Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answers 1-4 tysm 1. Which of the following may not be deducted from gross receipts to arrive at gross income for purposes of computing

pls answers 1-4 tysm

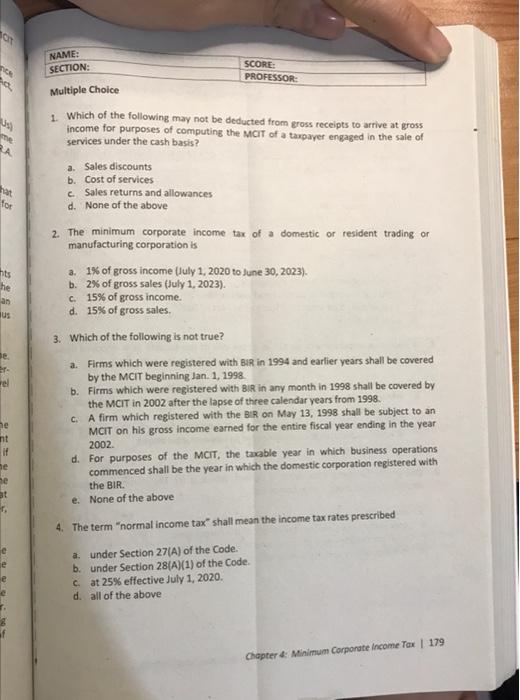

1. Which of the following may not be deducted from gross receipts to arrive at gross income for purposes of computing the MCit of a taxpayer engaged in the sale of services under the cash basis? a. Sales discounts b. Cost of services c. Sales returns and allowances d. None of the above 2. The minimum corporate income tax of a domestic or resident trading or manufacturing corporation is 3. 1% of gross income (July 1,2020 to June 30,2023 ). b. 2% of gross sales (July 1, 2023). c. 15% of gross income. d. 15% of gross sales. 3. Which of the following is not true? a. Firms which were registered with 8 .R in 1994 and earlier years shall be covered by the MCIT beginning Jan. 1,1998. b. Firms which were registered with BIR in any month in 1998 shall be covered by the MCIT in 2002 after the lapse of three calendar years from 1998. c. A firm which registered with the BIR on May 13, 1998 shall be subject to an MCIT on his gross income earned for the entire fiscal year ending in the year 2002. d. For purposes of the MCIT, the taxable year in which business operations commenced shall be the year in which the domestic corporation registered with the BIR. e. None of the above 4. The term "normal income tax" shall mean the income tax rates prescribed a. under Section 27(A) of the Code. b. under Section 28(A)(1) of the Code. c. at 25% effective July 1,2020 . d. all of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started