pls answer these

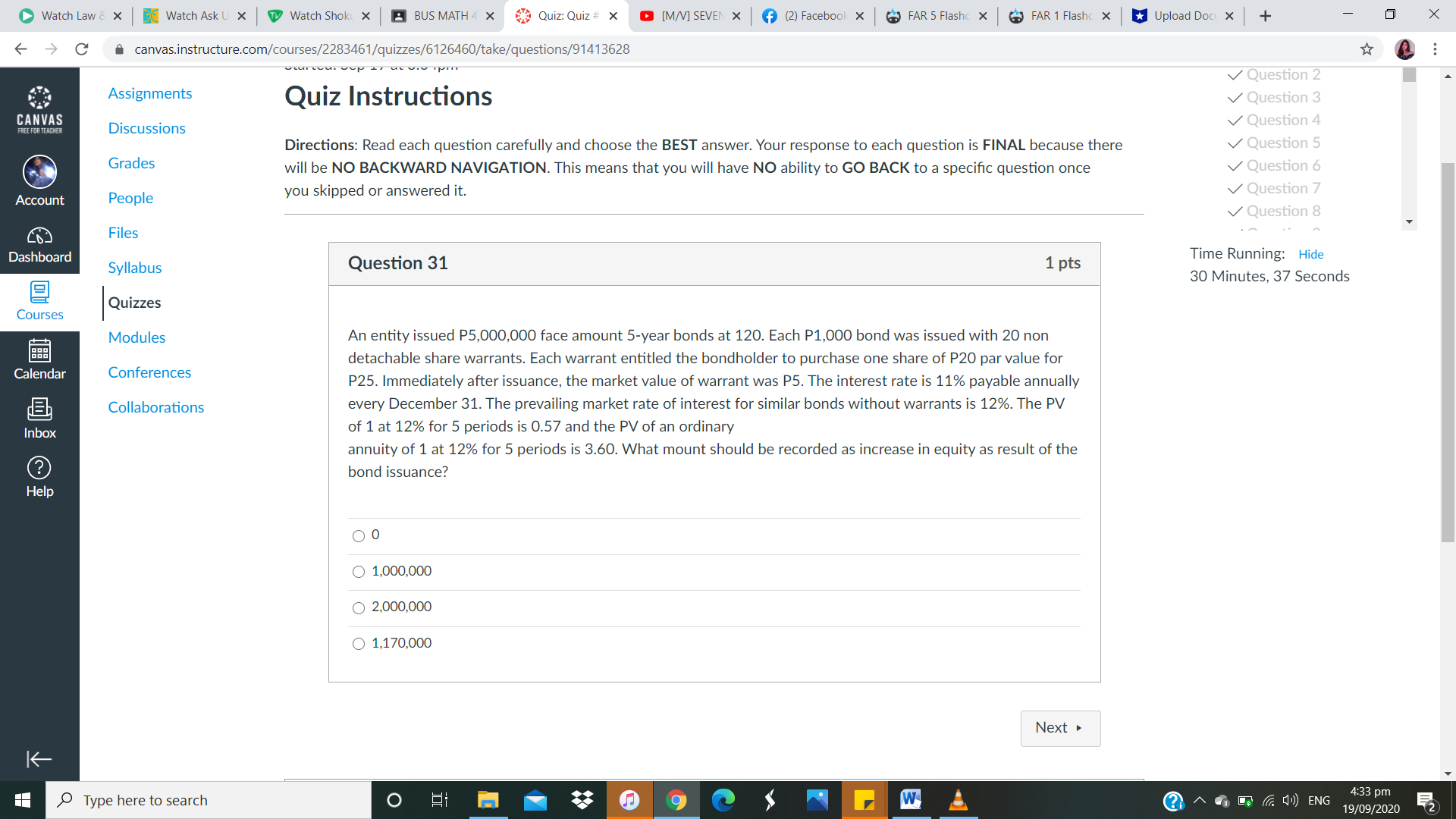

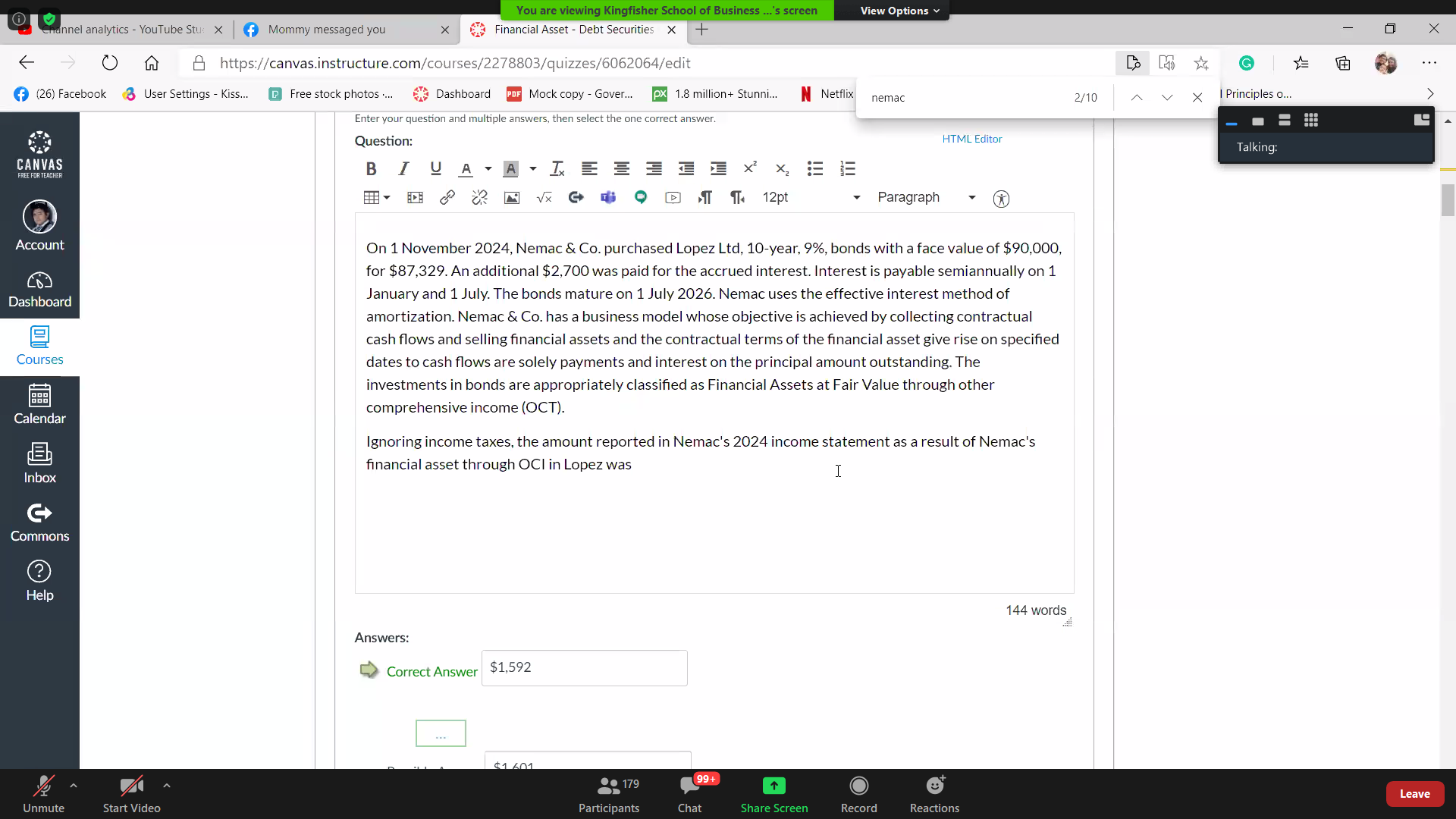

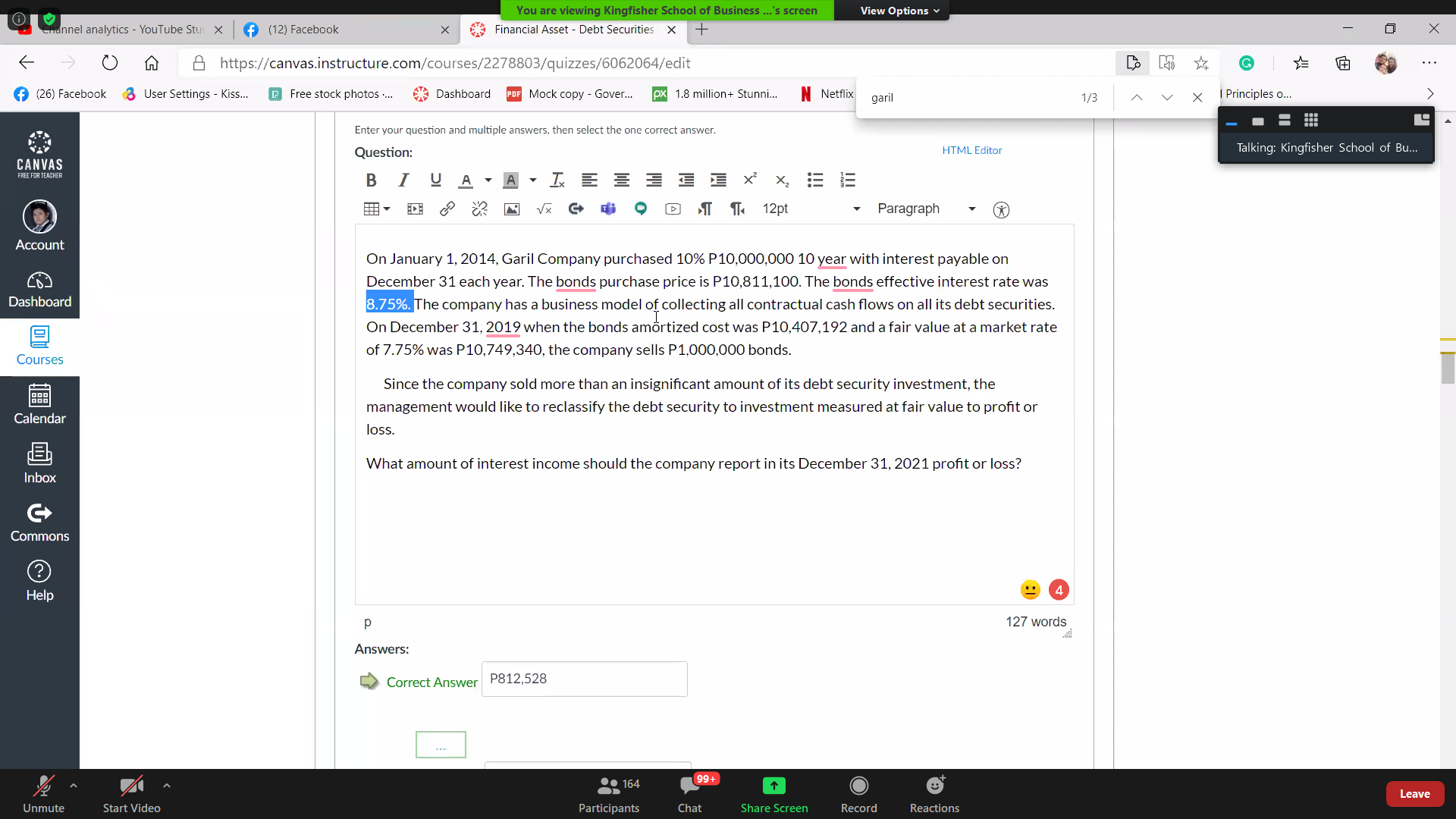

0 Watch Law x l E WatcllAskl. x l 9 Watch Snok x l E EUSMATHL x 3- Quiz:ouiz: x a [M/V] scvcr x l a (ziracebooi x i Q FAREFIash; x l a; FAR1 Flash! x | u Upload Doc x l + i X (- 9 C O canvas.instrudure.com/coumes/2283461/quizzes/Gi26460/take/questions/914'l 3628 r . m... 1. cw... \\/ A ASS'enments QUIZ Instructions v CAN'T/7A5 Discussions \\/ Directions: Read each question carefully and choose the BEST answer. Your response to each question is FINAL because there \\/ 63 Grades will be NO BACKWARD NAVIGATION. This means that you will have NO ability to GO BACK to a specic question once \\/ ' ' \\/ Account People you skipped or answered It. \\/ v (5} Files , Dashboard Syllabus Question 31 1 pts TIme Running; Hide 30 Minutes, 37 Seconds E | Quizzes Courses Modules An entity issued P5,000,000 face amount 5-year bonds at 120. Each P1000 bond was issued with 20 non detachable share warrants. Each warrant entitled the bondholder to purchase one share of P20 parvalue for P25. Immediately after issuance, the market value of warrant was P5. The interest rate is 11% payable