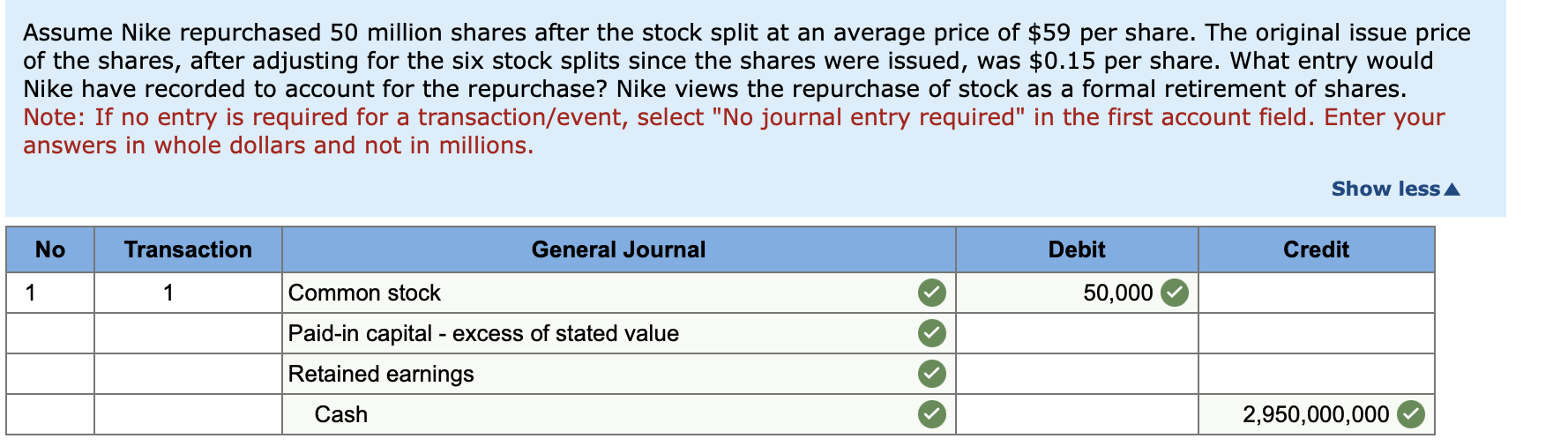

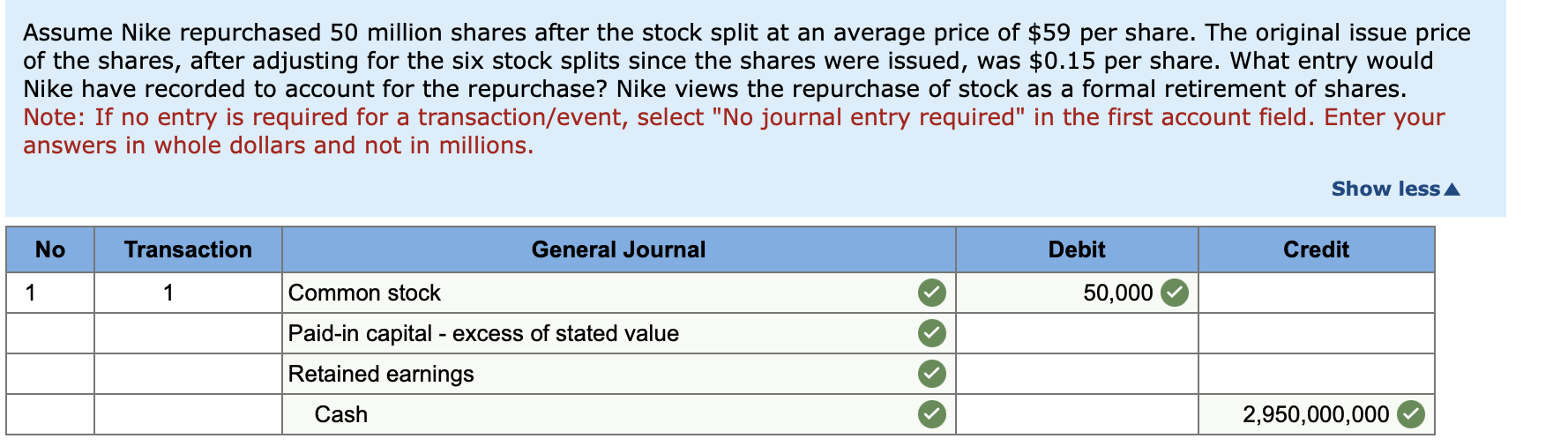

Pls help for question 2. I couldn't figure out the amount for "paid in capital - excess of stated value" and "retained earnings" to balance the journal entry

