Answered step by step

Verified Expert Solution

Question

1 Approved Answer

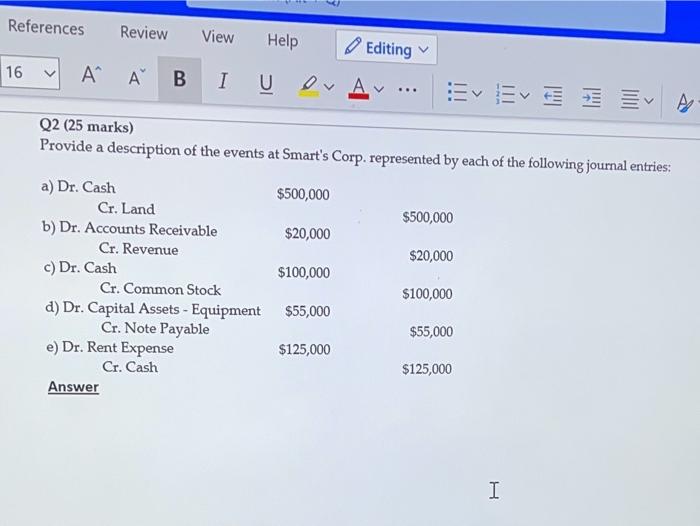

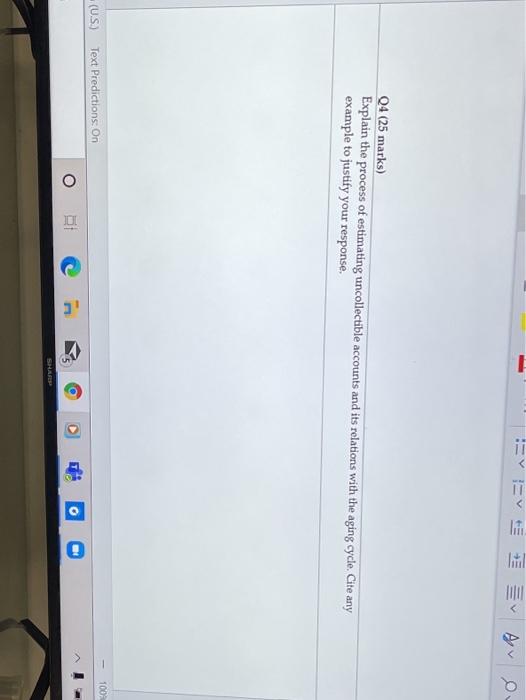

pls check the photo their are 4 question References Review View Help Editing 16 A B I Q2 (25 marks) Provide a description of the

pls check the photo their are 4 question

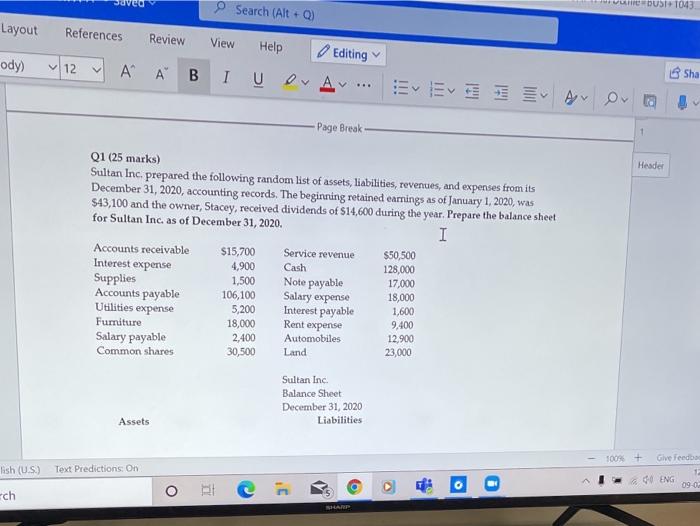

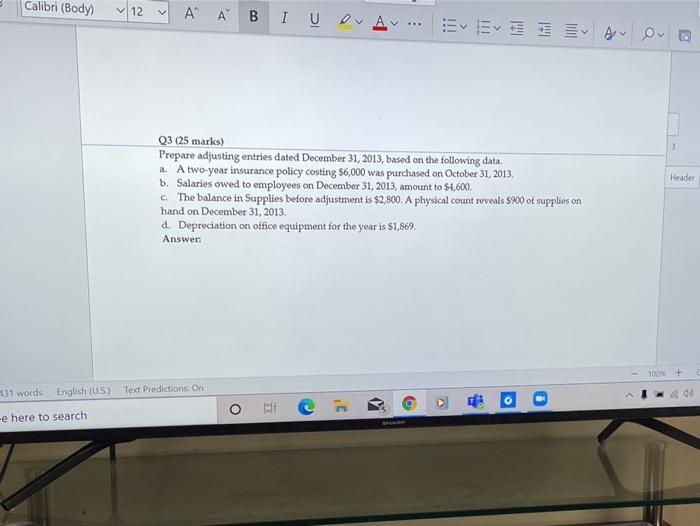

References Review View Help Editing 16 A B I Q2 (25 marks) Provide a description of the events at Smart's Corp. represented by each of the following journal entries: $500,000 $20,000 a) Dr. Cash $500,000 Cr. Land b) Dr. Accounts Receivable $20,000 Cr. Revenue c) Dr. Cash $100,000 Cr. Common Stock d) Dr. Capital Assets - Equipment $55,000 Cr. Note Payable e) Dr. Rent Expense $125,000 Cr. Cash Answer $100,000 $55,000 $125,000 I Search (Alt+Q) UST1043 Layout References Review View ody) 12 A A Help Editing U or Av ... B I Sha Ev Eva Av orta - Page Break 1 Header Q1 (25 marks) Sultan Inc. prepared the following random list of assets, liabilities, revenues, and expenses from its December 31, 2020, accounting records. The beginning retained earnings as of January 1, 2020, was $43,100 and the owner, Stacey, received dividends of $14,600 during the year. Prepare the balance sheet for Sultan Inc. as of December 31, 2020. I Accounts receivable $15,700 Service revenue $50,500 Interest expense 4,900 Cash 128,000 Supplies 1,500 Note payable 17,000 Accounts payable 106,100 Salary expense 18,000 Utilities expense 5,200 Interest payable 1,600 Furniture 18,000 Rent expense 9,400 Salary payable 2,400 Automobiles 12,900 Common shares 30,500 Land 23,000 Sultan Inc. Balance Sheet December 31, 2020 Liabilities Assets 100% + Give feedba lish (US) Text Predictions on 40 ENG 09-02 ch O Calibri (Body) 12 ' ' 3 Header 03 (25 marks) Prepare adjusting entries dated December 31, 2013, based on the following data a. A two-year insurance policy costing $6,000 was purchased on October 31, 2013, b. Salaries owed to employees on December 31, 2013, amount to $4,600. c. The balance in Supplies before adjustment is $2,800, A physical count reveals 5900 of supplies on hand on December 31, 2013. d. Depreciation on office equipment for the year is $1,869 Answer: 431 words English (US) Text Predictions: On e here to search 1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started