Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLS HELP !!! APPLY THE CONCEPTS: Prepare the operating activities section The income statement and comparative balance sheets for Leonardo Inc. can be viewed by

PLS HELP !!!

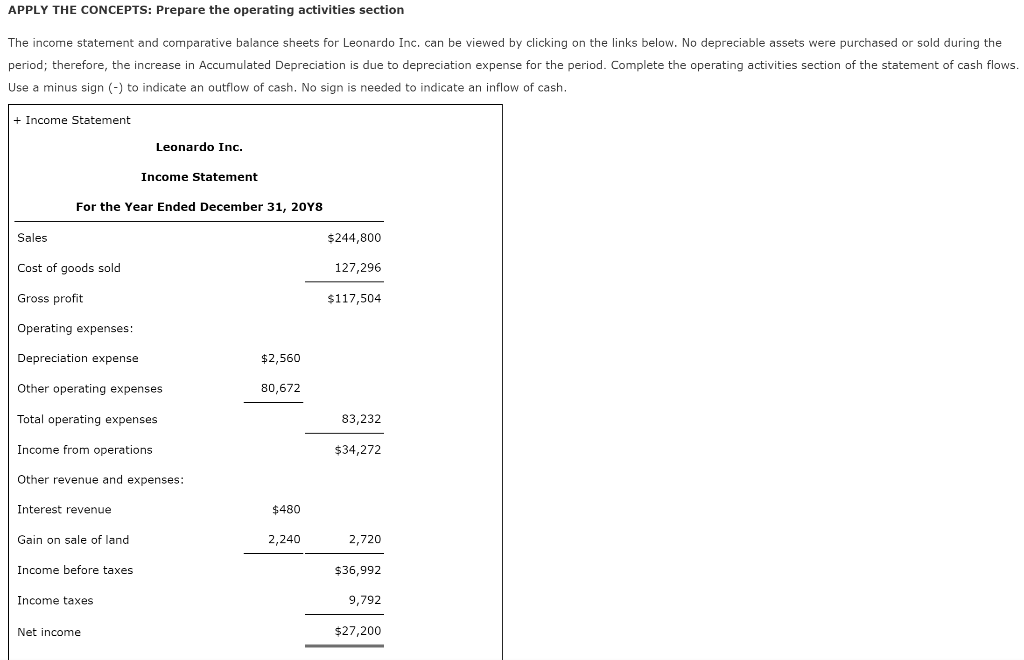

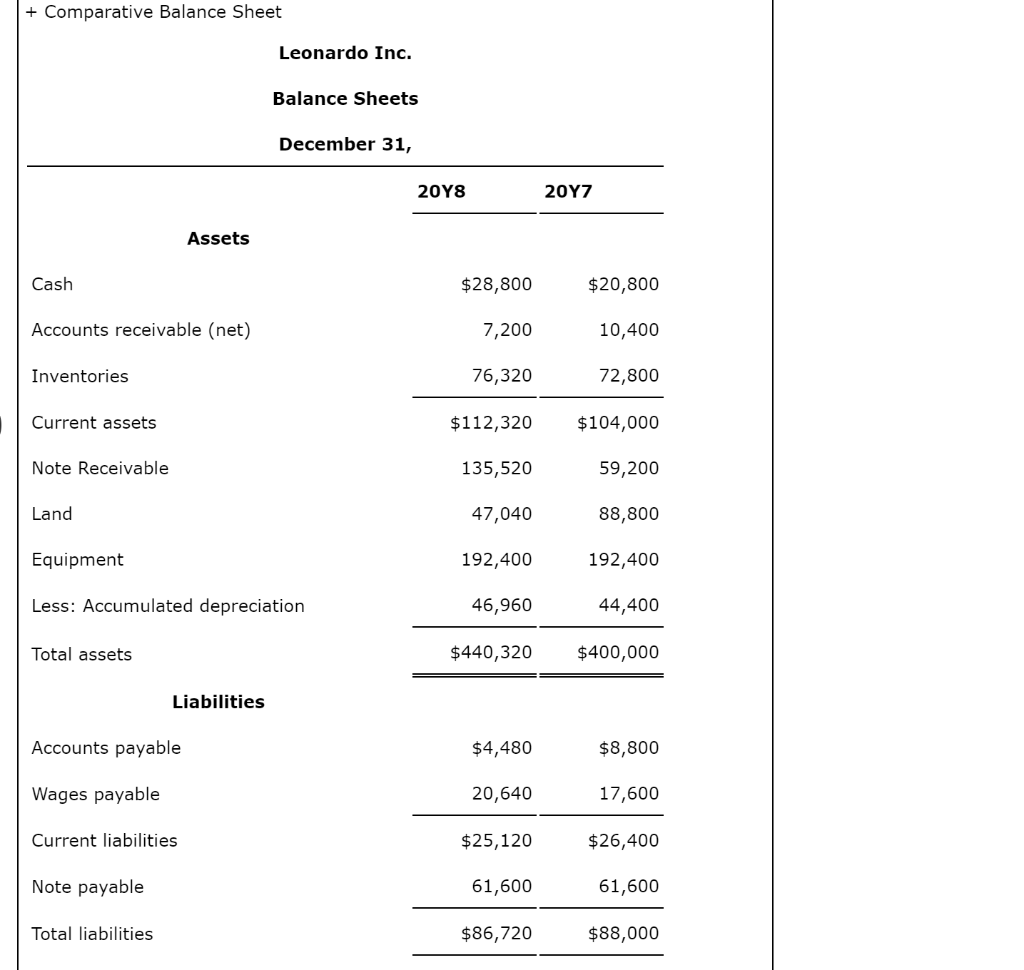

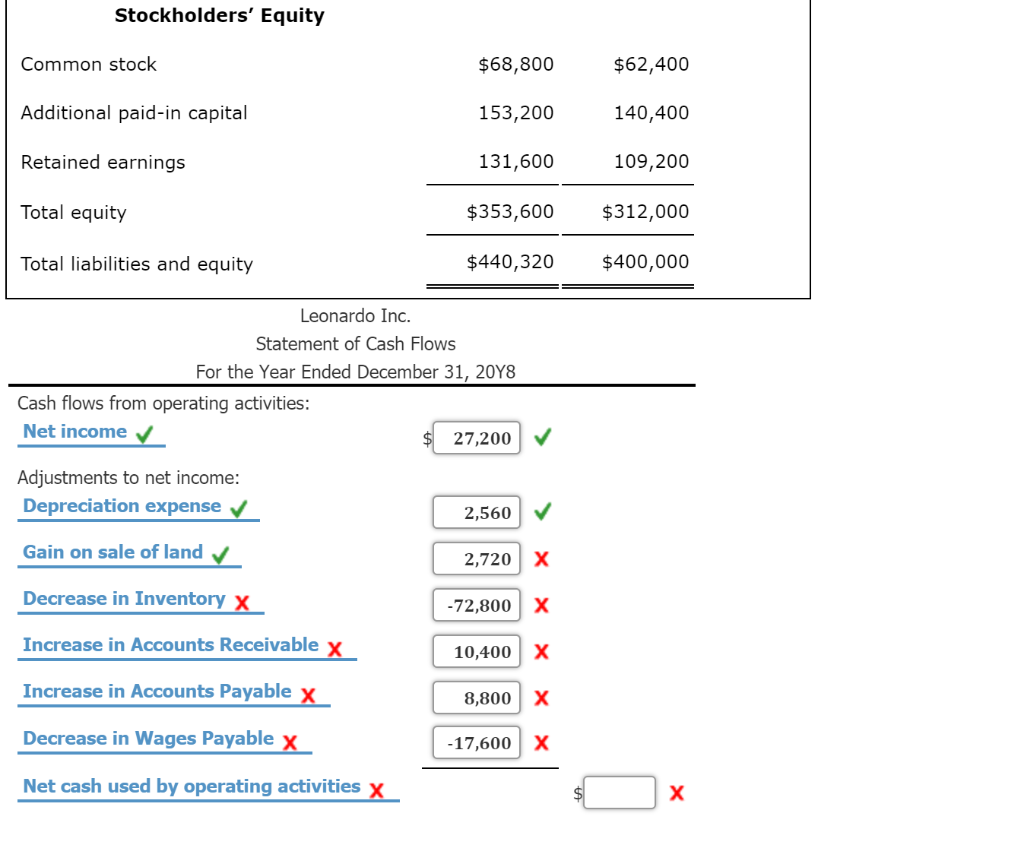

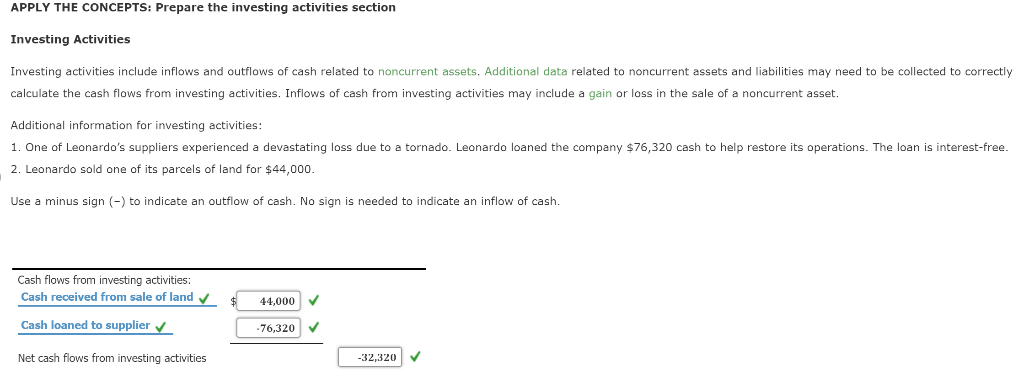

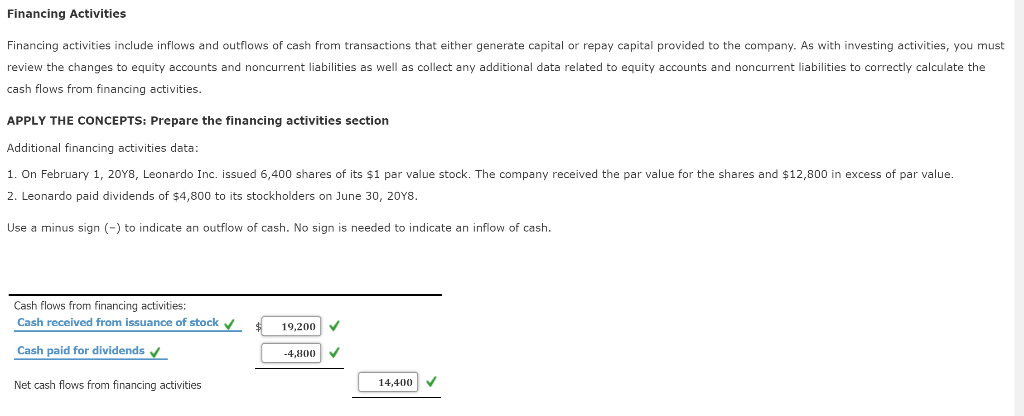

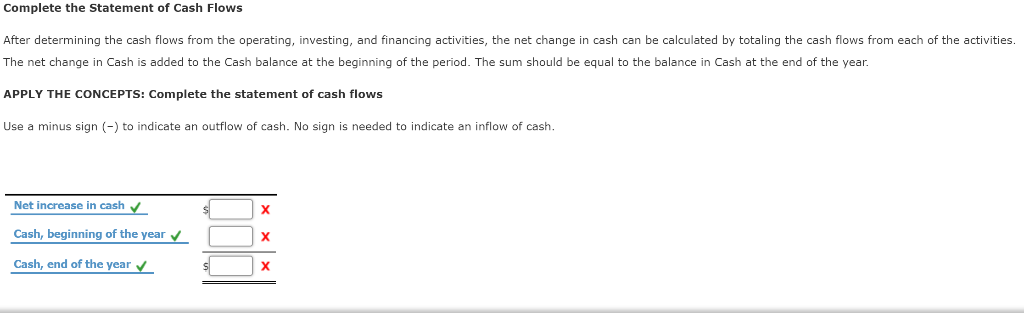

APPLY THE CONCEPTS: Prepare the operating activities section The income statement and comparative balance sheets for Leonardo Inc. can be viewed by clicking on the links below. No depreciable assets were purchased or sold during the period; therefore, the increase in Accumulated Depreciation is due to depreciation expense for the period. Complete the operating activities section of the statement of cash flows. Use a minus sign (-) to indicate an outflow of cash. No sign is needed to indicate an inflow of cash + Income Statement Leonardo Inc. Income Statement For the Year Ended December 31, 20Y8 $244,800 127,296 $117,504 Sales Cost of goods sold Gross profit Operating expenses: Depreciation expense Other operating expenses Total operating expenses Income from operations Other revenue and expenses Interest revenue Gain