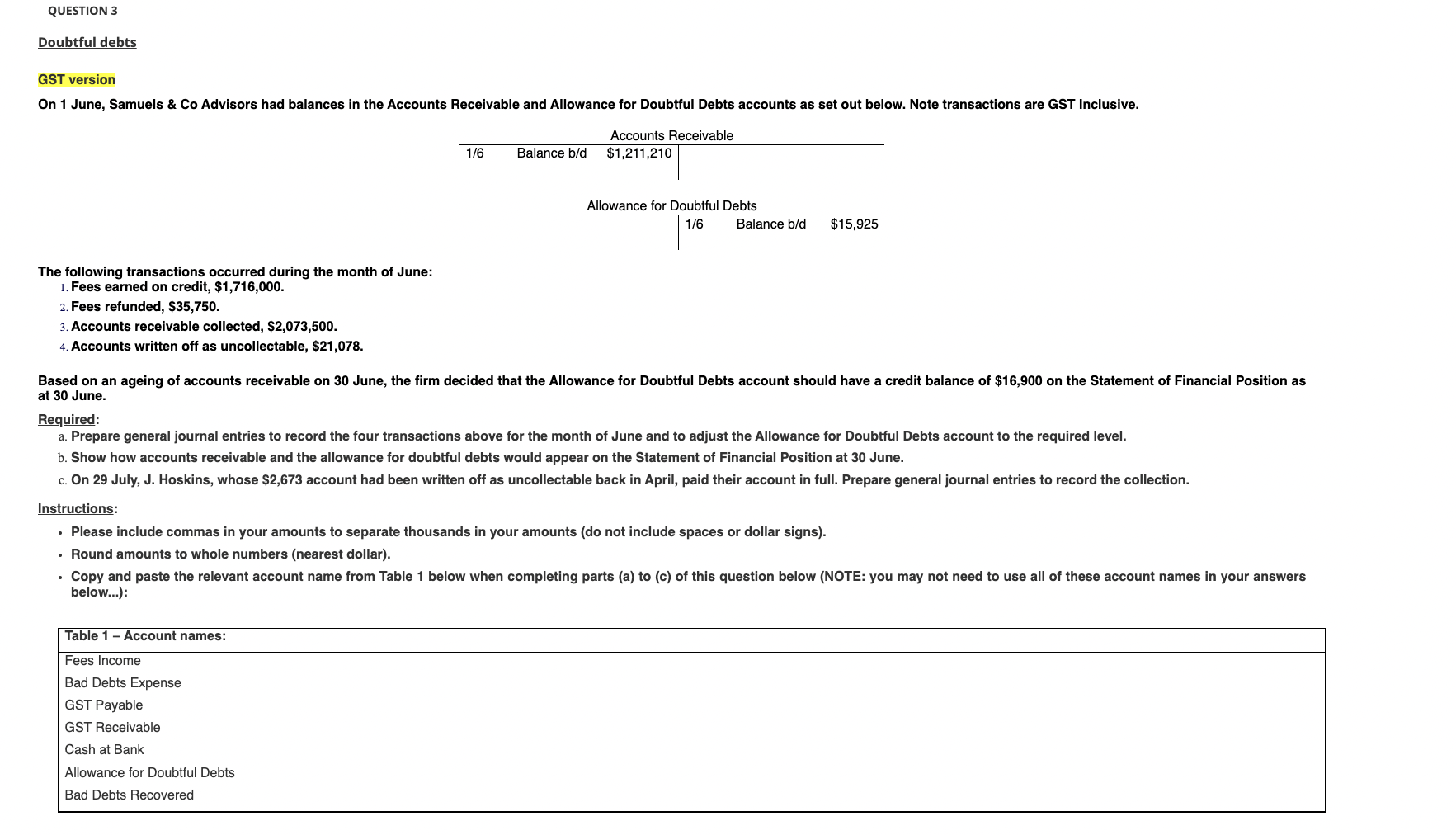

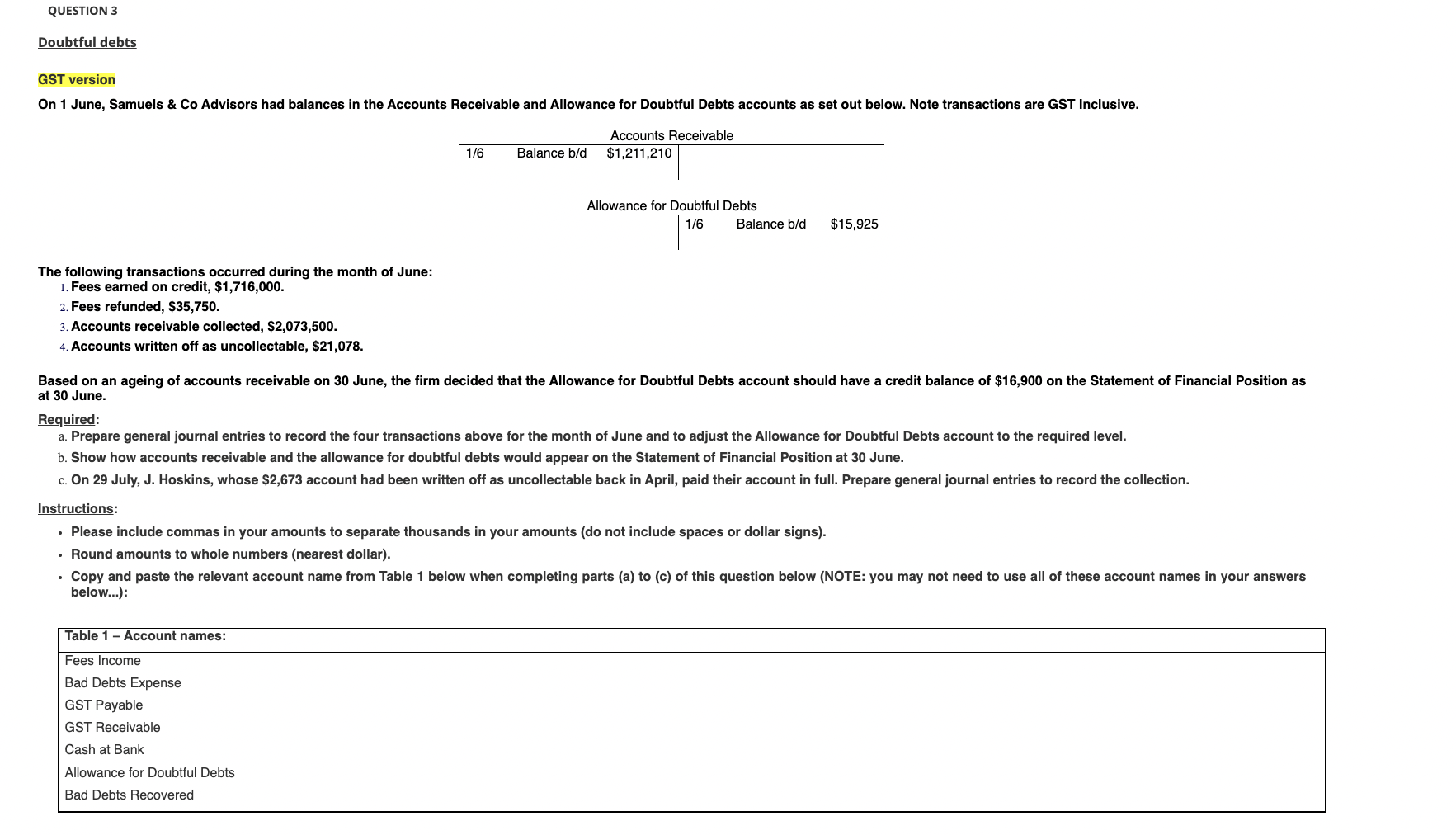

