Pls answer Q 7

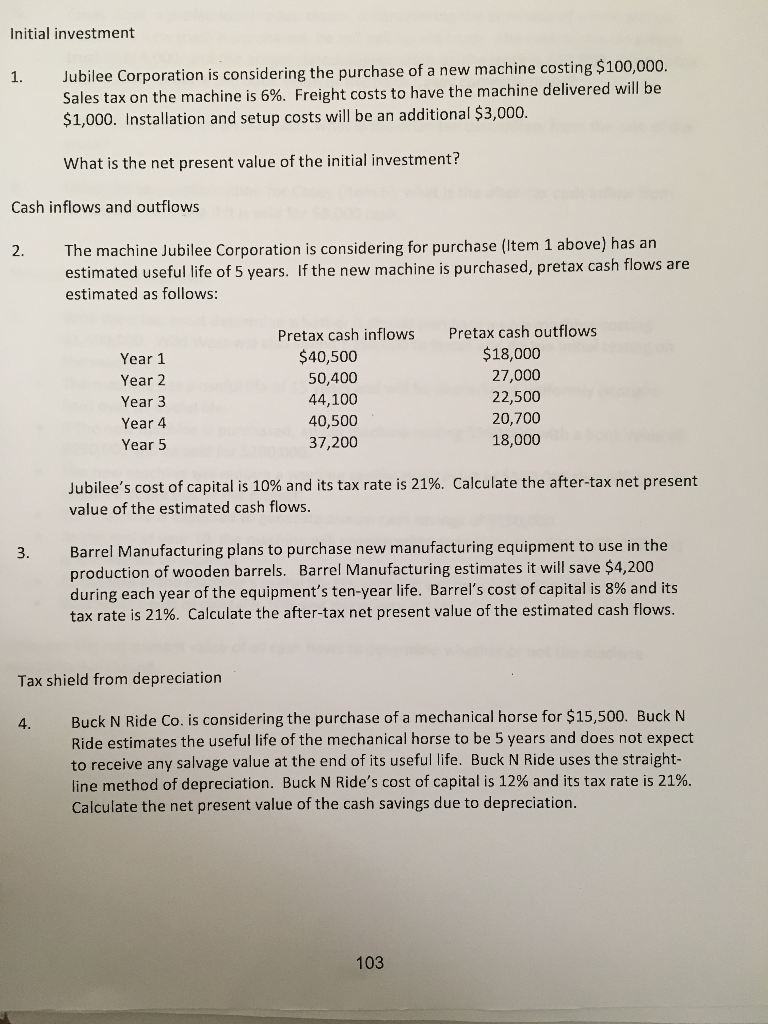

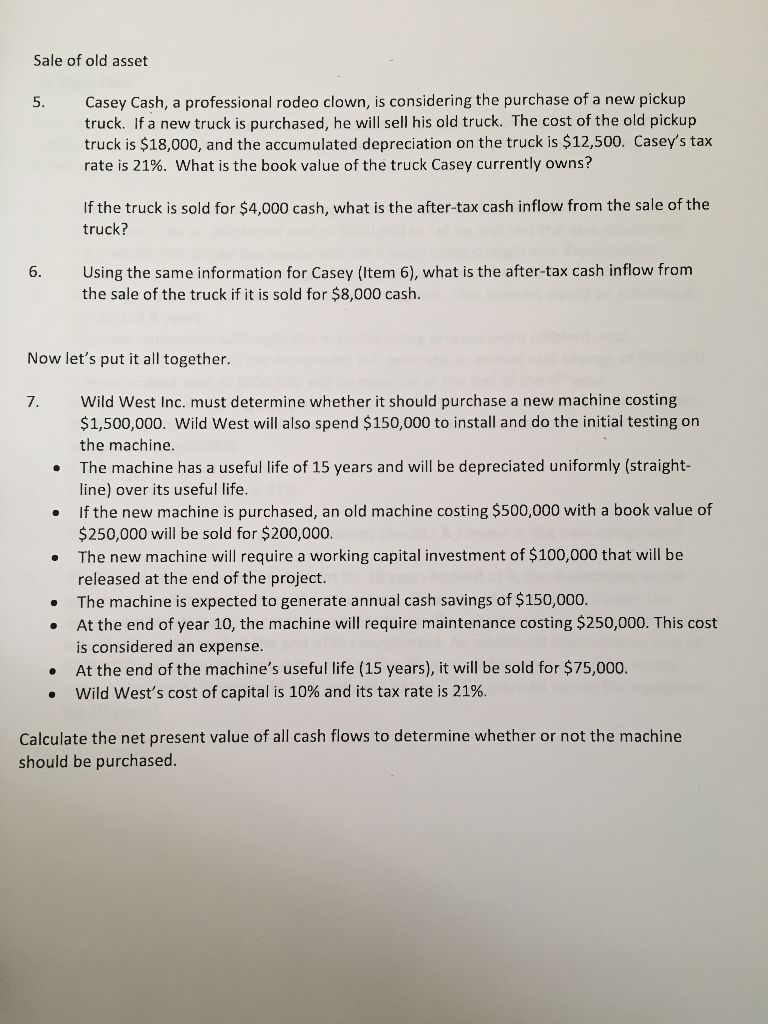

Initial investment Jubilee Corporation is considering the purchase of a new machine costing $100,000. Sales tax on the machine is 6%. Freight costs to have the machine delivered will be $1,000. Installation and setup costs will be an additional $3,000. 1. What is the net present value of the initial investment? Cash inflows and outflows The machine Jubilee Corporation is considering for purchase (Item 1 above) has an estimated useful life of 5 years. If the new machine is purchased, pretax cash flows are estimated as follows: 2. Pretax cash outflows Pretax cash inflows $18,000 27,000 22,500 20,700 18,000 $40,500 50,400 44,100 40,500 37,200 Year 1 Year 2 Year 3 Year 4 Year 5 Jubilee's cost of capital is 10% and its tax rate is 21%. Calculate the after-tax net present value of the estimated cash flows. Barrel Manufacturing plans to purchase new manufacturing equipment to use in the production of wooden barrels. Barrel Manufacturing estimates it will save $4,200 during each year of the equipment's ten-year life. Barrel's cost of capital is 8% and its tax rate is 21%. Calculate the after-tax net present value of the estimated cash flows. 3. Tax shield from depreciation Buck N Ride Co. is considering the purchase of a mechanical horse for $15,500. Buck N Ride estimates the useful life of the mechanical horse to be 5 years and does not expect to receive any salvage value at the end of its useful life. Buck N Ride uses the straight- line method of depreciation. Buck N Ride's cost of capital is 12% and its tax rate is 21%. Calculate the net present value of the cash savings due to depreciation. 