annually Collaborations every December 31. The prevailing market rate of interest for similar bonds without warrants is 12%. The PV of 1 at 12% for 5 periods is 0.57 and the PV of an ordinary annuity of 1 at 12% for 5 periods is 3.60. What mount should be recorded as increase in equity as result of the Calendar Conferences bond issuance? o 0 0 1,000,000 0 2,000,000 0 1,170,000 Next , )3 Type hereto search You are viewing Kingfisher School of Business ..'s screen View Options tannel analytics - YouTube Stu: X f Mommy messaged you X Financial Asset - Debt Securities X + X https://canvas.instructure.com/courses/2278803/quizzes/6062064/edit G . . . (26) Facebook 3 User Settings - Kiss.. Free stock photos .. Dashboard PDF Mock copy - Gover.. px 1.8 million+ Stunni... N Netflix nemac 2/10 V X | Principles O... Enter your question and multiple answers, then select the one correct answer. Question: HTML Editor Talking: CANVAS FREE FOR TEACHER B I U A . A . I E E B E E X X E . 1 2 2 x G 9 0 1 1 12 pt Paragraph Account On 1 November 2024, Nemac & Co. purchased Lopez Lid, 10-year, 9%, bonds with a face value of $90,000, for $87,329. An additional $2,700 was paid for the accrued interest. Interest is payable semiannually