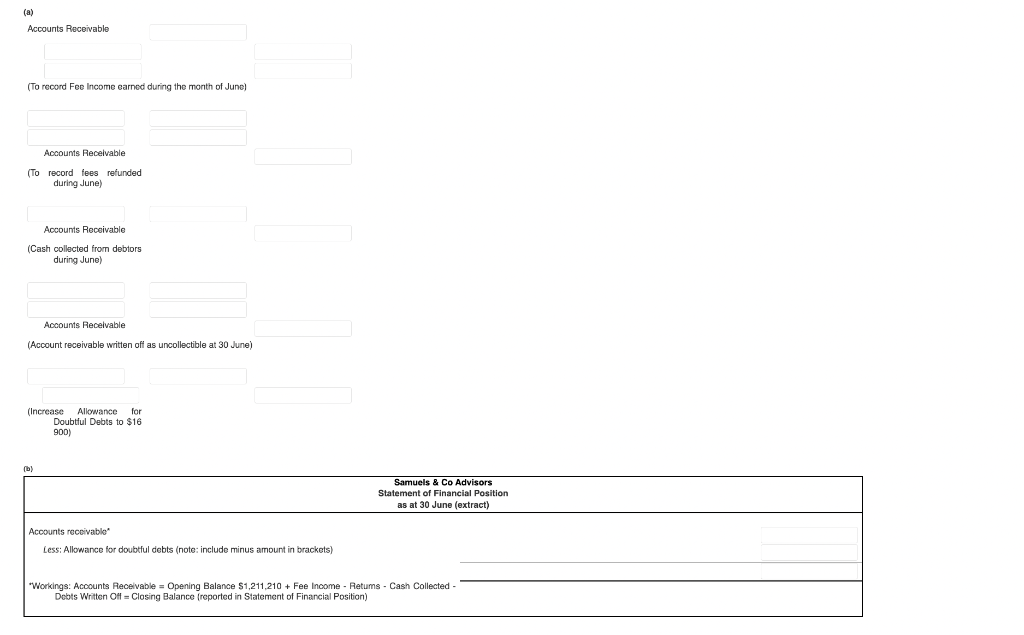

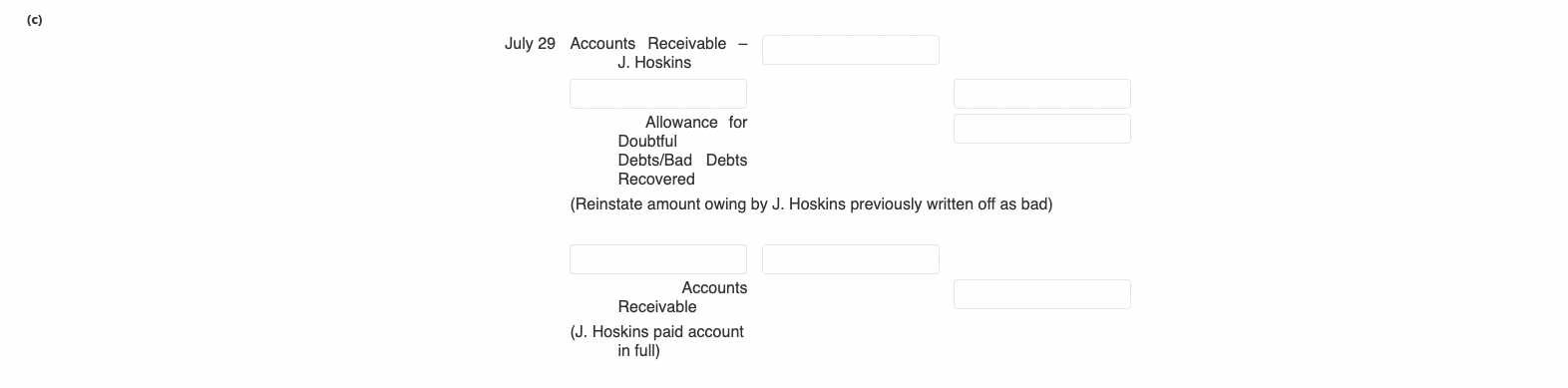

Pls answer question a, b and c for question 3 with working out. GST is 10% (Good and services tax)

