Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls answer this Whispering Winds Corp. completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Whispering

Pls answer this

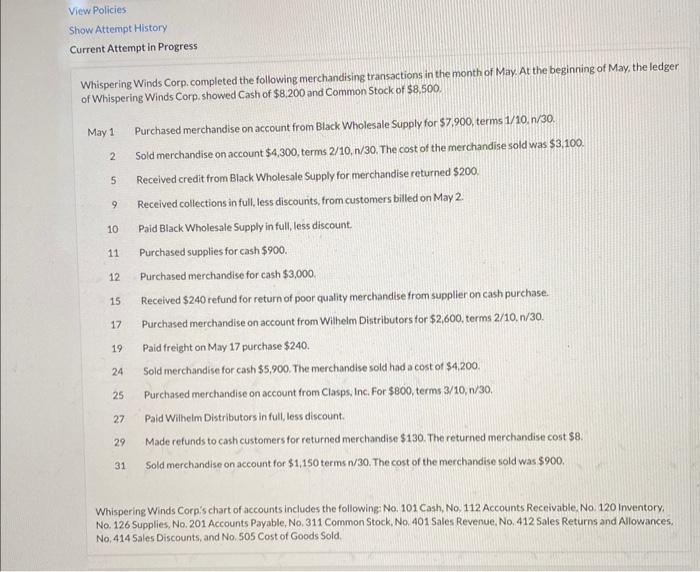

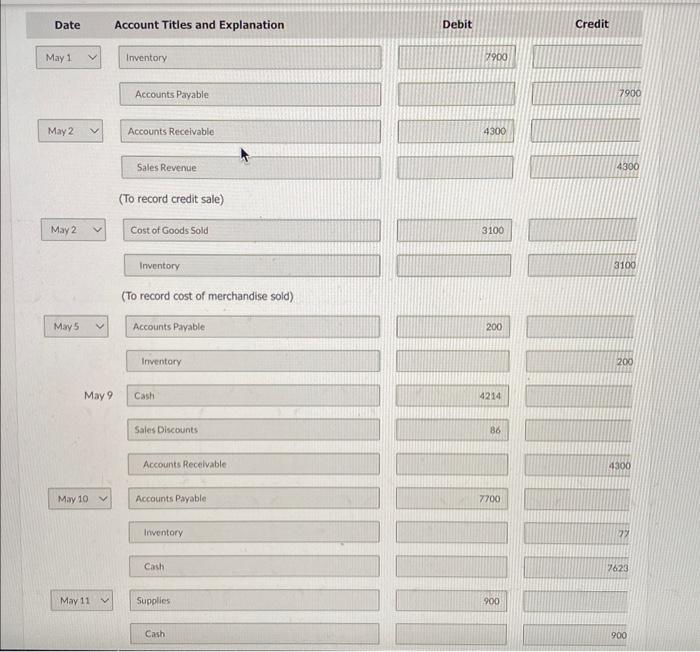

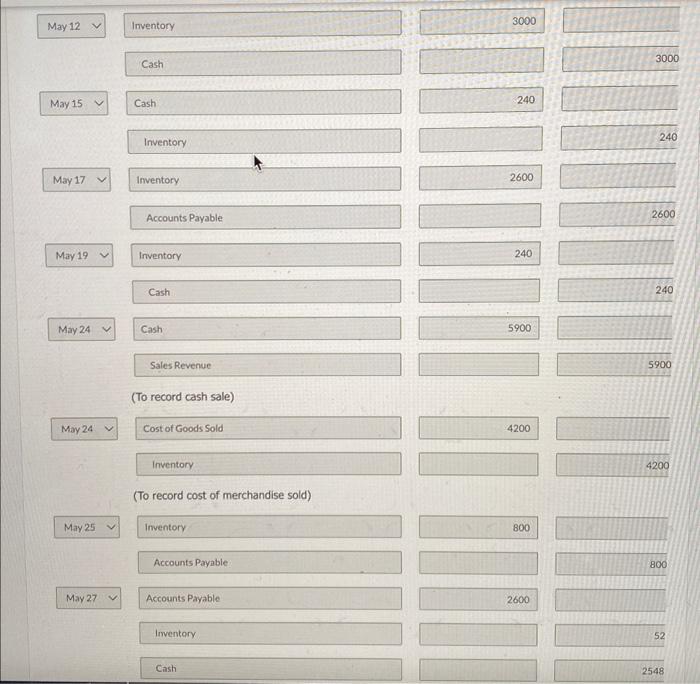

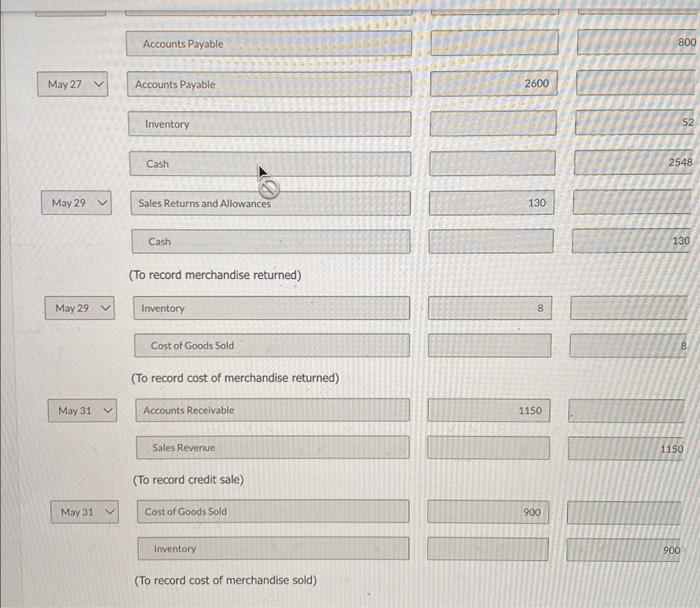

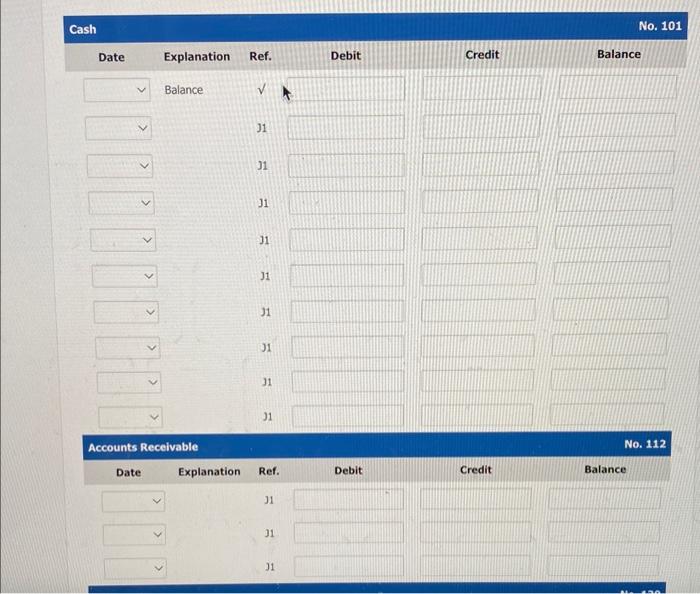

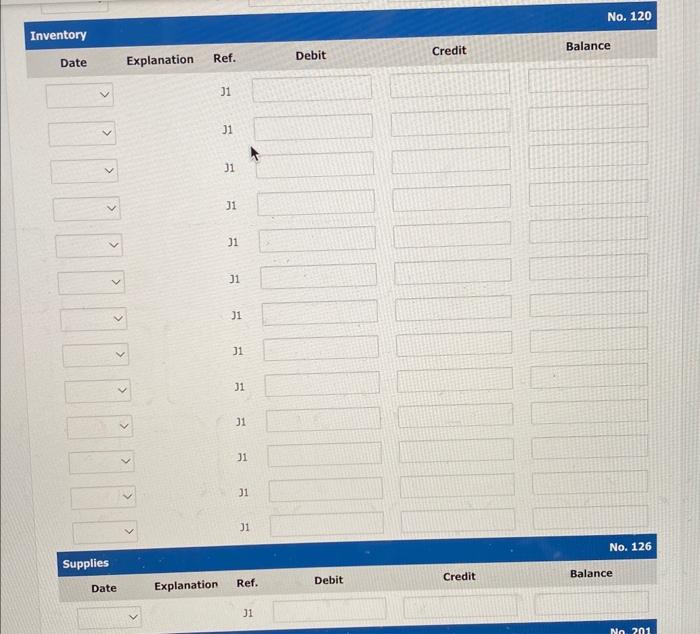

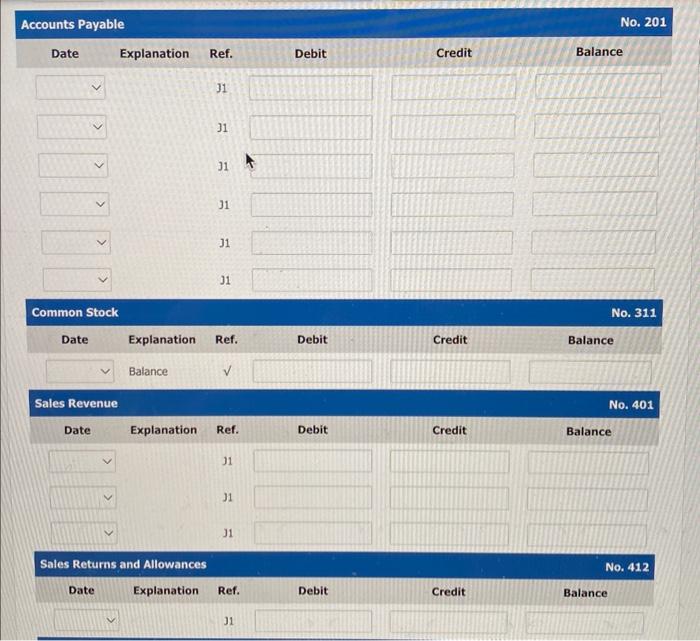

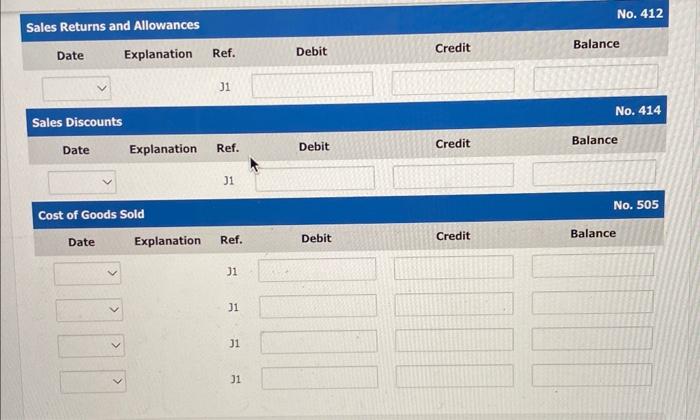

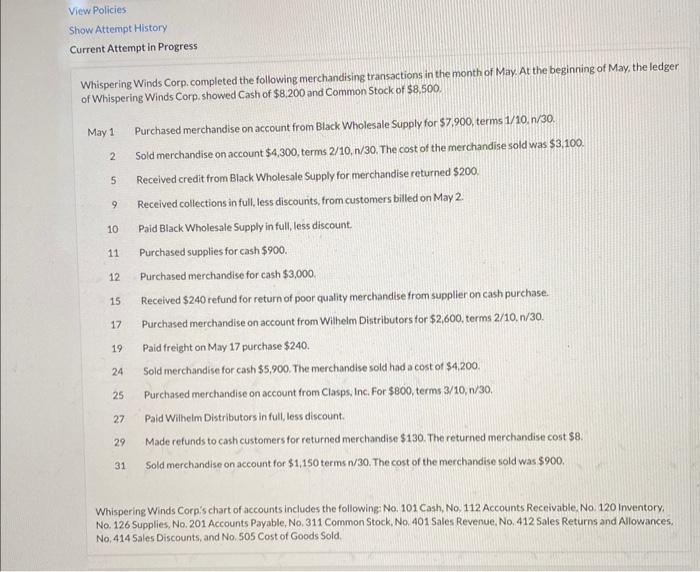

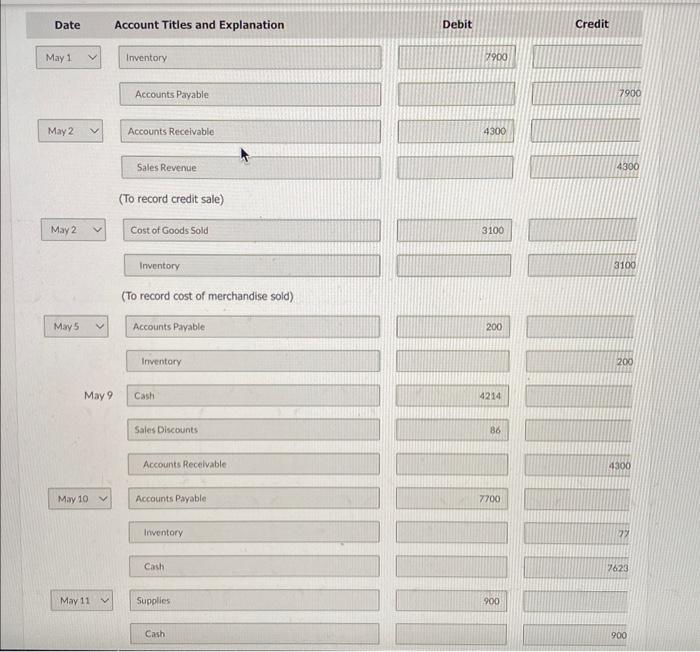

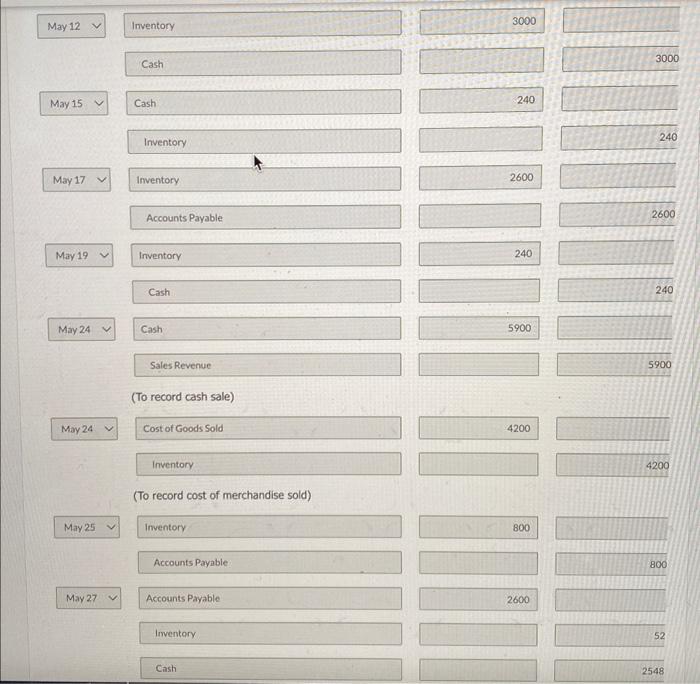

