Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls fill out in t-chart form Separation of the physical responsibility for the long-lived assets from the accounting for those assets is, as with all

pls fill out in t-chart form

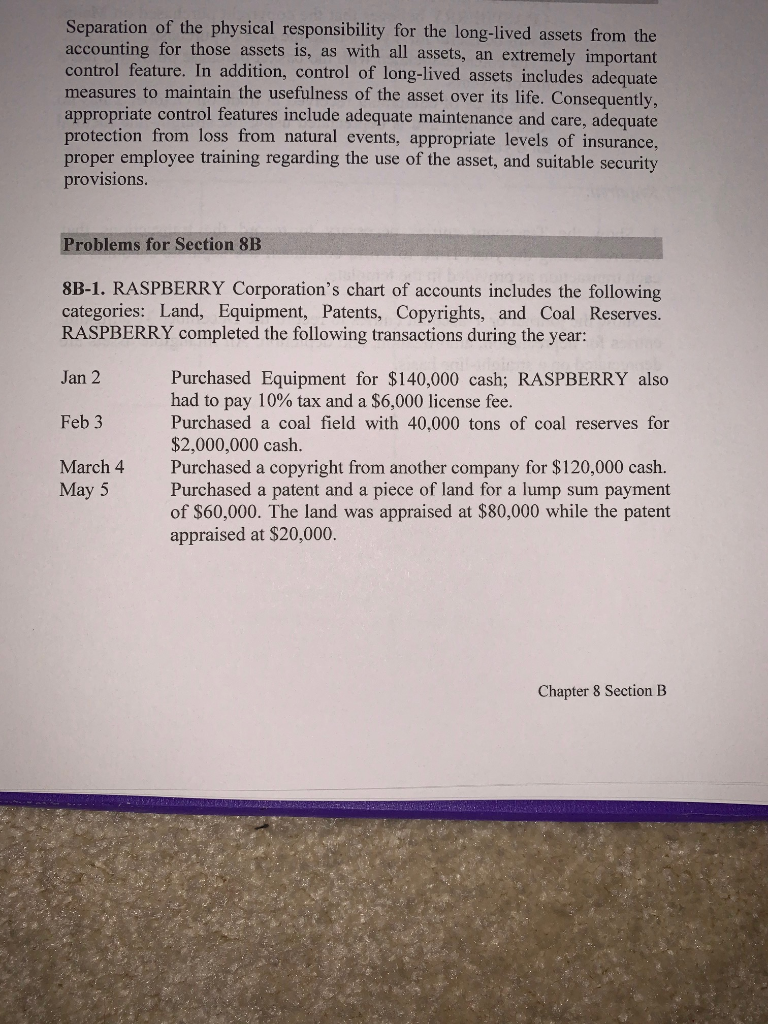

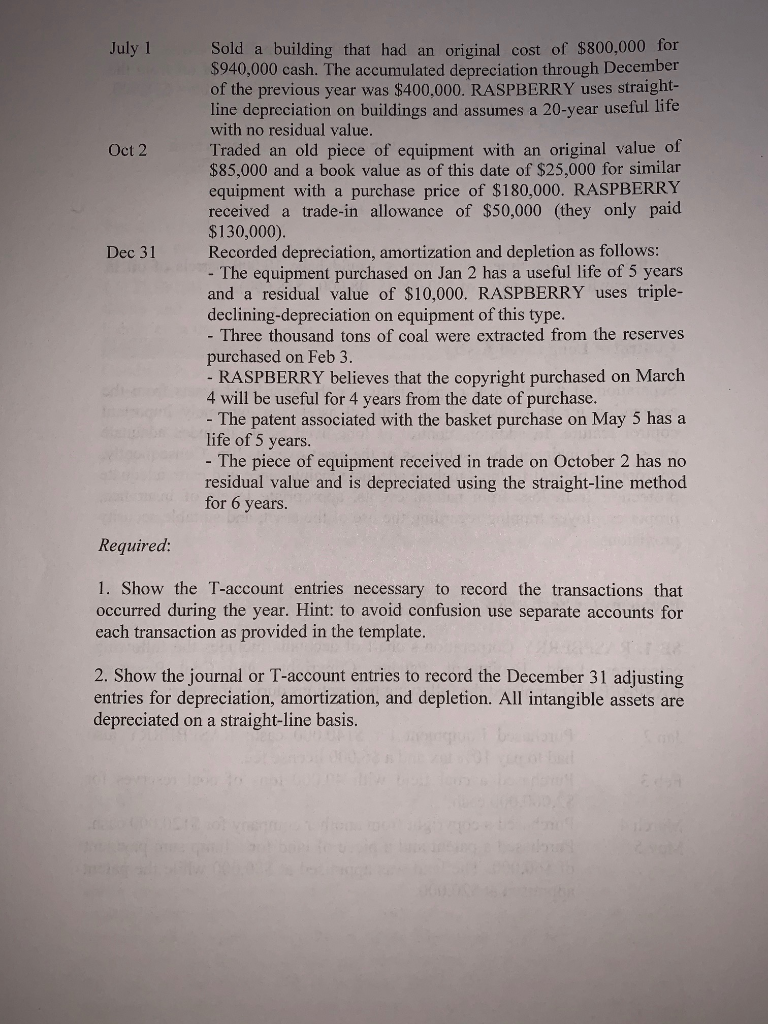

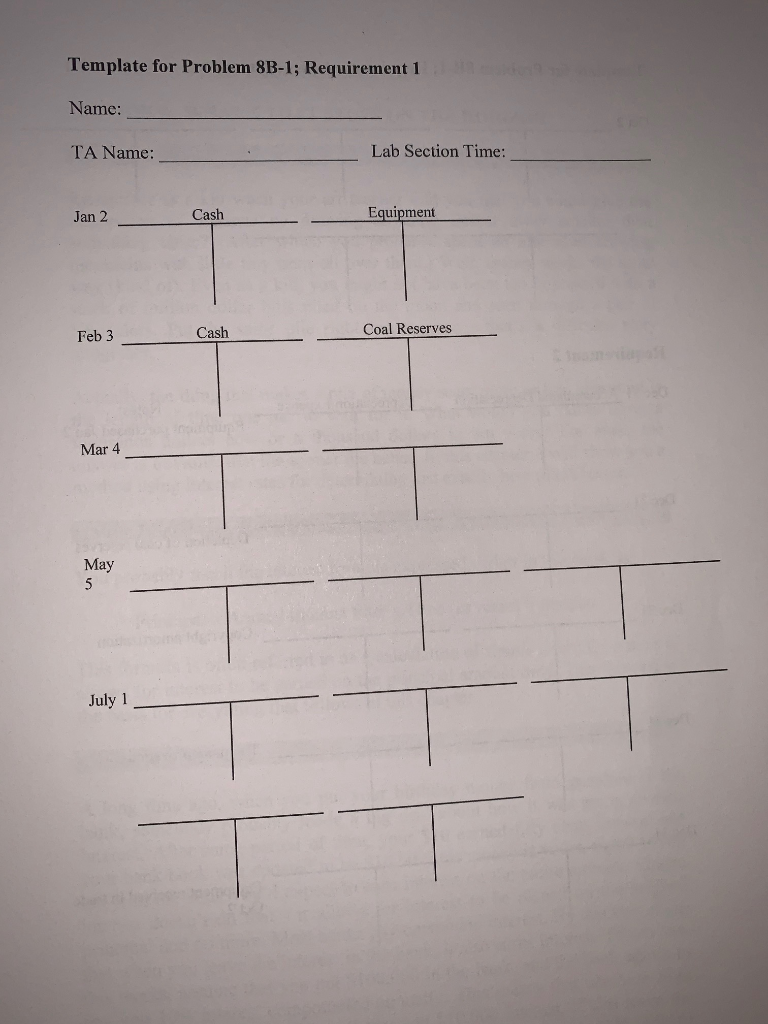

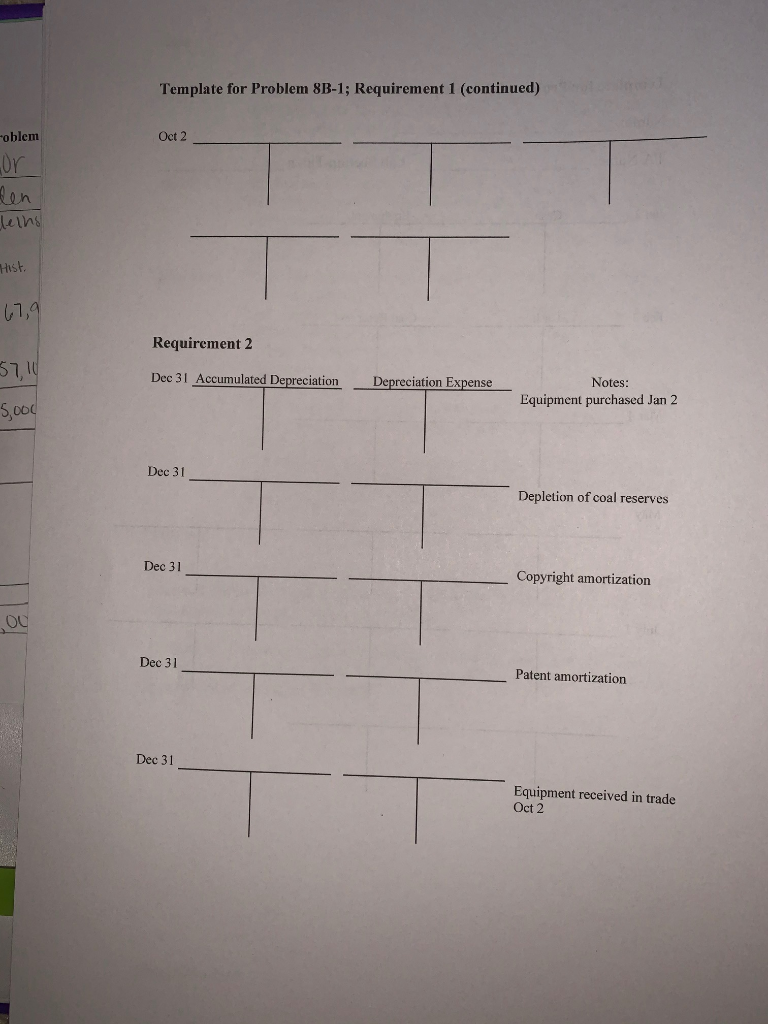

Separation of the physical responsibility for the long-lived assets from the accounting for those assets is, as with all assets, an extremely important control feature. In addition, control of long-lived assets includes adequate measures to maintain the usefulness of the asset over its life. Consequently, appropriate control features include adequate maintenance and care, adequate protection from loss from natural events, appropriate levels of insurance. proper employee training regarding the use of the asset, and suitable security provisions. Problems for Section 8B 8B-1. RASPBERRY Corporation's chart of accounts includes the following categories: Land, Equipment, Patents, Copyrights, and Coal Reserves. RASPBERRY completed the following transactions during the year: Jan 2 Feb 3 March 4 May 5 Purchased Equipment for $140,000 