pls help

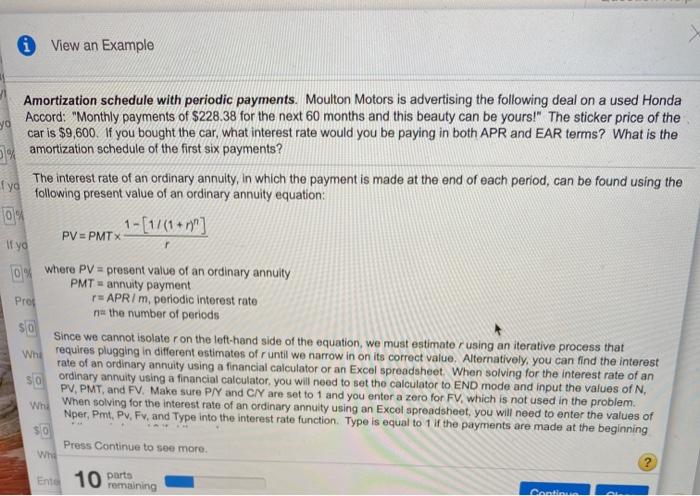

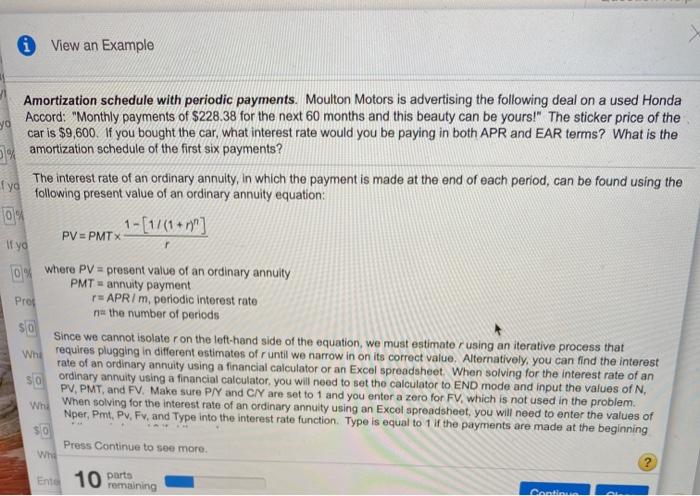

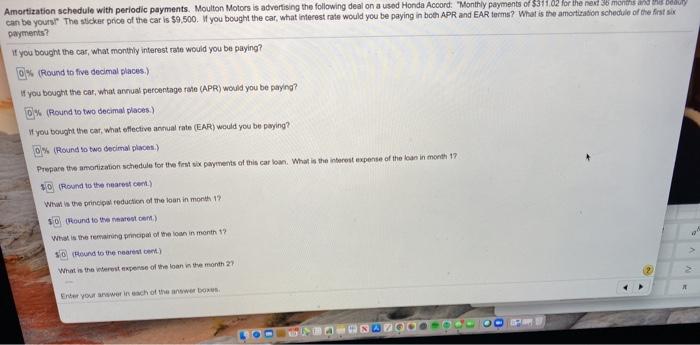

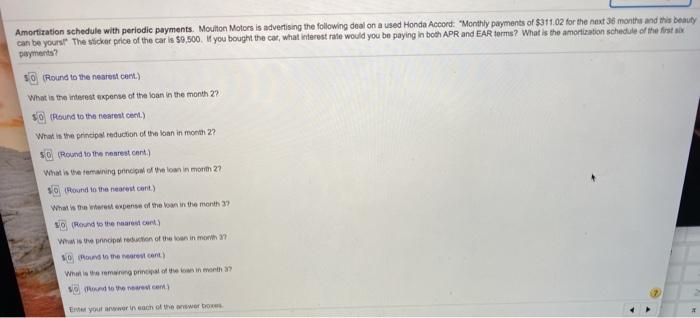

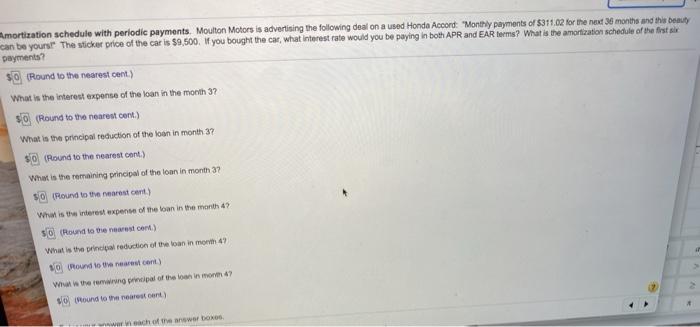

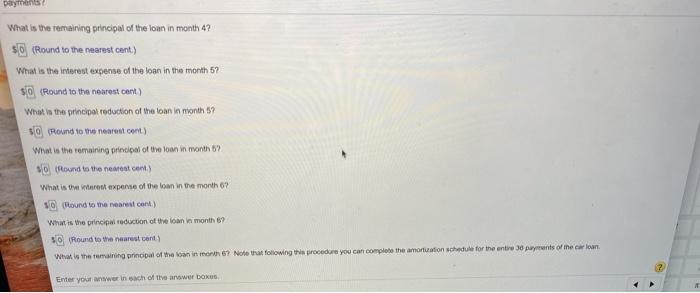

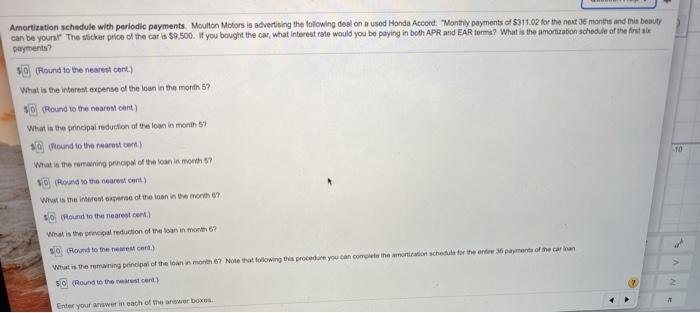

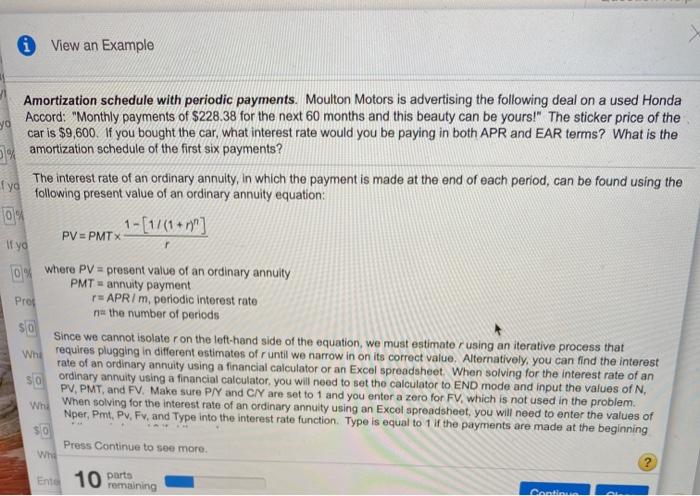

0 View an Example ya Amortization schedule with periodic payments. Moulton Motors is advertising the following deal on a used Honda Accord: "Monthly payments of $228.38 for the next 60 months and this beauty can be yours!" The sticker price of the car is $9,600. If you bought the car, what interest rate would you be paying in both APR and EAR terms? What is the amortization schedule of the first six payments? fya The interest rate of an ordinary annuity, in which the payment is made at the end of each period, can be found using the following present value of an ordinary annuity equation: 10% " PV=PMTX 1-[1/(1+mn] If yo r 0% Where PV - present value of an ordinary annuity PMT = annuity payment Pros PE APR/m, periodic interest rate na the number of periods SO Since we cannot isolate ron the left-hand side of the equation, we must estimate r using an iterative process that wne requires plugging in different estimates of runtil we narrow in on its correct value. Alternatively, you can find the interest rate of an ordinary annuity using a financial calculator or an Excel spreadsheet. When solving for the interest rate of an so ordinary annuity using a financial calculator, you will need to set the calculator to END mode and input the values of N, Whe When solving for the interest rate of an ordinary annuity using an Excel spreadsheet, you will need to enter the values of Nper, Pmt, Pv. Fv, and Type into the interest rate function. Type is equal to 1 if the payments are made at the beginning SO Press Continue to see more. Whe ? Ene 10 purta remaining Canto Amortization schedule with periodic payments. Moulton Motors is advertising the following deal on a used Honda Accord: "Monthly payments of 331102 for the next 36 months and moduly can be yours!" The sticker price of the car is $9,500. If you bought the car, what interest rate would you be paying in both APR and EAR terms? What is the amortization schedule of the first six payments? Y you bought the car, what monthly interest rate would you be paying? 