Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer part C) The risk-free rate of interest is 5% per year semi-annually compounded Consider a stock with current price of $80. On this

pls answer part C)

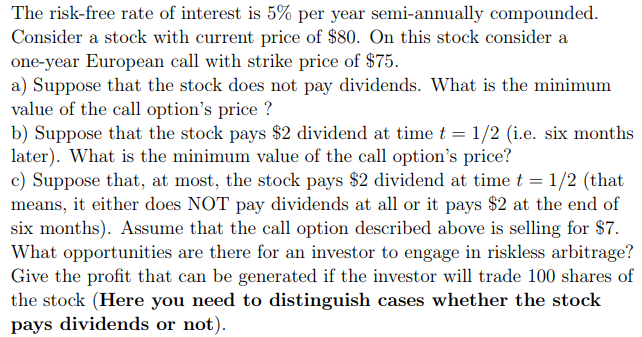

The risk-free rate of interest is 5% per year semi-annually compounded Consider a stock with current price of $80. On this stock consider a one-year European call with strike price of $75 a) Suppose that the stock does not pay dividends. What is the minimum value of the call option's price? b) Suppose that the stock pays $2 dividend at time t = 1/2 (ie, six months later). What is the minimum value of the call option's price? c) Suppose that, at most, the stock pays $2 dividend at time t-1/2 (that means, it either does NOT pay dividends at all or it pays $2 at the end of six months). Assume that the call option described above is selling for $7. What opportunities are there for an investor to engage in riskless arbitrage? Give the profit that can be generated if the investor will trade 100 shares of the stock (Here you need to distinguish cases whether the stock pays dividends or not)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started