cash; RASPBERRY also had to pay 10% tax and a $6,000 license fee. Purchased a coal field with 40,000 tons of coal reserves for $2,000,000 cash. Purchased a copyright from another company for $120,000 cash. Purchased a patent and a piece of land for a lump sum payment of $60,000. The land was appraised at $80,000 while the patent appraised at $20,000. Chapter 8 Section B July 1 Oct 2 Dec 31 Sold a building that had an original cost of $800,000 for $940,000 cash. The accumulated depreciation through December of the previous year was $400.000. RASPBERRY uses straight- line depreciation on buildings and assumes a 20-year useful life with no residual value. Traded an old piece of equipment with an original value of $85,000 and a book value as of this date of $25,000 for similar equipment with a purchase price of $180,000. RASPBERRY received a trade-in allowance of $50,000 (they only paid $130,000). Recorded depreciation, amortization and depletion as follows: - The equipment purchased on Jan 2 has a useful life of 5 years and a residual value of $10,000. RASPBERRY uses triple- declining-depreciation on equipment of this type. - Three thousand tons of coal were extracted from the reserves purchased on Feb 3. - RASPBERRY believes that the copyright purchased on March 4 will be useful for 4 years from the date of purchase. - The patent associated with the basket purchase on May 5 has a life of 5 years. - The piece of equipment received in trade on October 2 has no residual value and is depreciated using the straight-line method for 6 years. Required: 1. Show the T-account entries necessary to record the transactions that occurred during the year. Hint: to avoid confusion use separate accounts for each transaction as provided in the template. 2. Show the journal or T-account entries to record the December 31 adjusting entries for depreciation, amortization, and depletion. All intangible assets are depreciated on a straight-line basis. Template for Problem 8B-1; Requirement 1 Name: TA Name: Lab Section Time: Jan 2 Cash Equipment Feb 3 Cash Coal Reserves Mar 4 May July 1 Template for Problem 8B-1; Requirement 1 (continued) Oct 2 -oblem or den leins Hist. 67,9 Requirement 2 5710 Dec 31 Accumulated Depreciation Depreciation Expense Notes: Equipment purchased Jan 2 5,000 Dec 31 Depletion of coal reserves Dec 31 Copyright amortization 00 Dec 31 Patent amortization Dec 31 Equipment received in trade Oct 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started