Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help due very soon!!! Bryan followed in his father's footsteps and entered into the carpet business. He owns and operates I Do Carpet (IDC).

pls help due very soon!!!

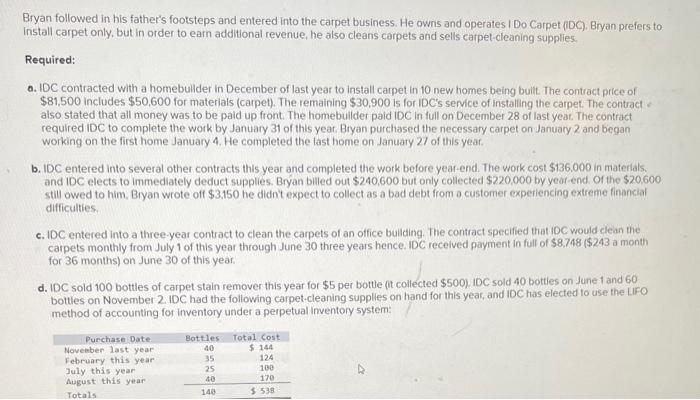

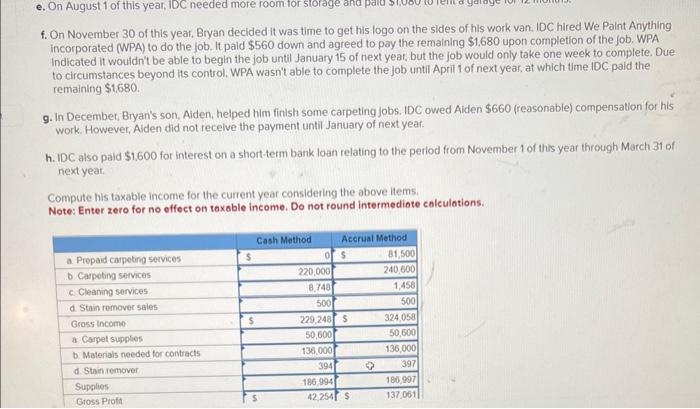

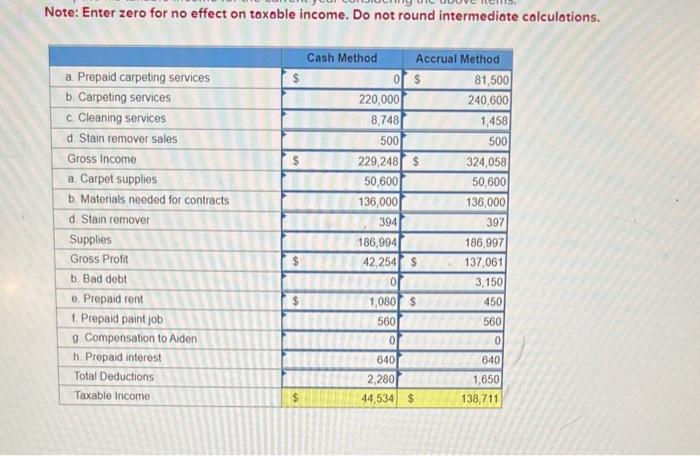

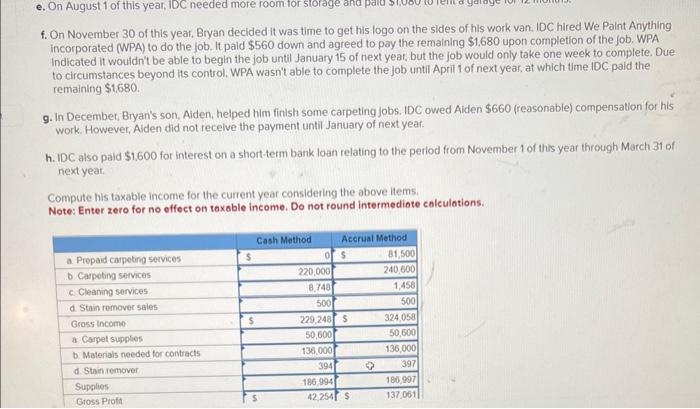

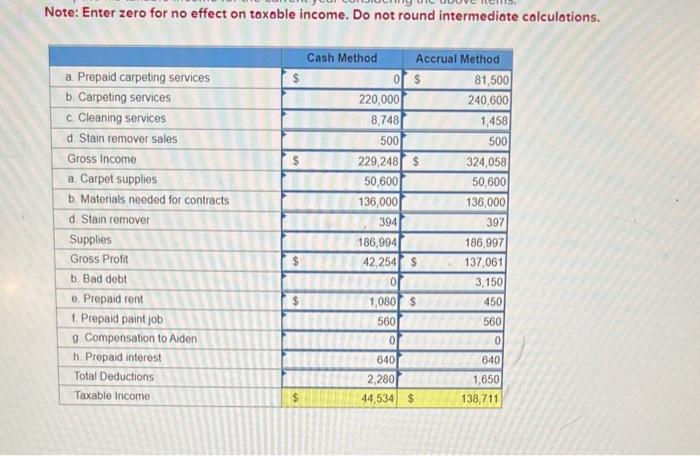

Bryan followed in his father's footsteps and entered into the carpet business. He owns and operates I Do Carpet (IDC). Bryan prefers to Install carpet only, but in order to earn additional revenue, he also cleans carpets and sells carpet-cleaning supplies. Required: a. IDC contracted with a homebulider in December of last year to install carpet in 10 new homes being bultt. The contract price of $81,500 includes $50,600 for materials (carpet). The remaining $30,900 is for iDC's service of installing the carpet. The contract) also stated that all money was to be pald up front. The homebulider paid IDC in full on December 28 of last yeat. The contract required IDC to complete the work by January 31 of this yeat. Bryan purchased the necessary carpet on January 2 and began working on the first home January 4 . He completed the last home on January 27 of this yeaf. b. IDC entered into several other contracts this year and completed the work before year-end. The work cost $136.000 in materlals. and 1DC elects to immediately deduct supplies. Bryan billed out $240,600 but only collected $220,000 by year-end. Of the $20,600 still owed to him, Bryan wrote off $3,150 he didn't expect to collect as a bad debt from a customer experiencing extreme financial difficulties. c. IDC entered into a three-year contract to