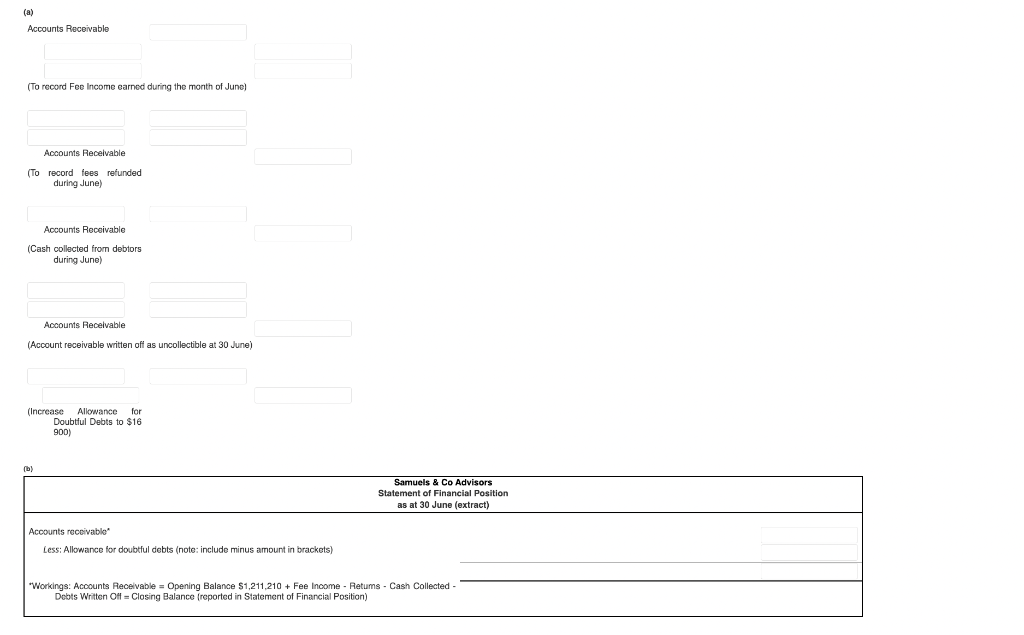

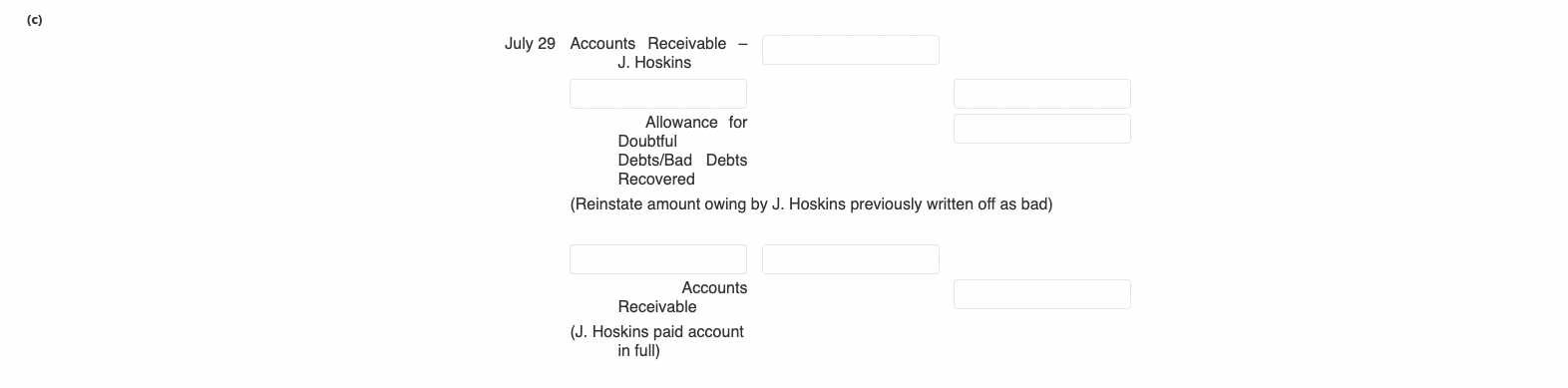

The following transactions occurred during the month of June: 1. Fees earned on credit, $1,716,000. 2. Fees refunded, $35,750. 3. Accounts receivable collected, $2,073,500. 4. Accounts written off as uncollectable, $21,078. at 30 June. Required: b. Show how accounts receivable and the allowance for doubtful debts would appear on the Statement of Financial Position at 30 June. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). below...): (a) Accounts Receivable (To record Fee Income earned during the month of June) Accounts Receivable (To record fees refunded during June) Accounts Recoivable (Cash collected from debtors during June) Accounts Receivable (Account receivable written oft as uncollectible at 30June ) (Increase Allowance for Doub (c) July 29 Accounts Receivable - J. Hoskins Allowance for Doubtful Debts/Bad Debts Recovered (Reinstate amount owing by J. Hoskins previously written off as bad) Accounts Receivable (J. Hoskins paid account in full) The following transactions occurred during the month of June: 1. Fees earned on credit, $1,716,000. 2. Fees refunded, $35,750. 3. Accounts receivable collected, $2,073,500. 4. Accounts written off as uncollectable, $21,078. at 30 June. Required: b. Show how accounts receivable and the allowance for doubtful debts would appear on the Statement of Financial Position at 30 June. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). below...): (a) Accounts Receivable (To record Fee Income earned during the month of June) Accounts Receivable (To record fees refunded during June) Accounts Recoivable (Cash collected from debtors during June) Accounts Receivable (Account receivable written oft as uncollectible at 30June ) (Increase Allowance for Doub (c) July 29 Accounts Receivable - J. Hoskins Allowance for Doubtful Debts/Bad Debts Recovered (Reinstate amount owing by J. Hoskins previously written off as bad) Accounts Receivable (J. Hoskins paid account in full)