Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help Autumn Music is considoring investing $725,000 in private lesson studos that wit have no residual value. The studios are expected to result in

pls help

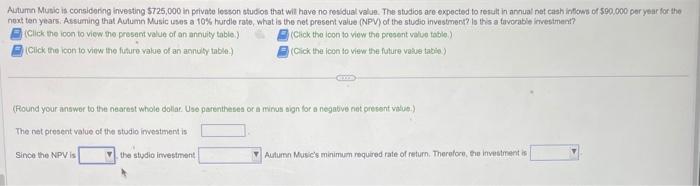

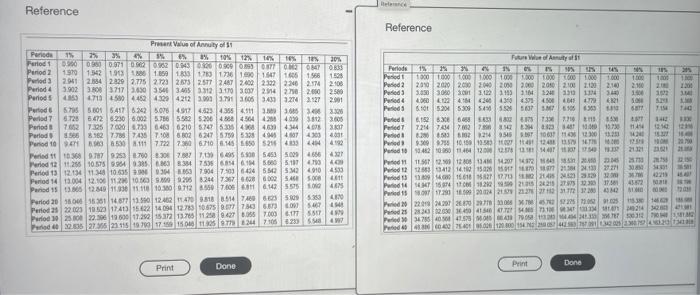

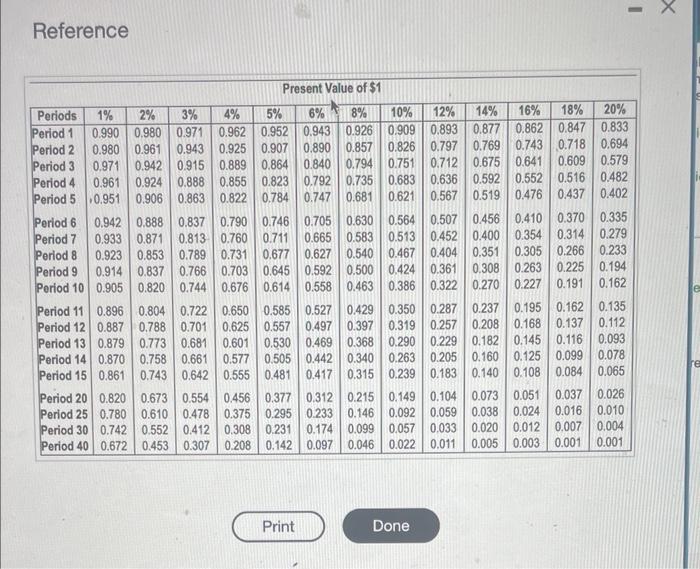

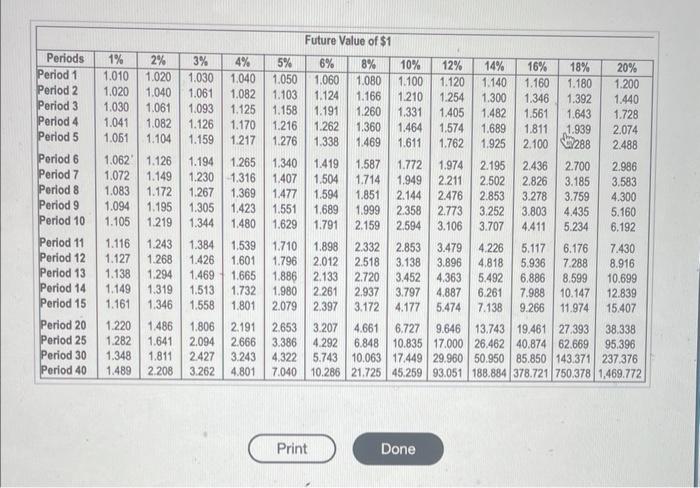

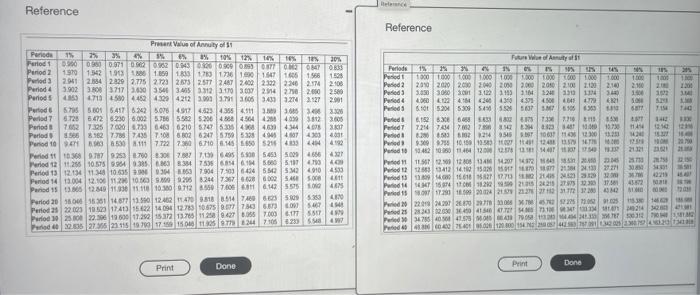

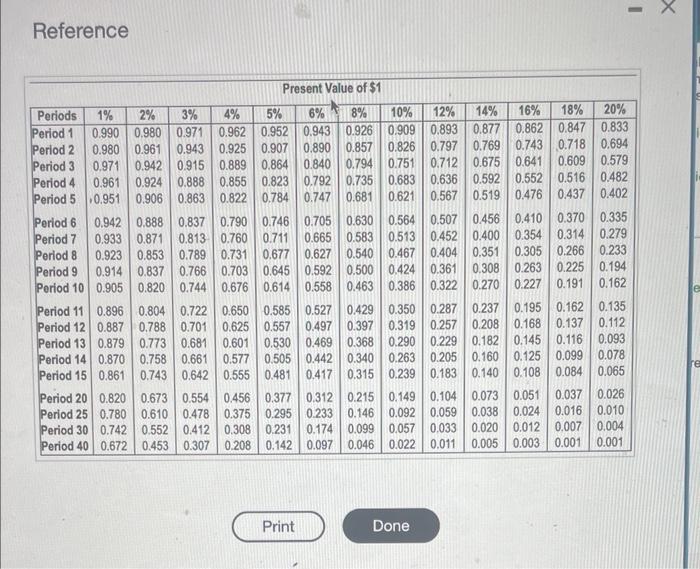

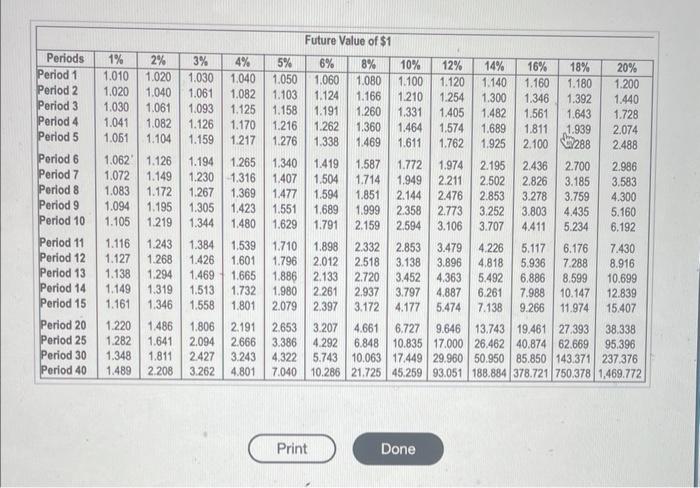

Autumn Music is considoring investing $725,000 in private lesson studos that wit have no residual value. The studios are expected to result in arnual net cash infiows of 590,000 per year for the noxt ten years: Assuming that Autumn Music uses a 10\% hurdle rate, what is the net present value (NPV) of the studio investment? is this a tavorable investment? (Cilck the icon to view the presant value of an annuity toble; (Click the icon to view the present vilue table) (Cick the icon to view the future value of an annuly table.) (Cick the icon to vies the future value tatio) (Round your answor to the nearest whole dollar. Use parentheses or a mirus sign for a negabve not orecent value.) The net present value of the studio investment is Since the NPV is the studio imestment Auturn Muscis minimum roquired rate of return. Therafore, te invesiment is Reference Reference Reference Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started