0% (Round to five decimal places) If you bought the car, what annual percentage rate (APR) would you be paying? 0% (Round to two decimal places) y you bought the car, what effective annual rate (EAR) would you be paying? 0% (Round to two decimal places) Prepare the amortization schedule for tive fest six payments of this car loan. What is the interest expense of the loan in month 17 NO (Round to the nearest Cent) What is the principal reduction of the loan in month 1? SO (Round to the GM) What is the remaining principal of the loan in month 1? Round to the neareston) What is the worst expense of the loan in the month 27 Enter your answer in each of the answer DOWE Amortization schedule with periodic payments. Moulton Motors is advertising the following deal on a used Honda Accord: "Monthly payments of $311.02 for the next 36 months and this beauty can be yours. The sticker price of the car is $9,500 you bought the car, what interest rate would you be paying in both APR and EAR terms? What is the amortization schedule of the first payments 50 Round to the nearest ceni.) What is the interest Expense of the loan in the month 2? $pound to the tearst.) What is the principal reduction of the loan in month 22 so Round to the neareston) What is the training principal of the loan in mort 27 30 Round to the nearest cant) What is the where expense of the loan in the month 3 sound to the nearest count) What is the principle of the inmorth O to the restant) What is the remaining of the wath? and to record Er your awwer in each of the wwwerowe Amortization schedule with periodic payments. Moulton Motors is advertising the following deal on a used Honda Accord: "Monthly payments of $311.02 for the next 36 months and the beauty can be yours! The sticker price of the car is $9,500. If you bought the car, what interest rate would you be paying in both APR and EAR terms? What is the amortization schedule of the first payments $0 Round to the nearest cent.) What is the interest expense of the loan in the month 3? 