Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls find the amount at the red slashes Ascend Corporation, a publicly held corporation, currently pays its president an annual salary of $900,000. As a

pls find the amount at the red slashes

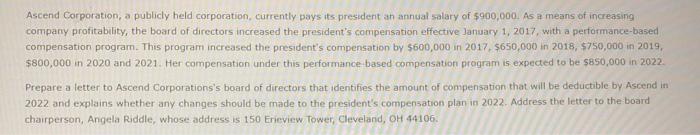

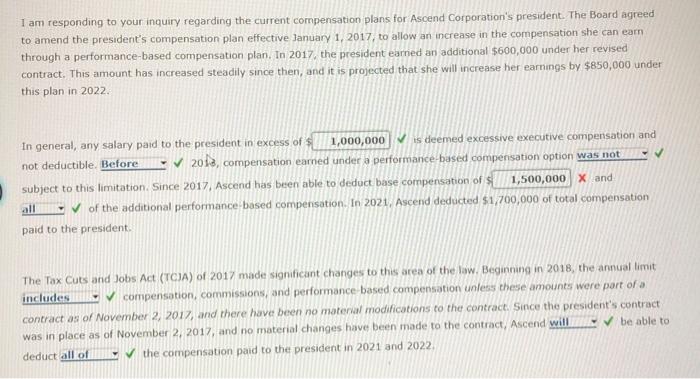

Ascend Corporation, a publicly held corporation, currently pays its president an annual salary of $900,000. As a means of increasing company profitability, the board of directors increased the president's compensation effective January 1 , 2017 , with a performance-based compensation program. This program increased the president's compensation by $600,000 in 2017,$650,000 in 2018,$750,000 in 2019 , $800,000 in 2020 and 2021 . Her compensation under this performance based compensation program is expected to be $850,000 in 2022. Prepare a letter to Ascend Corporations's board of directors that identifies the amount of compensation that will be deductible by Ascend in 2022 and explains whether any changes should be made to the president's compensation plan in 2022 . Address the letter to the board charperson, Angela Riddle, whose address is 150 Erieview Tower, Cleveland, 0H44106. I am responding to your inquiry regarding the current compensation plans for Ascend Corporation's president. The Board agreed to amend the president's compensation plan effective January 1, 2017, to allow an increase in the compensation she can earn through a performance-based compensation plan. In 2017, the president earned an additional $600,000 under her revised contract. This amount has increased steadily since then, and it is projected that she will increase her earnings by $850,000 under this plan in 2022. In general, any salary paid to the president in excess of $ is deemed excessive executive compensation and not deductible. 2013, compensation eamed under a performance-based compensation option subject to this limitation. Since 2017. Ascend has been able to deduct base compensation of $ and V of the additional performance-based compensation. In 2021 , Ascend deducted $1,700,000 of total compensation paid to the president. The Tax Cuts and Jobs Act (TCJA) of 2017 made significant changes to this area of the law. Beginning in 2018 , the annual limit compensation, commissions, and performance based compensation unless these amounts were part of a contract as of November 2, 2017, and there have been no matenal modifications to the contract. Since the president's contract was in place as of November 2,2017 , and no material changes have been made to the contract, Ascend be able to deduct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started