Answered step by step

Verified Expert Solution

Question

1 Approved Answer

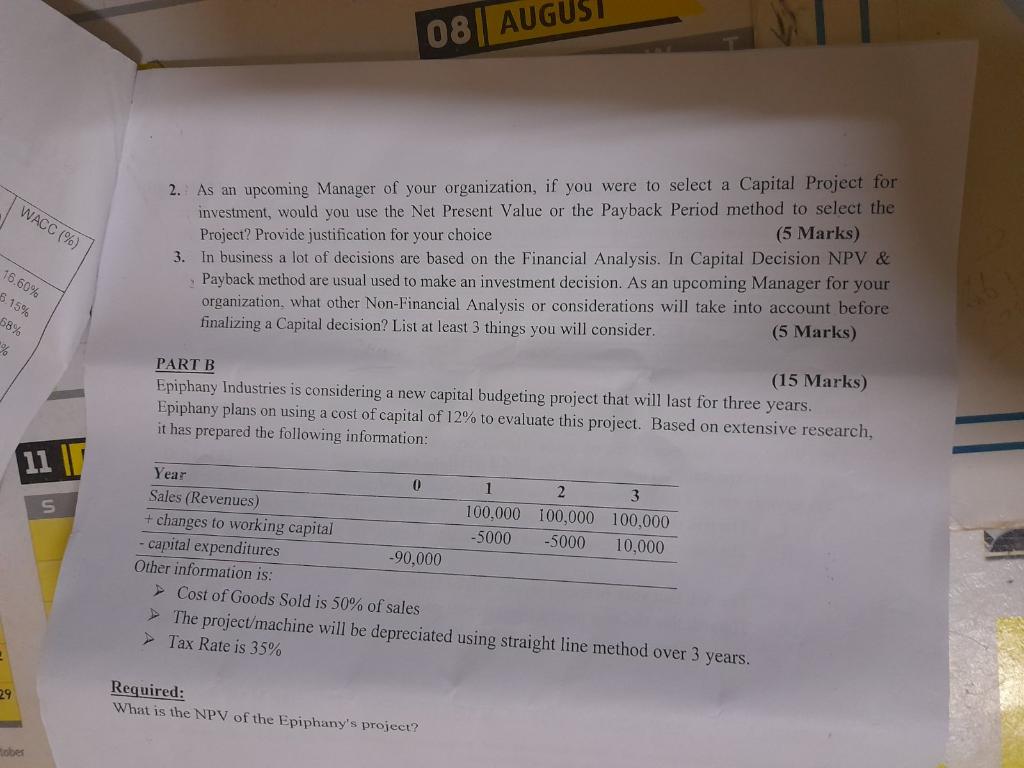

Pls do Part B Only 08 AUGUS WACC (%) 2. As an upcoming Manager of your organization, if you were to select a Capital Project

Pls do Part B Only

08 AUGUS WACC (%) 2. As an upcoming Manager of your organization, if you were to select a Capital Project for investment, would you use the Net Present Value or the Payback Period method to select the Project? Provide justification for your choice (5 Marks) 3. In business a lot of decisions are based on the Financial Analysis. In Capital Decision NPV & Payback method are usual used to make an investment decision. As an upcoming Manager for your organization, what other Non-Financial Analysis or considerations will take into account before finalizing a Capital decision? List at least 3 things you will consider (5 Marks) 16.60% 6.15% 68% % PART B (15 Marks) Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following information: 1 Year 0 2 3 Sales (Revenues) 100.000 100,000 100,000 + changes to working capital -5000 -5000 10,000 - capital expenditures -90,000 Other information is: Cost of Goods Sold is 50% of sales The project/machine will be depreciated using straight line method over 3 years. Tax Rate is 35% 29 Required: What is the NPV of the Epiphany's projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started