Answered step by step

Verified Expert Solution

Question

1 Approved Answer

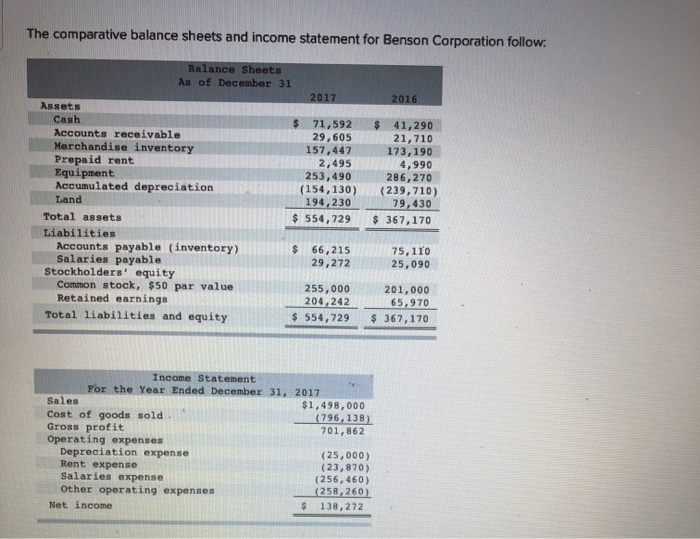

PLS BE SUPER SPECIFIC AND UNDERSTANDABLE The comparative balance sheets and income statement for Benson Corporation follow: Balance Sheets As of December 31 2017 2016

PLS BE SUPER SPECIFIC AND UNDERSTANDABLE

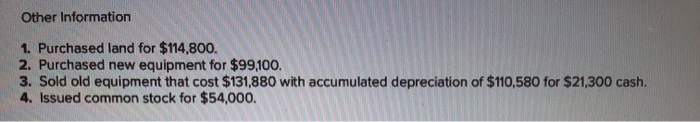

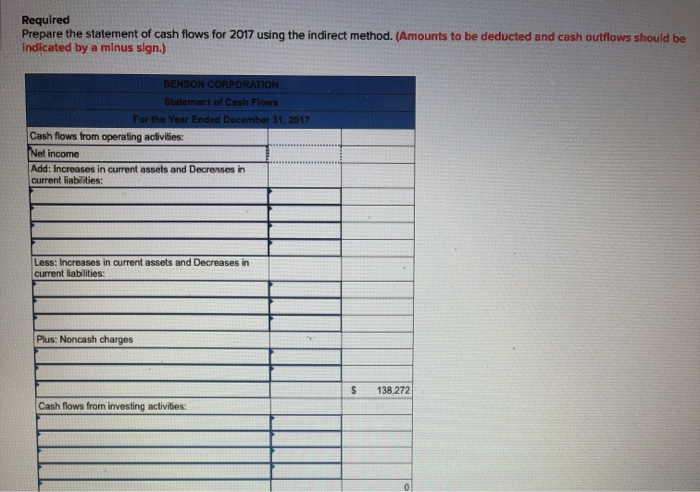

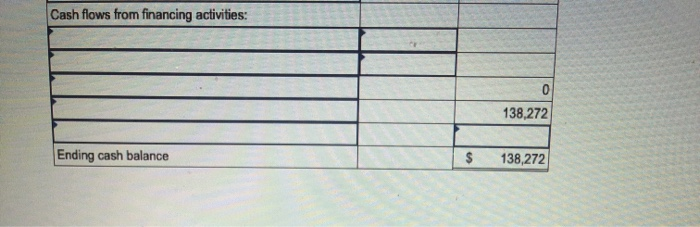

The comparative balance sheets and income statement for Benson Corporation follow: Balance Sheets As of December 31 2017 2016 Assets Cash Accounts receivable Merchandise inventory Prepaid rent Equipment Accumulated depreciation Land Total assets Liabilities Accounts payable (inventory) Salaries payable Stockholders' equity Common stock, $50 par value Retained earnings Total liabilities and equity $ 71,592 29,605 157,447 2,495 253,490 (154,130) 194,230 $ 554,729 $ 41,290 21, 710 173,190 4,990 286,270 (239,710) 79,430 $ 367,170 66,215 29,272 75,110 25,090 255,000 204,242 $ 554,729 201,000 65,970 $ 367,170 Income Statement For the Year Ended December 31, 2017 Sales $1,498,000 Cost of goods sold. (796,138) Gross profit 701,862 Operating expenses Depreciation expense (25,000) Rent expense (23,870) Salaries expense (256, 460) Other operating expenses (258,260) Net income 138,272 Other Information 1. Purchased land for $114,800. 2. Purchased new equipment for $99,100. 3. Sold old equipment that cost $131,880 with accumulated depreciation of $110,580 for $21,300 cash. 4. Issued common stock for $54,000. Required Prepare the statement of cash flows for 2017 using the indirect method. (Amounts to be deducted and cash outflows should be indicated by a minus sign.) BENSON CORPORATION Statement of Cash Flows For the Year Ended December 31, 2017 Cash flows from operating activities: Net income Add: Increases in current assets and Decreases in current liabies: Less: Increases in current assets and Decreases in current liabilities Plus: Noncash charges Cash flows from investing activities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started