Answered step by step

Verified Expert Solution

Question

1 Approved Answer

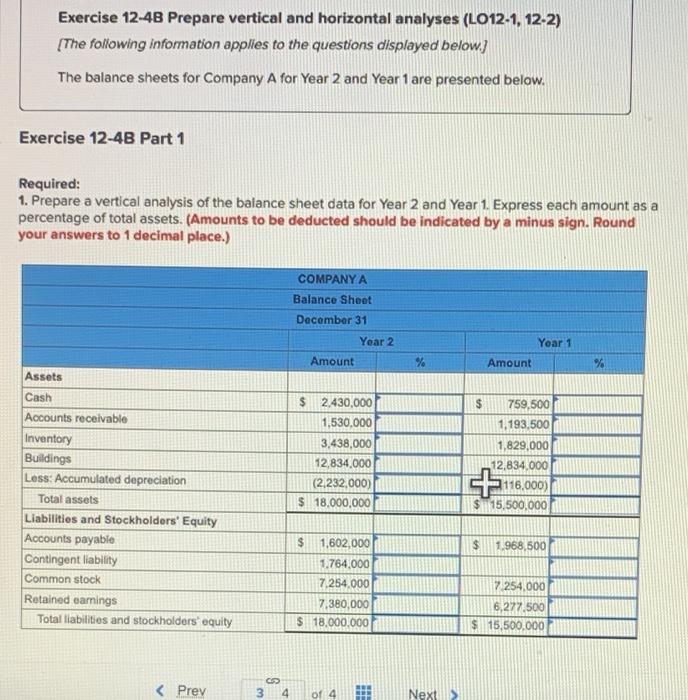

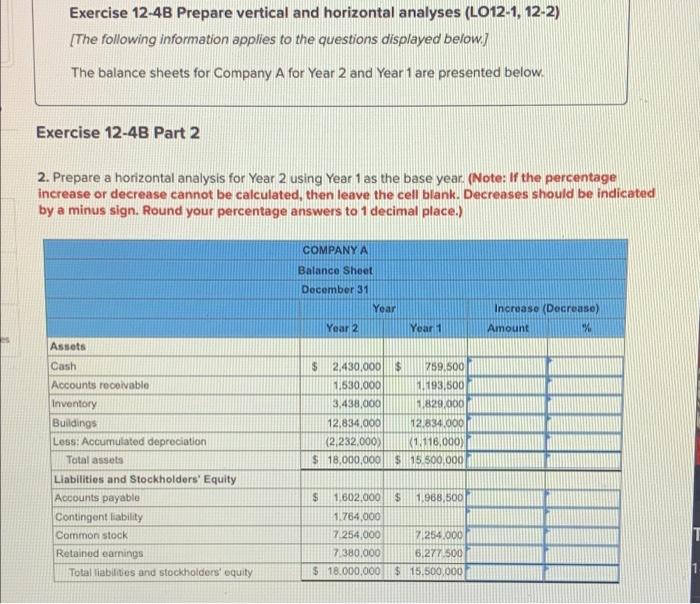

pls answer both Part 1 and 2 Exercise 12-4B Prepare vertical and horizontal analyses (LO12-1, 12-2) [The following information applies to the questions displayed below)

pls answer both Part 1 and 2

Exercise 12-4B Prepare vertical and horizontal analyses (LO12-1, 12-2) [The following information applies to the questions displayed below) The balance sheets for Company A for Year 2 and Year 1 are presented below. Exercise 12-48 Part 1 Required: 1. Prepare a vertical analysis of the balance sheet data for Year 2 and Year 1. Express each amount as a percentage of total assets. (Amounts to be deducted should be indicated by a minus sign. Round your answers to 1 decimal place.) COMPANYA Balance Sheet December 31 Year 1 Year 2 Amount Amount Assets $ $ 2,430,000 1,530,000 3,438,000 12,834.000 (2,232,000) $ 18,000,000 759,500 1,193,500 1,829,000 12,834.000 Cash Accounts receivable Inventory Buildings Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Contingent liability Common stock Retained earnings Total liabilities and stockholders' equity 116.000) $ 15,500,000 $ 1.968.500 $ 1,602,000 1.764,000 7.254.000 7,380,000 $ 18,000,000 7254,000 6,277.500 $ 15,500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started