Answered step by step

Verified Expert Solution

Question

1 Approved Answer

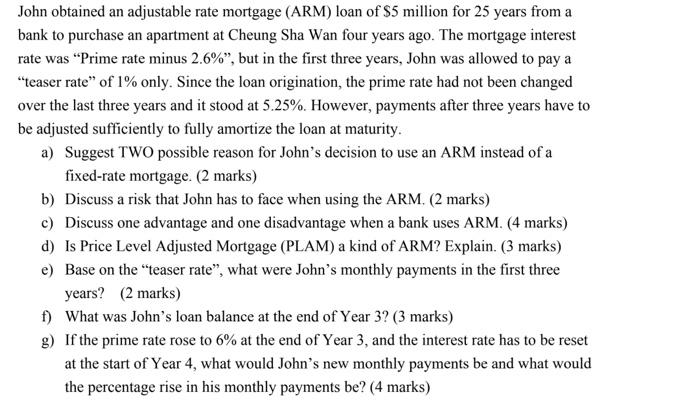

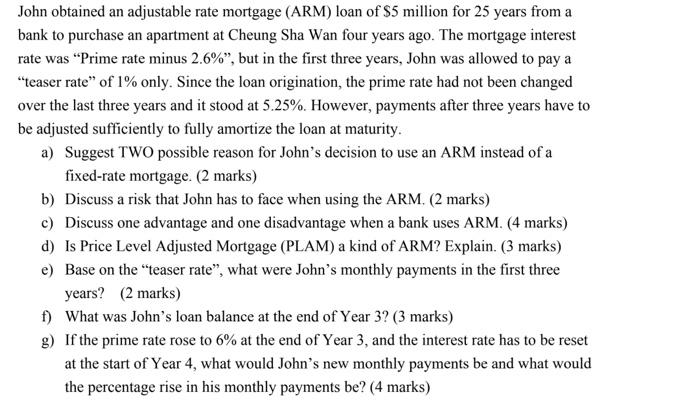

pls answer part(e) (f)&(g), thx John obtained an adjustable rate mortgage (ARM) loan of $5 million for 25 years from a bank to purchase an

pls answer part(e) (f)&(g), thx

John obtained an adjustable rate mortgage (ARM) loan of $5 million for 25 years from a bank to purchase an apartment at Cheung Sha Wan four years ago. The mortgage interest rate was "Prime rate minus 2.6%", but in the first three years, John was allowed to pay a "teaser rate" of 1% only. Since the loan origination, the prime rate had not been changed over the last three years and it stood at 5.25%. However, payments after three years have to be adjusted sufficiently to fully amortize the loan at maturity. a) Suggest TWO possible reason for John's decision to use an ARM instead of a fixed-rate mortgage. (2 marks) b) Discuss a risk that John has to face when using the ARM (2 marks) c) Discuss one advantage and one disadvantage when a bank uses ARM. (4 marks) d) Is Price Level Adjusted Mortgage (PLAM) a kind of ARM? Explain. (3 marks) e) Base on the teaser rate, what were John's monthly payments in the first three years? (2 marks) 1) What was John's loan balance at the end of Year 3? (3 marks) g) If the prime rate rose to 6% at the end of Year 3, and the interest rate has to be reset at the start of Year 4, what would John's new monthly payments be and what would the percentage rise in his monthly payments be? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started