on 1 Dashboard January and 1 July. The bonds mature on 1 July 2026. Nemac uses the effective interest method of amortization. Nemac & Co. has a business model whose objective is achieved by collecting contractual cash flows and selling financial assets and the contractual terms of the financial asset give rise on specified Courses dates to cash flows are solely payments and interest on the principal amount outstanding. The investments in bonds are appropriately classified as Financial Assets at Fair Value through other Calendar comprehensive income (OCT). Eh Ignoring income taxes, the amount reported in Nemac's 2024 income statement as a result of Nemac's Inbox financial asset through OCI in Lopez was I Commons ? Help 144 words Answers: Correct Answer $1,592 ... $1 601 179 99+ O Leave Unmute Start Video Participants Chat Share Screen Record ReactionsYou are viewing Kingfisher School of Business ..'s screen View Options Channel analytics - YouTube Stu: X f (12) Facebook X Financial Asset - Debt Securities X + X https://canvas.instructure.com/courses/2278803/quizzes/6062064/edit G . . . (26) Facebook 3 User Settings - Kiss... Free stock photos . Dashboard PDF Mock copy - Gover.. px 1.8 million+ Stunni.. N Netflix garil 1/3 V X | Principles O... Enter your question and multiple answers, then select the one correct answer. CANVAS Question: HTML Editor Talking: Kingfisher School of Bu... FREE FOR TEACHER B I U A . A . T B B B B E X X - 1 3 2 x 9 0 1 1 12 pt Paragraph Account On January 1, 2014, Garil Company purchased 10% P10,000,000 10 year with interest payable on December 31 each year. The bonds purchase price is P10,811,100. The bonds effective interest rate was Dashboard 8.75%. The company has a business model of collecting all contractual cash flows on all its debt securities. On December 31, 2019 when the bonds amortized cost was P10,407,192 and a fair value at a market rate Courses of 7.75% was P10,749,340, the company sells P1,000,000 bonds. Since the company sold more than an insignificant amount of its debt security investment, the Calendar management would like to reclassify the debt security to investment measured at fair value to profit or loss Eh Inbox What amount of interest income should the company report in its December 31, 2021 profit or loss? Commons ? Help 4 p 127 words Answers: Correct Answer P812,528 ... 164 99+ O Leave Unmute Start Video Participants Chat Share Screen Record Reactions