Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer qn 6 Mayo plc is financed by 31 million shares of equity with a market capitalisation of 74.4 million, and debt with a

pls answer qn 6

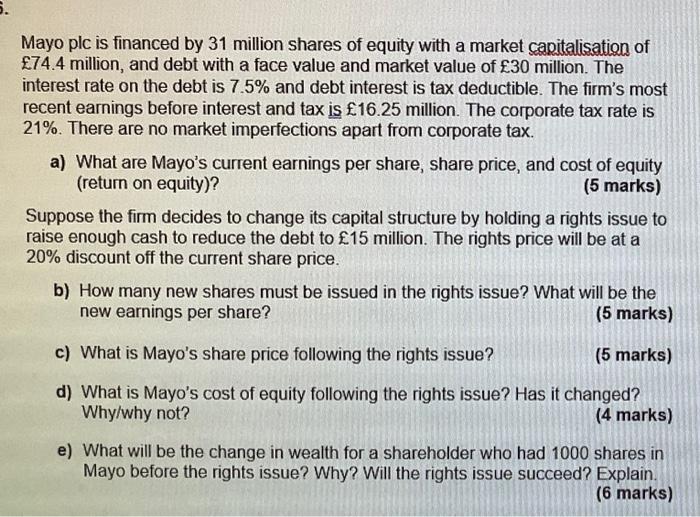

Mayo plc is financed by 31 million shares of equity with a market capitalisation of 74.4 million, and debt with a face value and market value of 30 million. The interest rate on the debt is 7.5% and debt interest is tax deductible. The firm's most recent earnings before interest and tax is 16.25 million. The corporate tax rate is 21%. There are no market imperfections apart from corporate tax. a) What are Mayo's current earnings per share, share price, and cost of equity (return on equity)? (5 marks) Suppose the firm decides to change its capital structure by holding a rights issue to raise enough cash to reduce the debt to 15 million. The rights price will be at a 20% discount off the current share price. b) How many new shares must be issued in the rights issue? What will be the new earnings per share? (5 marks) c) What is Mayo's share price following the rights issue? (5 marks) d) What is Mayo's cost of equity following the rights issue? Has it changed? Why/why not? (4 marks) e) What will be the change in wealth for a shareholder who had 1000 shares in Mayo before the rights issue? Why? Will the rights issue succeed? Explain. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started