Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer both questions 12.4 & 12.6 EXERCISE 12.4 Hardy-Furn is a manufacturing company that makes and restores furniture and uses a jobcosting system. Fixed

pls answer both questions 12.4 & 12.6

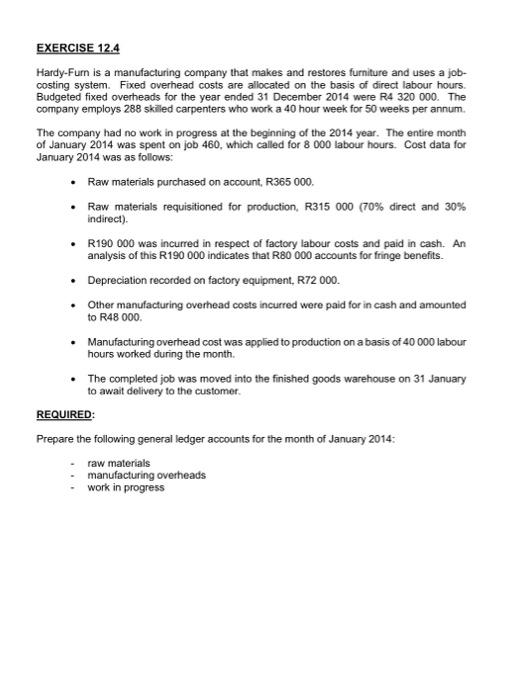

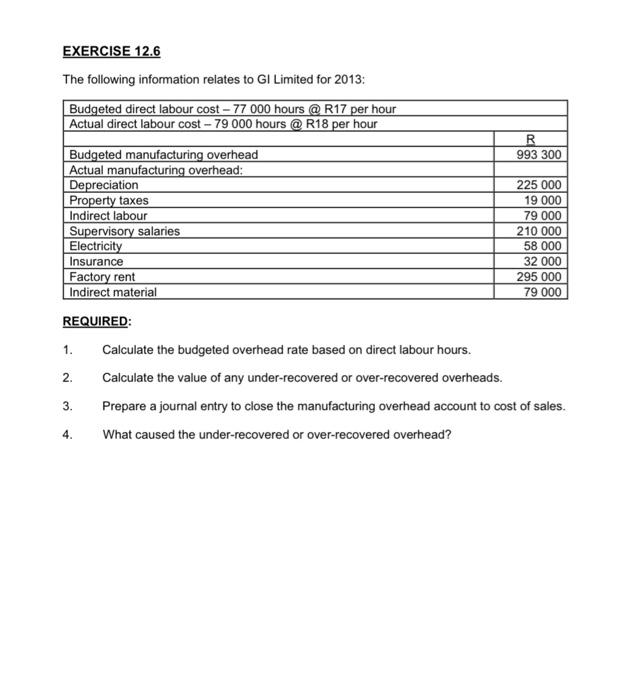

EXERCISE 12.4 Hardy-Furn is a manufacturing company that makes and restores furniture and uses a jobcosting system. Fixed overhead costs are allocated on the basis of direct labour hours. Budgeted fixed overheads for the year ended 31 December 2014 were R4 320000 . The company employs 288 skilled carpenters who work a 40 hour week for 50 weeks per annum. The company had no work in progress at the beginning of the 2014 year. The entire month of January 2014 was spent on job 460 , which called for 8000 labour hours. Cost data for January 2014 was as follows: - Raw materials purchased on account, R365000. - Raw materials requisitioned for production, R315 000(70% direct and 30% indirect). - R190 000 was incurred in respect of factory labour costs and paid in cash. An analysis of this R190 000 indicates that R80 000 accounts for fringe benefits. - Depreciation recorded on factory equipment, R72 000. - Other manufacturing overhead costs incurred were paid for in cash and amounted to R48 000 . - Manufacturing overhead cost was applied to production on a basis of 40000 labour hours worked during the month. - The completed job was moved into the finished goods warehouse on 31 January to await delivery to the customer. REQUIRED: Prepare the following general ledger accounts for the month of January 2014: - raw materials - manufacturing overheads - work in progress EXERCISE 12.6 The following information relates to GI Limited for 2013: REQUIRED: 1. Calculate the budgeted overhead rate based on direct labour hours. 2. Calculate the value of any under-recovered or over-recovered overheads. 3. Prepare a journal entry to close the manufacturing overhead account to cost of sales. 4. What caused the under-recovered or over-recovered overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started