Answered step by step

Verified Expert Solution

Question

1 Approved Answer

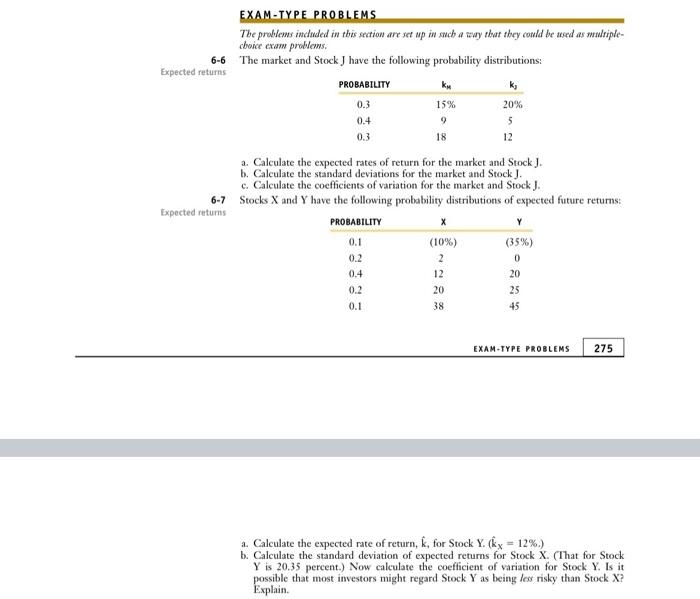

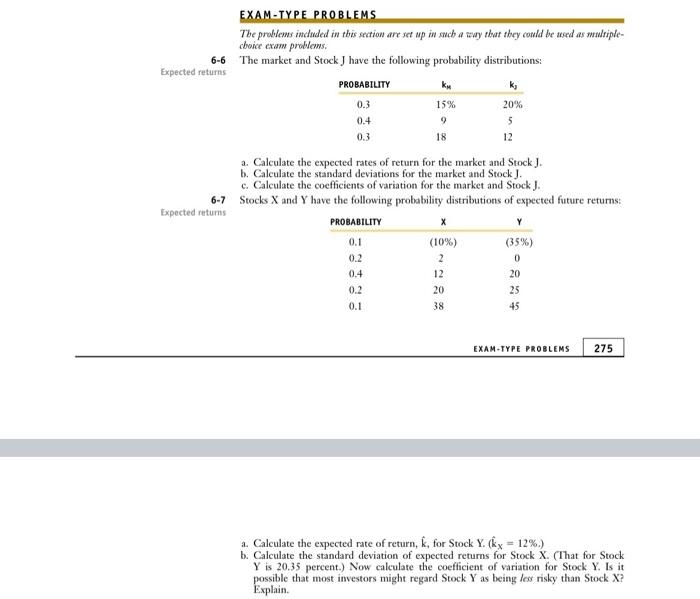

PLS ANSWER ASAP 6-7 ONLY! Will upvote! THANK YOU! Tbe probems indaded in tbis section are set up in anch a way that they could

PLS ANSWER ASAP 6-7 ONLY! Will upvote! THANK YOU!

Tbe probems indaded in tbis section are set up in anch a way that they could be wad as multiplechoice exam problows. The market and Stock J have the following probability distributions: a. Calculate the expected rates of return for the market and Stock J. b. Calculate the standard deviations for the market and Stock J. c. Calculate the coefficients of variation for the market and Stock J. Stocks X and Y have the following probability distributions of expected future returns: EXAM-TYPE PROBLEMS 275 a. Calculate the expected rate of return, k^,for Stock Y.(k^X=12%.) b. Calculate the standard deviation of expected returns for Stock X. (That for Stock Y is 20.35 percent.) Now calculate the coefficient of variation for Stock Y. Is it possible that most investors might regard Stock Y as being les risky than Stock X? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started