4. 103 Sale of old asset Casey Cash, a professional rodeo clown, is considering the purchase of a new pickup truck. If a new truck is purchased, he will sell his old truck. The cost of the old pickup truck is $18,000, and the accumulated depreciation on the truck is $12,500. Casey's tax rate is 21%. What is the book value of the truck Casey currently owns? 5. If the truck is sold for $4,000 cash, what is the after-tax cash inflow from the sale of the truck? 6. Using the same information for Casey (tem 6), what is the after-tax cash inflow from the sale of the truck if it is sold for $8,000 cash. Now let's put it all together. Wild West Inc. must determine whether it should purchase a new machine costing $1,500,000. Wild West will also spend $150,000 to install and do the initial testing or the machine. The machine has a useful life of 15 years and will be depreciated uniformly (straight- line) over its useful life. 7. . If the new machine is purchased, an old machine costing $500,000 with a book value of $250,000 will be sold for $200,000. The new machine will require a working capital investment of $100,000 that will be released at the end of the project. . The machine is expected to generate annual cash savings of $150,000. . At the end of year 10, the machine will require maintenance costing $250,000. This cost is considered an expense. At the end of the machine's useful life (15 years), it will be sold for $75,000. Wild West's cost of capital is 10% and its tax rate is 21%. . . Calculate the net present value of all cash flows to determine whether or not the machine should be purchased