on sale of land Income before taxes Income taxes $2,560 80,672 83,232 $34,272 $480 2,720 $36,992 9,792 $27,200 2,240 Net income + Comparative Balance Sheet Leonardo Inc. Balance Sheets December 31, 20Y8 Assets Cash Accounts receivable (net) Inventories Current assets Note Receivable Land Equipment Less: Accumulated depreciation Total assets $20,800 10,400 72,800 $112,320 $104,000 59,200 88,800 192,400 44,400 $440,320 $400,000 $28,800 7,200 76,320 135,520 47,040 192,400 46,960 Liabilities Accounts payable Wages payable Current liabilities Note payable Total liabilities $4,480 20,640 $25,120 61,600 $86,720 $8,800 17,600 $26,400 61,600 $88,000 Stockholders' Equity Common stock Additional paid-in capital Retained earnings Total equity Total liabilities and equity $62,400 140,400 109,200 $353,600 $312,000 $440,320 $400,000 $68,800 153,200 131,600 Leonardo Inc. Statement of Cash Flows For the Year Ended December 31, 20Y8 Cash flows from operating activities Net income Adjustments to net income Depreciation expense Gain on sale of land Decrease in Inventory X Increase in Accounts Receivable x 27,200 V 2,560v 2,720 X 72,800 X 10,400 X 8,800 | X 17,600 X Increase in Accounts Payable x800 Decrease in Wages Payablex Net cash used by operating actiiiesx APPLY THE CONCEPTS: Prepare the investing