pls help ASAP

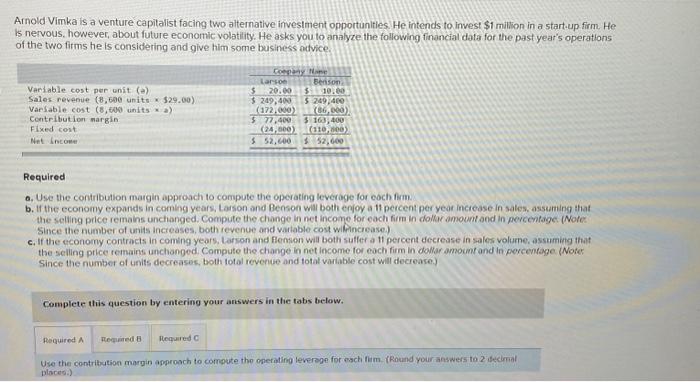

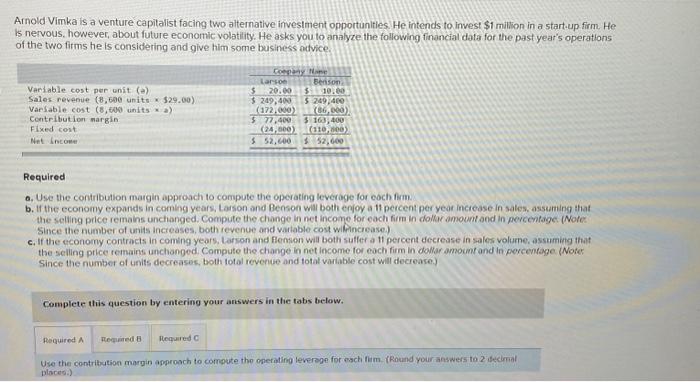

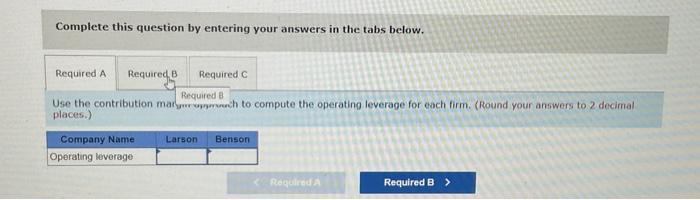

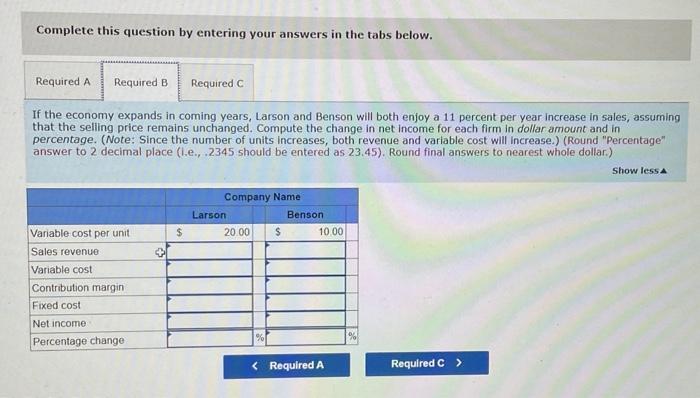

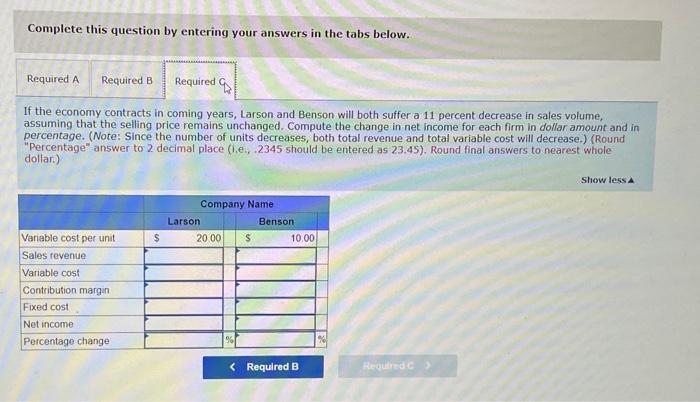

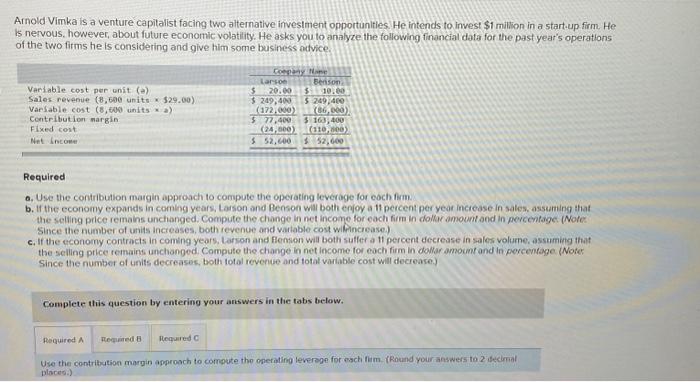

Complete this question by entering your answers in the tabs below. Use the contribution marymoromsech to compute the operating leverage for each firm. (Round your answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note: Since the number of units increases, both revenue and variable cost will increase.) (Round "Percentage" answer to 2 decimal place (i.e., .2345 should be entered as 23.45 ). Round final answers to nearest whole dollar.) Complete this question by entering your answers in the tabs below. If the economy contracts in coming years, Larson and Benson will both suffer a 11 percent decrease in sales volume, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note: Since the number of units decreases, both total revenue and total variable cost will decrease.) (Round "Percentage" answer to 2 decimal place (i,e., 2345 should be entered as 23.45). Round final answers to nearest whole dollar.) Arnold Vimka is a venture capitalist facing two alternative invesiment opportunities. He intends to invest \$1 million in a start-up firm. He Is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year's operations of the two firms he is considering and give him some business odvice. Required a, Use the contribution margin approach to compute the operating leveroge for eoch fim: b. If the economy expands in comhg years, Lasson and Benson will both enjoy a 11 percent per yeor inciease in sates, assuming that the selling price remains unchanged. Compute the change in net income for each firm in dollar amoumt ond in percentsges iNote: Since the number of units increases, both revenue and vatable cost wifinciease) c. If the economy contracts in coming years, tarson and flemson will both sulfer a 11 percent decrease in sales volume, assuming that the selling pice remains unchanged. Compute the change in net income for each firm in dollar amoumf and in porcentage (Noter Since the number of units decreasos, both total revenue and fotal varable cost will decrease.) Complete this question by entering your answers in the tabs below. Use the contribution marpin approsch to compute tho onerating leveroge for esch fim. (Round your answers to 2 ifecimal places?)