clean the carpets of an office bulling. The contract specified that IDC would clean the carpets monthly from July 1 of this year through June 30 three years hence. IDC recelved payment in full of $8.748 ( $243 a month for 36 months) on June 30 of this year. d. IDC sold 100 bottles of carpet stain remover this year for $5 per bottle (it collected $500, 1DC sold 40 bottles on June 1 and 60 bottles on November 2. IDC had the following carpet-cleaning supplies on hand for this year, and IDC has elected to use the LIFO method of accounting for inventory under a perpetual inventory system: f. On November 30 of this year, Bryan decided it was time to get his logo on the sides of his work van. IDC hired We Paint Anything incorporated (WPA) to do the job. It pald $560 down and agreed to pay the remaining $1,680 upon completion of the job. WPA Indicated it wouldn't be able to begin the job until January 15 of next yeat, but the job would only take one week to complete. Due to circumstances beyond its control. WPA wasn't able to complete the job until April 1 of next year, at which time IDC paid the remaining $1,680. g. In December, Bryan's son, Aiden, helped him finish some carpeting jobs. IDC owed Aiden $660 (reasonable) compensation for his work. However, Aiden did not recelve the payment until January of next year. h. IDC also paid $1,600 for interest on a short-term bank loan relating to the period from November 1 of this year through March 31 of next year, Compute his taxable income for the current year considering the above liems. Note: Enter zero for no effect on taxable income. Do not round intermediate calculations. Note: Enter zero for no effect on taxable income. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started