pls help

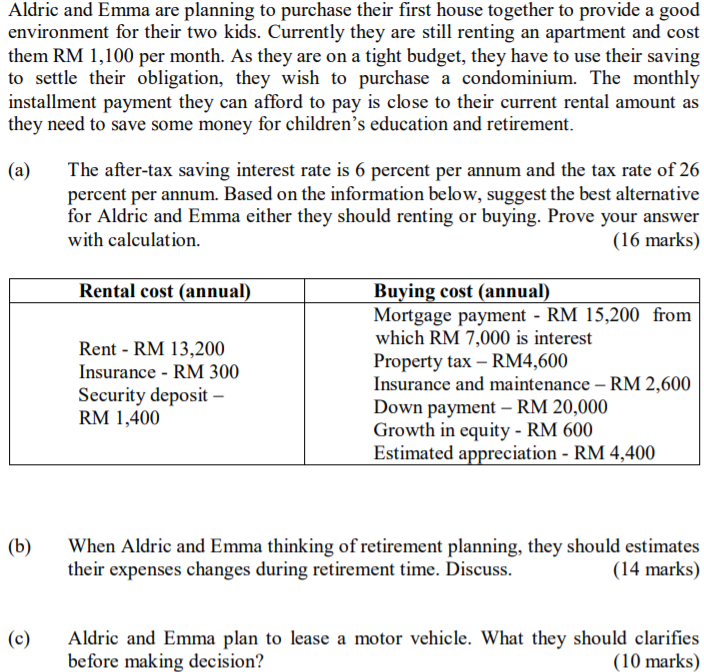

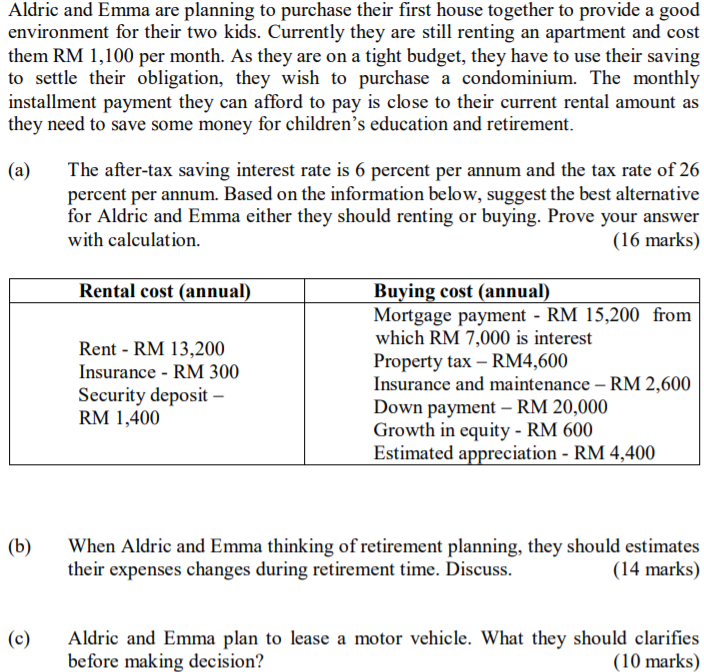

Aldric and Emma are planning to purchase their first house together to provide a good environment for their two kids. Currently they are still renting an apartment and cost them RM 1,100 per month. As they are on a tight budget, they have to use their saving to settle their obligation, they wish to purchase a condominium. The monthly installment payment they can afford to pay is close to their current rental amount as they need to save some money for children's education and retirement. (a) The after-tax saving interest rate is 6 percent per annum and the tax rate of 26 percent per annum. Based on the information below, suggest the best alternative for Aldric and Emma either they should renting or buying. Prove your answer with calculation. (16 marks) Rental cost (annual) Rent - RM 13,200 Insurance - RM 300 Security deposit - RM 1,400 Buying cost (annual) Mortgage payment - RM 15,200 from which RM 7,000 is interest Property tax - RM4,600 Insurance and maintenance - RM 2,600 Down payment - RM 20,000 Growth in equity - RM 600 Estimated appreciation - RM 4,400 (b) When Aldric and Emma thinking of retirement planning, they should estimates their expenses changes during retirement time. Discuss. (14 marks) (C) Aldric and Emma plan to lease a motor vehicle. What they should clarifies before making decision? (10 marks) Aldric and Emma are planning to purchase their first house together to provide a good environment for their two kids. Currently they are still renting an apartment and cost them RM 1,100 per month. As they are on a tight budget, they have to use their saving to settle their obligation, they wish to purchase a condominium. The monthly installment payment they can afford to pay is close to their current rental amount as they need to save some money for children's education and retirement. (a) The after-tax saving interest rate is 6 percent per annum and the tax rate of 26 percent per annum. Based on the information below, suggest the best alternative for Aldric and Emma either they should renting or buying. Prove your answer with calculation. (16 marks) Rental cost (annual) Rent - RM 13,200 Insurance - RM 300 Security deposit - RM 1,400 Buying cost (annual) Mortgage payment - RM 15,200 from which RM 7,000 is interest Property tax - RM4,600 Insurance and maintenance - RM 2,600 Down payment - RM 20,000 Growth in equity - RM 600 Estimated appreciation - RM 4,400 (b) When Aldric and Emma thinking of retirement planning, they should estimates their expenses changes during retirement time. Discuss. (14 marks) (C) Aldric and Emma plan to lease a motor vehicle. What they should clarifies before making decision? (10 marks)