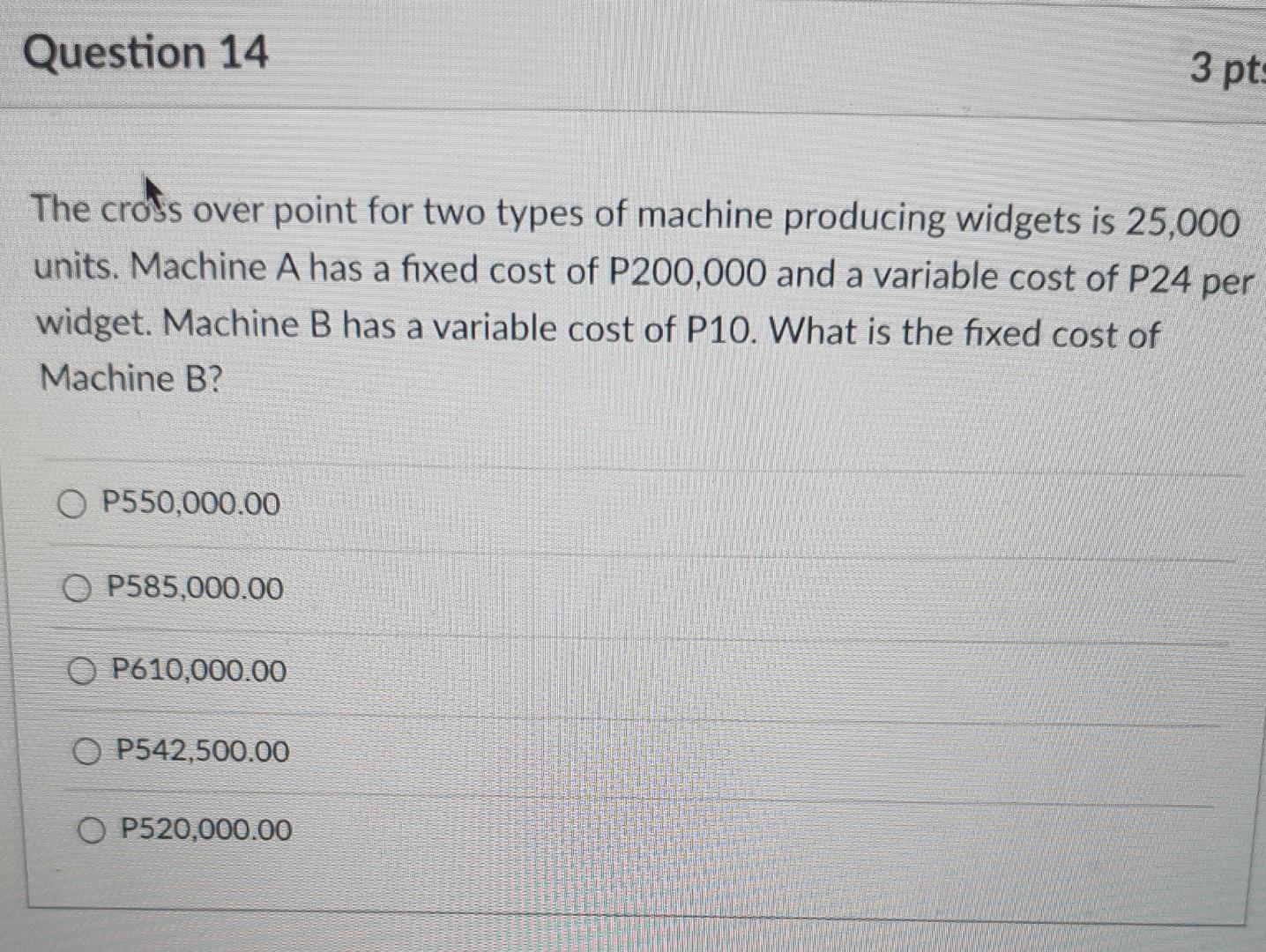

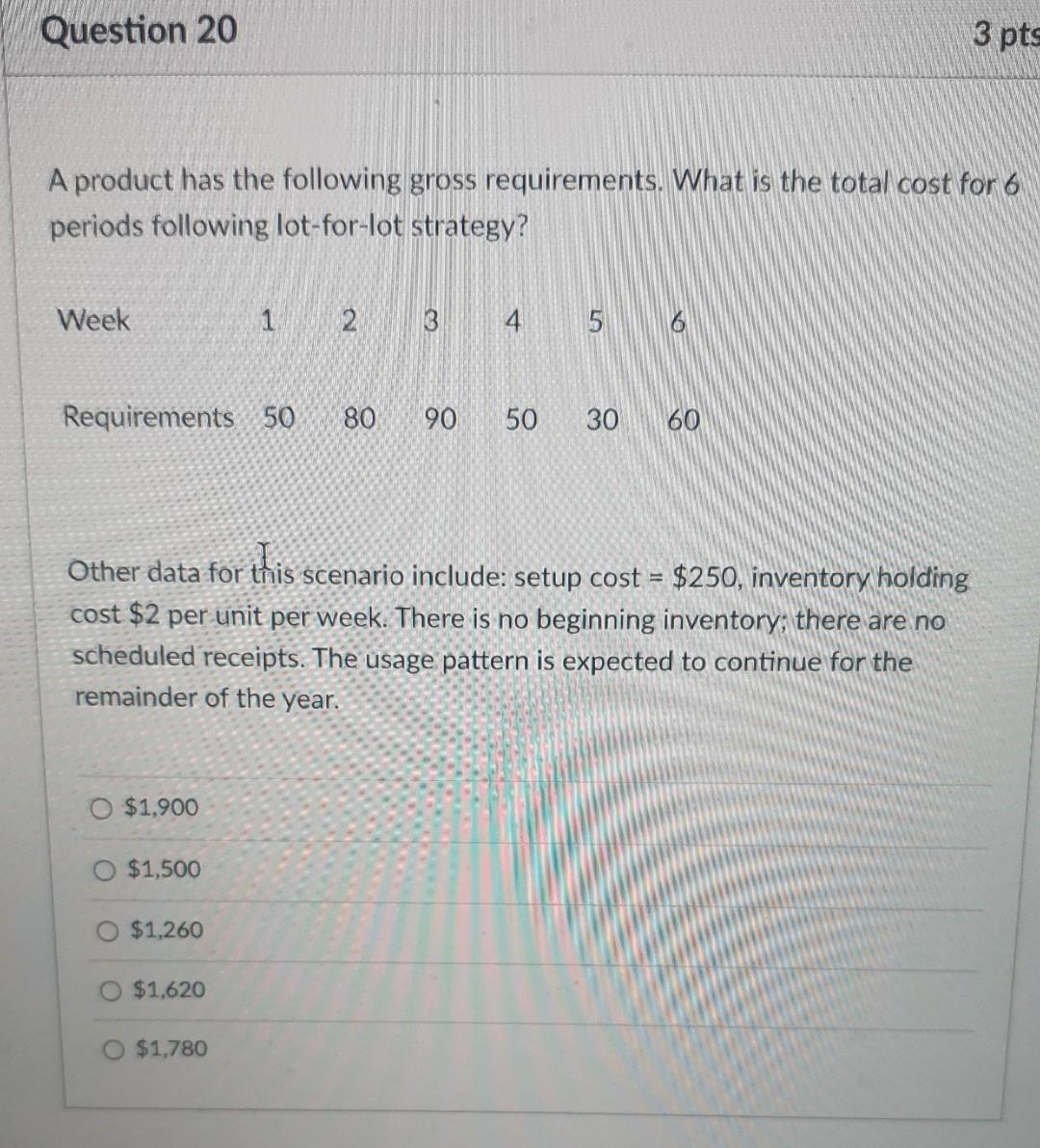

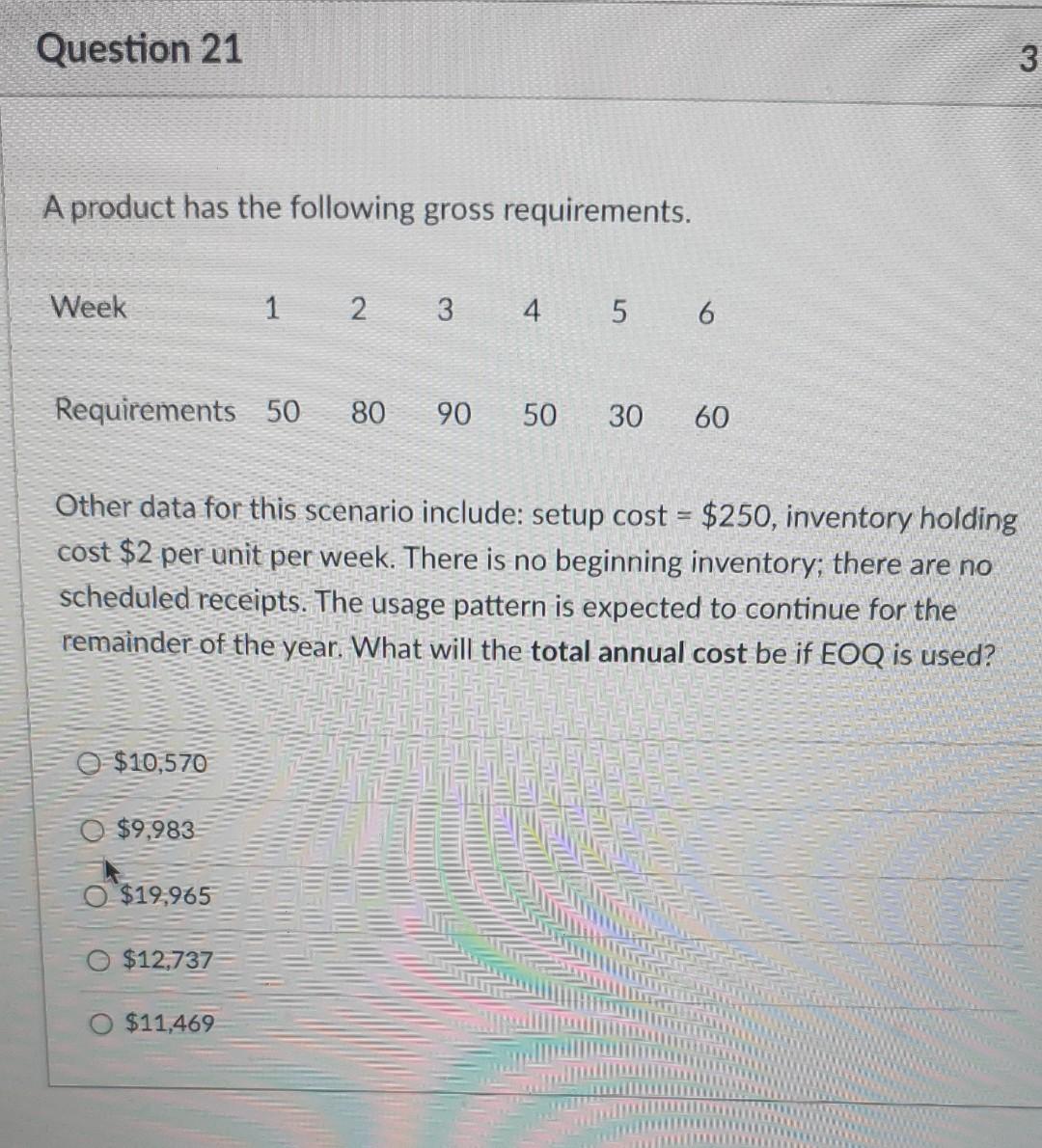

Question 6 Brandon Production is a small firm focused on the assembly and sale of custom computers. The firm is facing stiff competition from low-priced alternatives, and is looking at various solutions to remain competitive and profitable. Current financials for the firm are shown in the table below. In the first option, marketing will increase sales by 60%. The next option is vendor (supplier) changes, which would result in a decrease of 10% in the cost of inputs. Finally there is an OM option, which would reduce production costs by 25%. $50,000 Cost of Inputs Production Costs Sales $25,000 $80,000 What can be observed from the comparison of the alternatives? 