activities section Investing Activities Investing activities include inflows and outflows of cash related to noncurrent assets. Additional data related to noncurrent assets and liabilities may need to be collected to correctly calculate the cash flows from investing activities. Inflows of cash from investing activities may include a gain or loss in the sale of a noncurrent asset. Additional information for investing activities: 1. One of Leonardo's suppliers experienced a devastating loss due to a tornado. Leonardo loaned the company $76,320 cash to help restore its operations. The loan is interest-free. 2. Leonardo sold one of its parcels of land for 44,000 Use a minus sign)to indicate an outflow of cash. No sign is needed to indicate an inflow of cash Cash flows from investing activities: Cash received from sale of land Cash loaned to supplier Net cash flows from investing activities 44,000 76,320 32,320 Financing Activities Financing activities include inflows and outflows of cash from transactions that either generate capital or repay capital provided to the company. As with investing activities, you must review the changes to equity accounts and noncurrent liabilities as well as collect any additional data related to equity accounts and noncurrent liabilities to correctly calculate the cash flows from financing activities APPLY THE CONCEPTS: Prepare the financing activities section Additional financing activities data: 1. On February 1, 20Y8, Leonardo Inc. issued 6,400 shares of its $1 par value stock. The company received the par value for the shares and $12,800 in excess of par value. 2. Leonardo paid dividends of $4,800 to its stockholders on June 30, 20Y8 Use a minus sign () to indicate an outflow of cash. No sign is needed to indicate an inflow of cash Cash flows from financing activities: Cash received from issuance of stock Cash paid for dividends Net cash flows from financing activities 19,200 -4,800Y 14,400 Complete the Statement of Cash Flows After determining the cash flows from the operating, investing, and financing activities, the net change in cash can be calculated by totaling the cash flows from each of the activities. The net change in Cash is added to the Cash balance at the beginning of the period. The sum should be equal to the balance in Cash at the end of the year APPLY THE CONCEPTS: Complete the statement of cash flows Use a minus sign () to indicate an outflow of cash. No sign is needed to indicate an inflow of cash. Net increase in cash Cash, beginning of the year Cash, end of the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started