Answered step by step

Verified Expert Solution

Question

1 Approved Answer

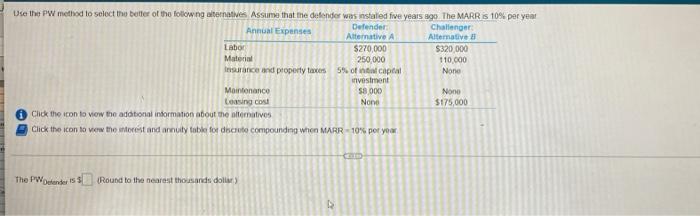

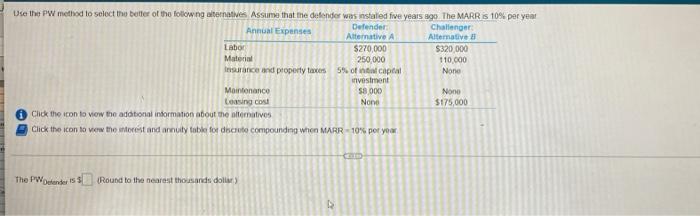

pls get present worth of defender and challenger Use the PW method to select the better of the following alternatives Assun that the defendes was

pls get present worth of defender and challenger

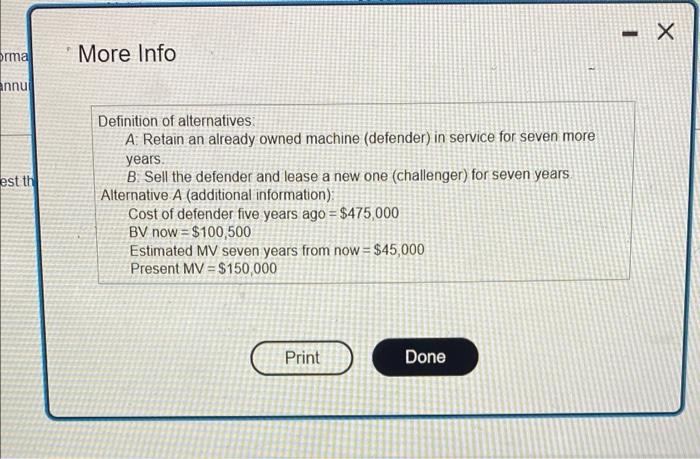

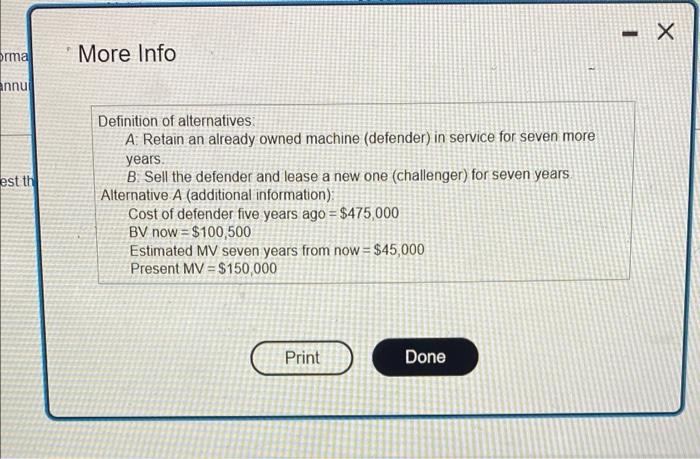

Use the PW method to select the better of the following alternatives Assun that the defendes was installed five years ago The MARR is 10% per year Annual Expenses Defender Challenger Alternative Alternative Labor $270,000 $320,000 Material 250,000 110.000 Insurance and property taxes 5% of capital None investment Maintenance 58.000 None Leasing cost None $175,000 Click the icon to view the additional information about the alleativos Click the icon to view the forest and annuity table for discute compounding when MARR -10% per your GE The PWetender is 5 Round to the nearest thousands dollar - X orma More Info annu est th Definition of alternatives A Retain an already owned machine (defender) in service for seven more years. B. Sell the defender and lease a new one (challenger) for seven years. Alternative A (additional information); Cost of defender five years ago = $475,000 BV now = $100,500 Estimated MV seven years from now = $45,000 Present MV = $150,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started