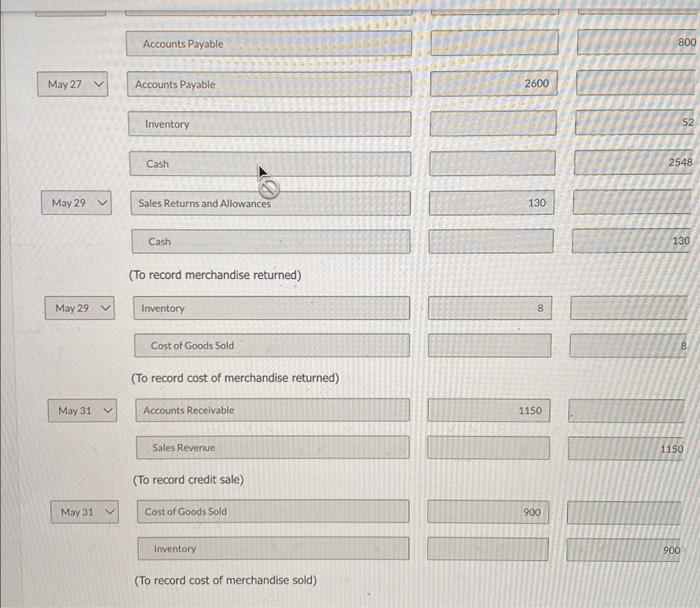

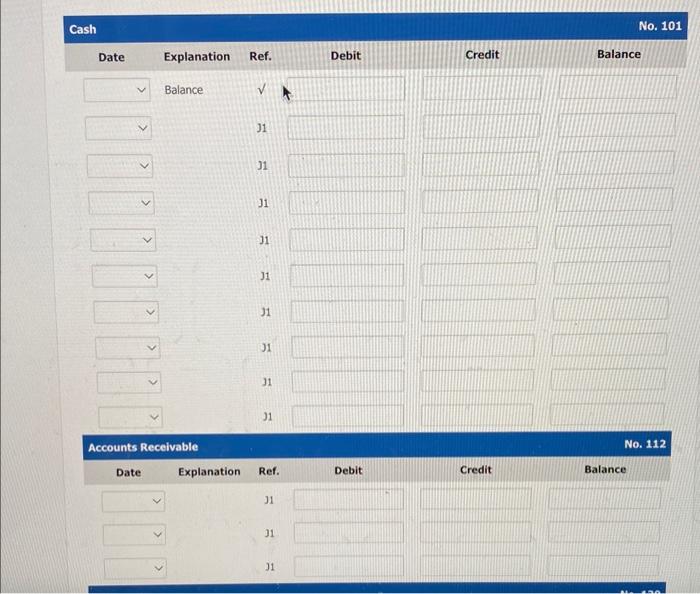

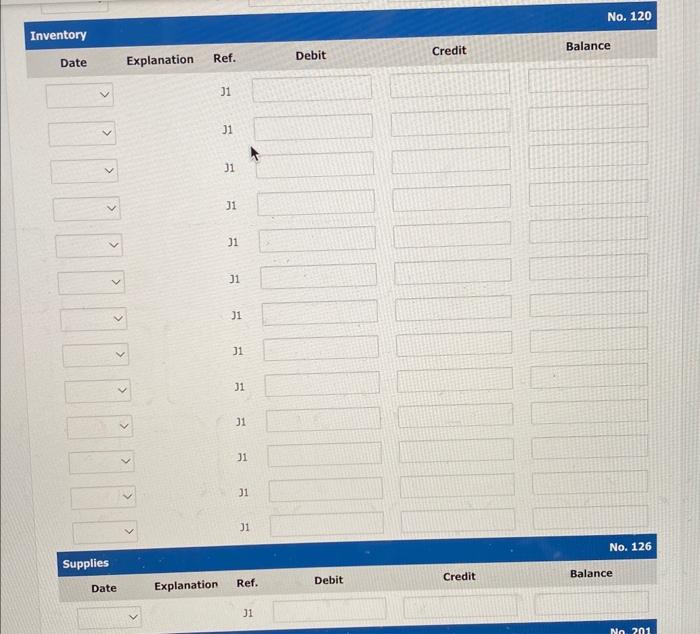

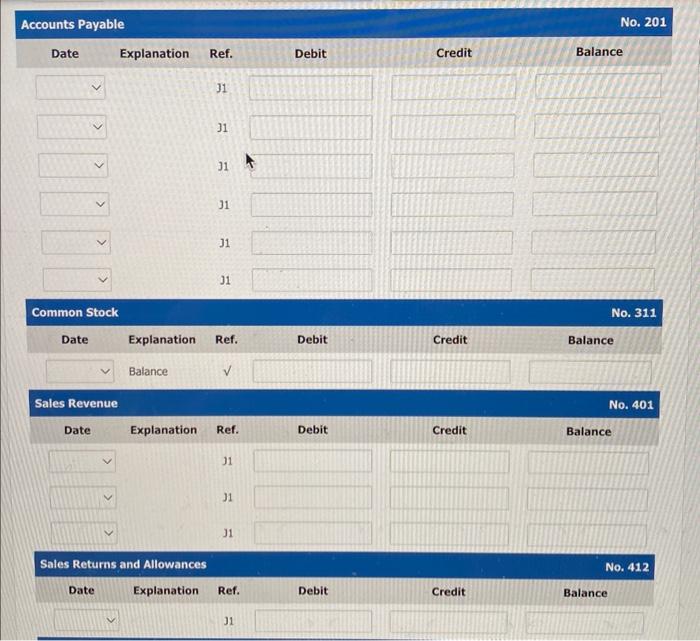

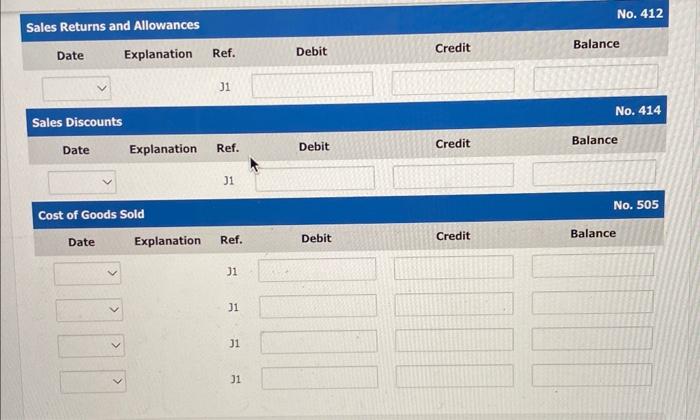

Whispering Winds Corp. completed the following merchandising transactions in the month of May. At the beginning of May, the ledger of Whispering Winds Corp. showed Cash of $8,200 and Common Stock of $8,500. May 1 Purchased merchandise on account from Black Wholesale Supply for $7,900, terms 1/10, n/30. 2 Sold merchandise on account $4,300, terms 2/10,n/30. The cost of the merchandise sold was $3,100. 