30 Round to the nearest cent) What is the principal reduction of the loon in month 37 $0 (Round to the nearest cont.) What is the remaining principal of the loan in month 37 50 Round to the recent What is the interest expense of the loan in the month 47 so (Round to the nearest cont.) What is the principal reduction of the loan in mor 47 Pound to the cont.) What is the coming principal of the loan in mo? tond to the root cant) wach of the answer DOKO payments What is the remaining principal of the loan in month 4? $0 (Round to the nearest cant) What is the interest expense of the loan in the month 57 50 (Round to the nearest cent) What is the principal reduction of the loan in month? 50 round to the nearest cont.) What is the remaining principal of the loan in month? SO Rownd to the nearest com. What is the West expense of the loan in the month 0 SC Round to the nearest cont) What is the principal reduction of the loan in month 67 30 Round to the nearest cent What is the remaining principal of them in month 67 Note that following the procedure you can complete the amortization schedule for the entire 38 punts of the car loan Enter your insach of the rower DOK 10 Amortization schedule with periodic payments Moulton Motors is advertising the following deal on a used Honda Accord "Monthly payments of $311.02 for the next 36 months and this beauty can be yours. The sticker price of the car is $9.500 #you bought the car, what interest rate would you be paying in both APR and EAR torms? What is the amortization schedule of the first payments? $Round to the nearest cont.) What is the interest expense of the loan in the month 5? $0 Round to the nearest cent) What is the principal reduction of the loan in months $0 Pound to the nearest.com What is the remaining principal of the icon in month $Round to the nearest cont.) What is the entre of the town in the more Round to the nearest) What is the preco reduction of the loan in month 6? (Round to the con What is the remaining principal of the loan in month 67 Note that following this procedure you can complete the main schedule for the entire part of the car SO(Round to the recent Erder your answer in each of me answer box