pls can do solve these all problems

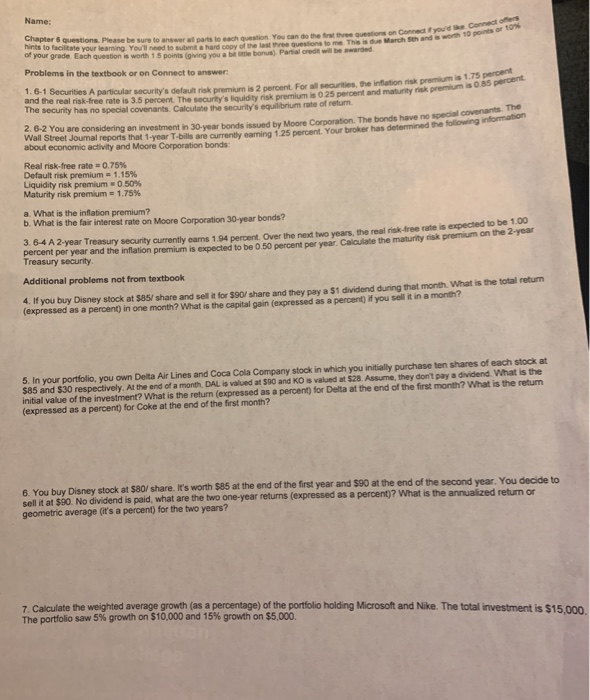

Name: o 10% hintat i ons. Please be sure to answer all parts to each question. You can do the fort the guestions on Connect you d of your grade. Each question is worth 1.5 points giving you a Your leaming You'll need to submit a hard copy of the last three questions to me. This is due Merch Sthandwe bonus) Partial credit will be awarded Problems in the textbook or on Connect to answer: es the inflation is premium is 1.75 percent mis 0.85 percent 1.6-1 Securities A particular security's default risk premium is 2 percent. For all securities, the inflation nisk prem and the real risk-free rate is 3.5 percent. The security's liquioty ce rate is 3.5 percent. The security's liquidity risk premium is 0 25 percent and maturity risk premium The security has no special covenants Calculate the security's equilibrium rate of return You are considering an investment in 30-year bonds issued by Moore Corporation. The bonds have no poco Wall Street Joumal reports that 1-year T-bills are currently earning 1.25 percent. Your broker has determined about economic activity and Moore Corporation bonds: have no special Covenants. The determined the following information Real risk-free rate 0.75% Default risk premium 1.15% Liquidity risk premium 0.50% Maturity risk premium 1.75% a What is the inflation premium? b. What is the fair interest rate on Moore Corporation 30-year bonds? 04 A 2-year Treasury security currently earns 1.94 percent. Over the next two years, the real risk-free rate is expected percent per year and the inflation premium is expected to be 0.50 percent per year Calculate the maturity risk premium on the 2 yea Treasury security Additional problems not from textbook 4. If you buy Disney stock at $85/ share and sell for $90/ share and they pay a $1 dividend during that month. What is the total return (expressed as a percent) in one month? What is the capital gain expressed as a percent) If you sell it in a month? 5. In your portfolio, you own Delta Air Lines and Coca Cola Company stock in which you initially purchase ten shares of each stock at $85 and $30 respectively. At the end of a month. DAL is valued at $90 and KO is valued at $28. Assume they don't pay a dividend. What is the initial value of the investment? What is the return (expressed as a percent) for Delta at the end of the first month? What is the return (expressed as a percent) for Coke at the end of the first month? 6. You buy Disney stock at $80/share. It's worth $85 at the end of the first year and $90 at the end of the second year. You decide to sell it at $90. No dividend is paid, what are the two one-year returns (expressed as a percent)? What is the annualized return of geometric average (it's a percent) for the two years? 7. Calculate the weighted average growth (as a percentage) of the portfolio holding Microsoft and Nike. The total investment is $15.000 The portfolio saw 5% growth on $10,000 and 15% growth on $5,000