5 Received credit from Black Wholesale Supply for merchandise returned $200. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Black Wholesale Supply in full, less discount. 11 Purchased supplies for cash $900. 12 Purchased merchandise for cash $3,000. 15 Received $240 refund for return of poor quality merchandise from supplier on cash purchase. 17 Purchased merchandise on account from Witheim Distributors for $2,600, terms 2/10,n/30. 19 Paid freight on May 17 purchase $240. 24 Sold merchandise for cash $5,900. The merchandise sold had a cost of $4,200. 25 Purchased merchandise on account from Clasps, Inc. For $800, terms 3/10,n/30. 27. Paid Wilhelm Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $130. The returned merchandise cost $8. 31 Sold merchandise on account for $1,150 terms n/30. The cost of the merchandise sold was $900. Whispering Winds Corp's chart of accounts includes the following: No. 101 Cash, No. 112 . Accounts Receivable. No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, No, 311 Common Stock, No. 401 Sales Revenue, No. 412 Sales Returns and Alowances. No, 414 5ales Discounts, and No, 505 Cost of Goods Sold. \begin{tabular}{l} Date Account Titles and Explanation \\ \hline May 1 \\ \begin{tabular}{ll|l|} \hline Accounts Payable \\ \hline May 2 \\ \hline Accounts Recelvable \\ \hline Sales Revenue \end{tabular} \end{tabular} (To record credit sale) \begin{tabular}{ll|l|l|l|} \hline May 25 & Cost of Goods Sold \\ \hline Inventory & \\ \hline \end{tabular} (To record cost of merchandise sold). \begin{tabular}{|l|l|} \hline May 5 & Accounts Payable \\ & Irventory \\ May 9 & Cash \\ & Sales Discounts \\ Mccounts Recelvable \\ May 10 & Accounts Payable \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & 200 \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline & 4214 \\ \hline \end{tabular} Itwentory Cash Cash May 12v Inventory Cash May 15 Cash 240 \begin{tabular}{l} \hline Inventory \\ \hline Inventory \end{tabular} (To record cash sale) (To record cost of merchandise sold) Irventory Cash Accounts Payable Accounts Payable Inventory Inventory Accounts Payable No. 201 Common Stock \begin{tabular}{|cccc|} \hline Date Explanation & Ref. & Debit \\ \hline Balance & & \\ \hline \end{tabular} Sales Revenue Sales Returns and Allowances Sales Returns and Allowances No. 412 \begin{tabular}{|r|c|} \hline Date Explanation Ref. Debit \end{tabular} Sales Discounts Date Explanation Ref. Debit No, 414 Cost of Goods Sold Date Explanation Ref. No. 505 31 31 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started