Answered step by step

Verified Expert Solution

Question

1 Approved Answer

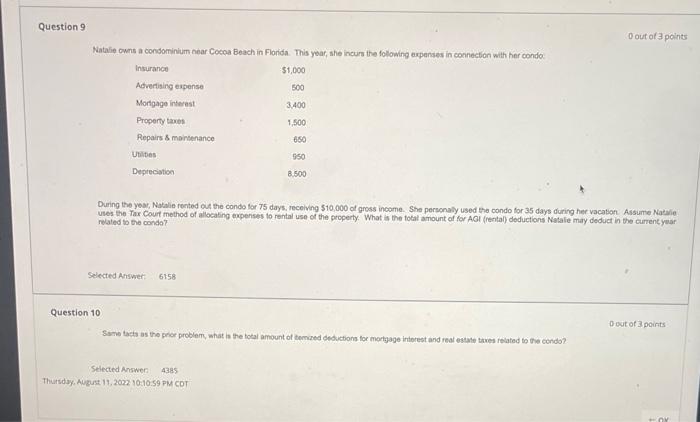

pls answer both 6158 and 4385 are incorrect Watahe owns a consominium near Cocoa Beach in Florida. This yoar, she incurs the folowing axpenses in

pls answer both 6158 and 4385 are incorrect

Watahe owns a consominium near Cocoa Beach in Florida. This yoar, she incurs the folowing axpenses in confecton with her oondo During the year, Natalie rented cut the condo for 75 days, receiving $10,000 of gross income. She personaly used the condo for 35 days during her vacation Assume Nakyle. uses the Tax Court method of allocating expenses to rental use of the property. What is the total amount of for Act (rental) deductions Natale may deduct in the currentyear rated to the conda? Selected Answer: 6158 Question 10 Dout of 3 points Ssmo tats as the price problem, ahat is the total amount of ternced deductions foe martyage intorest and reat estate tives related to the condo? Selected Arswen 4385 Mrsday, August 11, 2022 10:10.59 PM CDT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started