Pls answer this in a good accounting form

1.

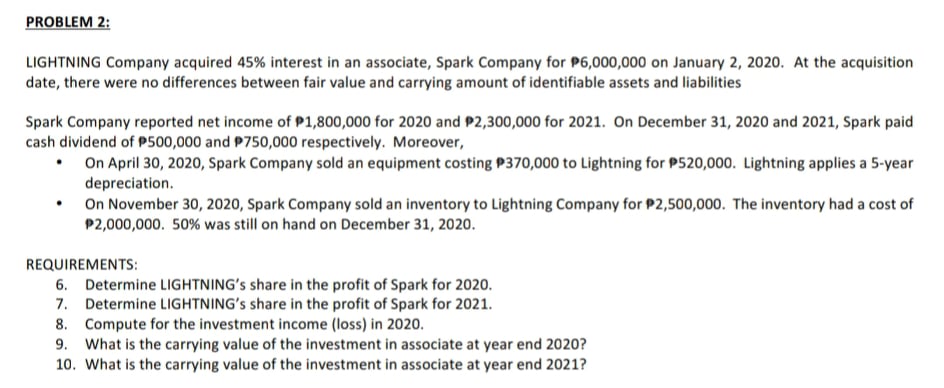

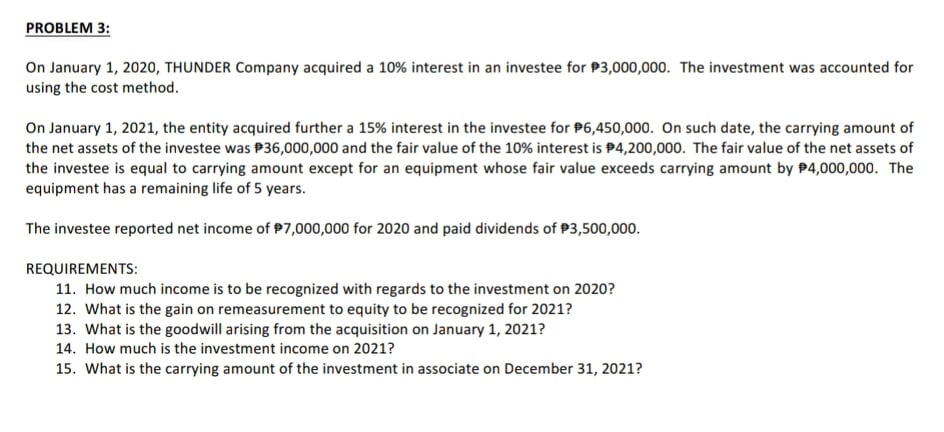

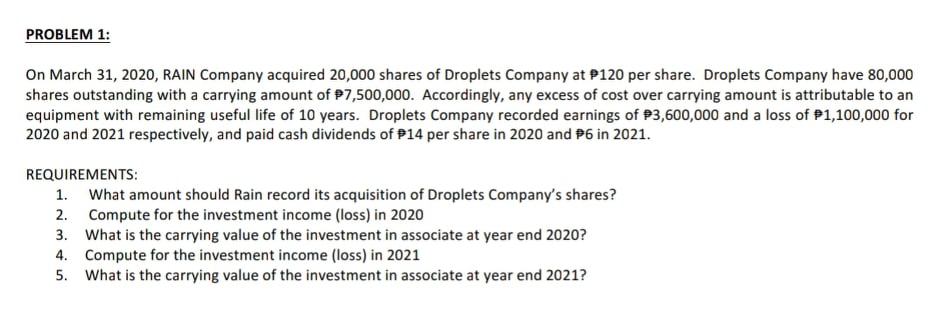

PROBLEM 2: LIGHTNING Company acquired 45% interest in an associate, Spark Company for P6,000,000 on January 2, 2020. At the acquisition date, there were no differences between fair value and carrying amount of identifiable assets and liabilities Spark Company reported net income of P1,800,000 for 2020 and P2,300,000 for 2021. On December 31, 2020 and 2021, Spark paid cash dividend of P500,000 and P750,000 respectively. Moreover, On April 30, 2020, Spark Company sold an equipment costing P370,000 to Lightning for P520,000. Lightning applies a 5-year depreciation. On November 30, 2020, Spark Company sold an inventory to Lightning Company for P2,500,000. The inventory had a cost of P2,000,000. 50% was still on hand on December 31, 2020. REQUIREMENTS: 6. Determine LIGHTNING's share in the profit of Spark for 2020. 7. Determine LIGHTNING's share in the profit of Spark for 2021. 8. Compute for the investment income (loss) in 2020. 9. What is the carrying value of the investment in associate at year end 2020? 10. What is the carrying value of the investment in associate at year end 2021?PROBLEM 3: On Januarv 1, 2020, THUNDER Company acquired a 1095 interest in an investee for 93,000,000. The investment was accounted for using the cost method. On January 1, 2021, the entity acquired further a 15% Interest In the Investee for 96,450,000. On such date, the carrying amount of the net assets of the investee was \"6,000,000 and the fair value of the 1096 interest is 04,200,000. The fair value of the net assets of the lnvestee is equal to carrying amount except for an equipment whose fair value exceeds carrying amount bv 94,000,000. The equipment has a remalnlng life ofS years. The Investee reported net income of P32000000 for 2020 and paid dividends of 03,500,000. REQUIREMENTS: 11. How much income Is to be recognized with regards to the investment on 2020? 12' What IS the Rain on remeasurement to equity to he recognized for 2021? 13. What Is the goodwill arising from the acquisition on January 1, 2021? 1d- How much is the investment income on 2021? 15. what is the carrying amount of the investment in associate on December 31, 2021?I PROBLEM 1: On March 31, 2020, RAIN Company acquired 20,000 shares of Droplets Company at P120 per share. Droplets Company have 30,000 shares outstanding with a carrying amount of #1500000. Accordingly, any excess of cost over carrying amount is attributable to an equipment with remaining useful life of 10 years. Droplets Company recorded earnings of 3,600,000 and a loss of P1,100,000 for 2020 and 2021 respectively, and pald cash dividends of '14 per share in 2020 and 96 In 2021. REQUIREMENTS: 1. What amount should Rain record its acquisition of Droplets Company' 5 shares? 2. Compute for the investment Income {loss}! In 2020 3. What is the carrying value of the investment in associate at year end 2020? 4. Compute for the investment income [loss] in 2021 5. What Is the carrylng value of the investment In associate at year end 2021