Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls help ASAP :/ Question 1: On January 26, 2022, Ms. Kramer and Mr. Smith entered into a partnership together. Kramer contributed $90,000 cash and

Pls help ASAP :/

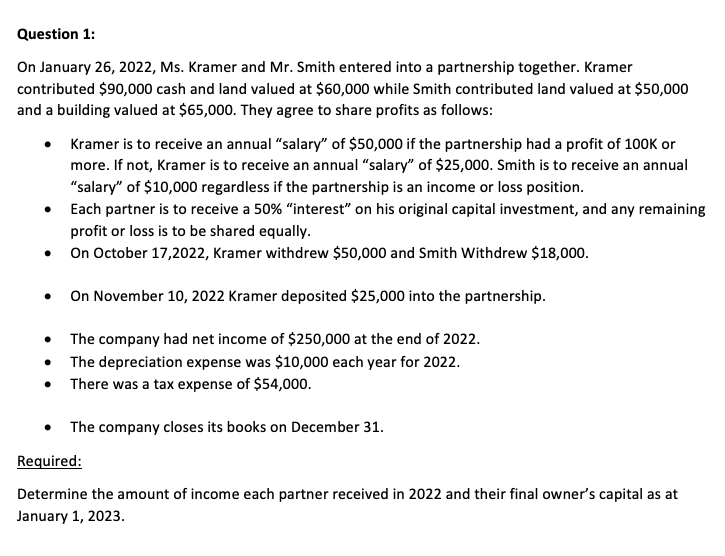

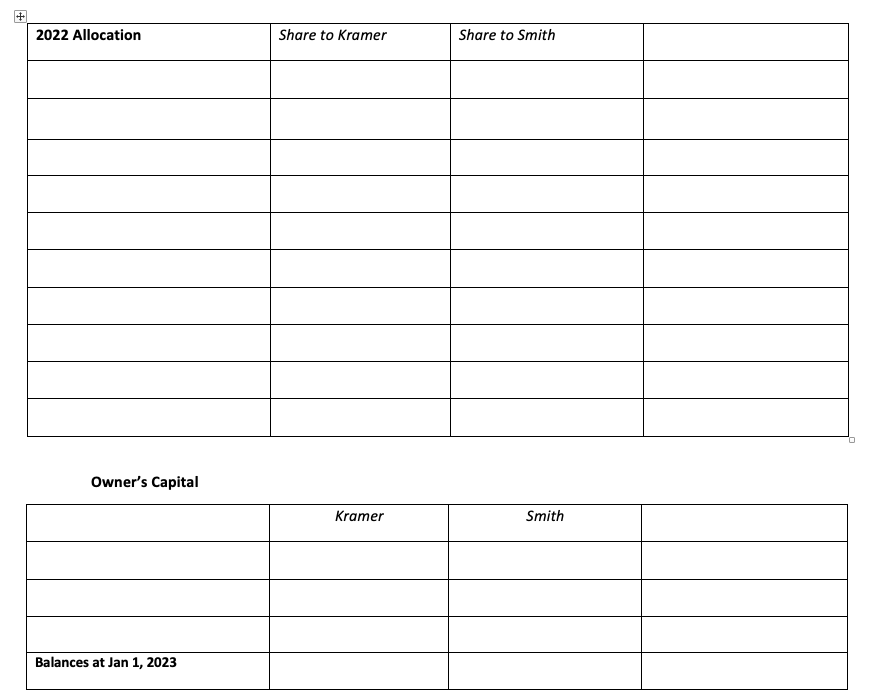

Question 1: On January 26, 2022, Ms. Kramer and Mr. Smith entered into a partnership together. Kramer contributed $90,000 cash and land valued at $60,000 while Smith contributed land valued at $50,000 and a building valued at $65,000. They agree to share profits as follows: - Kramer is to receive an annual "salary" of $50,000 if the partnership had a profit of 100K or more. If not, Kramer is to receive an annual "salary" of $25,000. Smith is to receive an annual "salary" of $10,000 regardless if the partnership is an income or loss position. - Each partner is to receive a 50% "interest" on his original capital investment, and any remaining profit or loss is to be shared equally. - On October 17,2022 , Kramer withdrew $50,000 and Smith Withdrew $18,000. - On November 10, 2022 Kramer deposited $25,000 into the partnership. - The company had net income of $250,000 at the end of 2022 . - The depreciation expense was $10,000 each year for 2022 . - There was a tax expense of $54,000. - The company closes its books on December 31. Required: Determine the amount of income each partner received in 2022 and their final owner's capital as at January 1, 2023. Owner's Capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started