3 O The vendor change increased the contribution margin by 10%. O The vendor change resulted in a 50% increase in conribution margin. The marketing option showed the highest increase in contribution margin. The OM option increased the contribution margin by 25% The ratio of the contribution margin to the total sales for OM is higher than that of vendor change. Question 14 The cross over point for two types of machine producing widgets is 25,000 units. Machine A has a fixed cost of P200,000 and a variable cost of P24 per widget. Machine B has a variable cost of P10. What is the fixed cost of Machine B? O P550,000.00 OP585,000.00 OP610,000.00 P542,500.00 3 pts OP520,000.00 Question 20 A product has the following gross requirements. What is the total cost for 6 periods following lot-for-lot strategy? Week Requirements 50 80 90 50 30 60 Other data for this scenario include: setup cost = $250, inventory holding cost $2 per unit per week. There is no beginning inventory; there are no scheduled receipts. The usage pattern is expected to continue for the remainder of the year. O $1,900 $1,500 $1,260 1 2 3 4 5 6 O $1,620 O $1,780 3 pts Question 21 A product has the following gross requirements. Week Requirements 50 80 90 50 30 60 $10,570 $9,983 Other data for this scenario include: setup cost = $250, inventory holding cost $2 per unit per week. There is no beginning inventory; there are no scheduled receipts. The usage pattern is expected to continue for the remainder of the year. What will the total annual cost be if EOQ is used? O $19,965 1 O$12,737 2 3 4 5 6 $11,469 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started