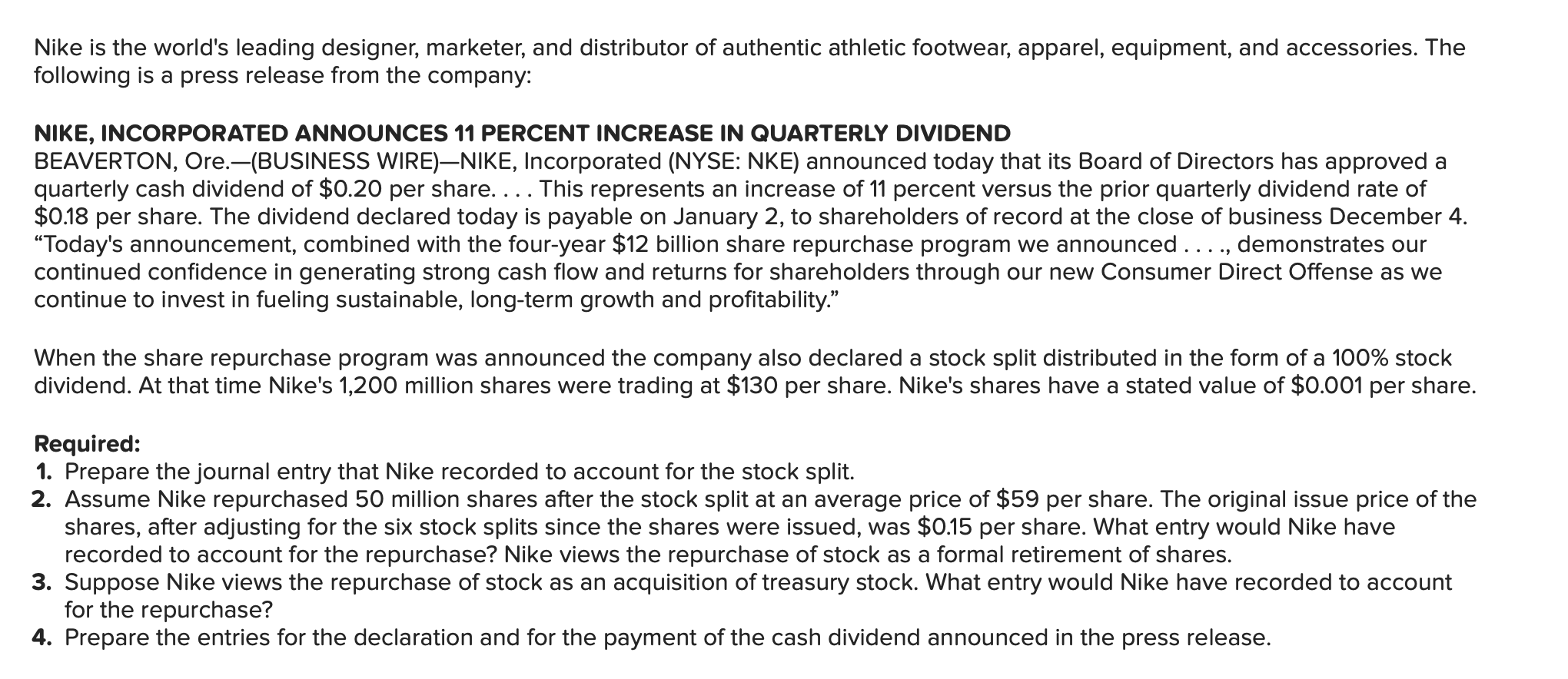

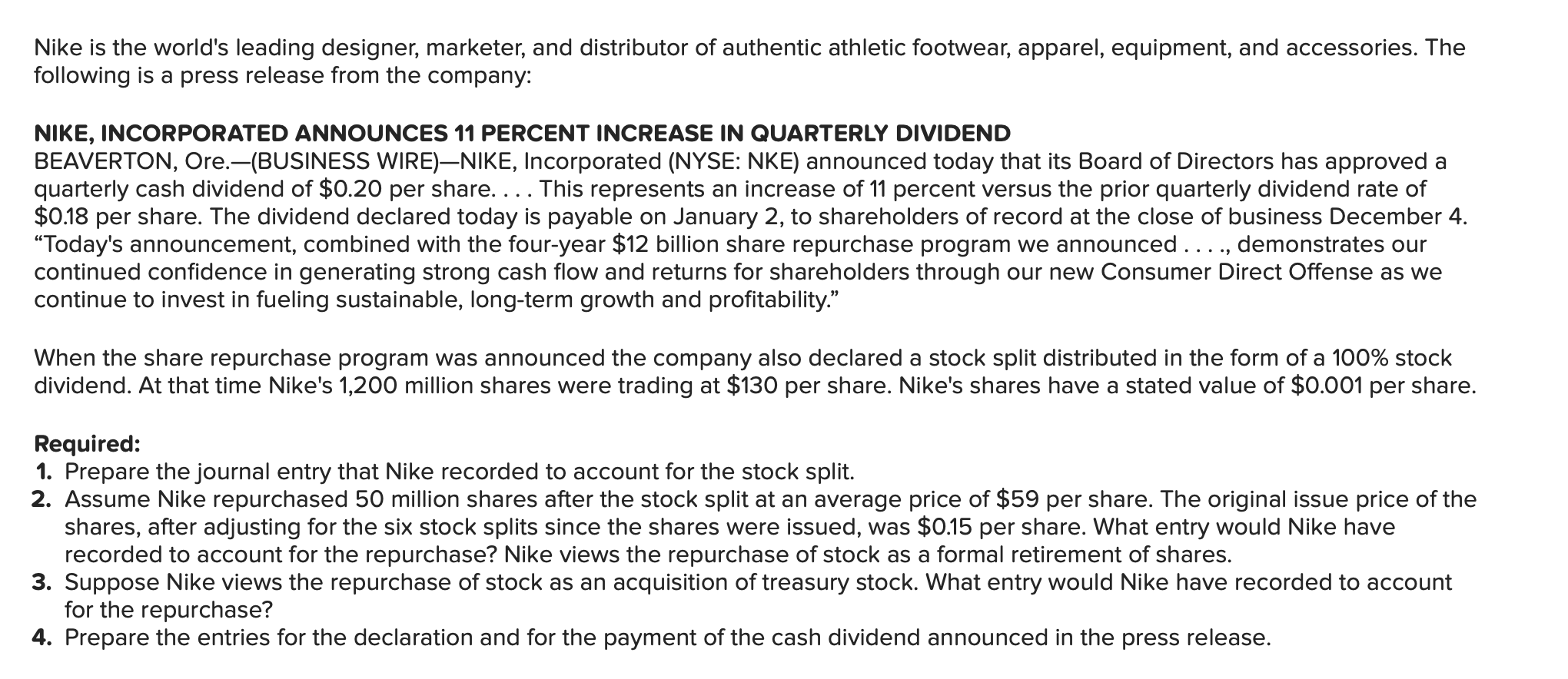

Nike is the world's leading designer, marketer, and distributor of authentic athletic footwear, apparel, equipment, and accessories. The following is a press release from the company: NIKE, INCORPORATED ANNOUNCES 11 PERCENT INCREASE IN QUARTERLY DIVIDEND BEAVERTON, Ore.-(BUSINESS WIRE)-NIKE, Incorporated (NYSE: NKE) announced today that its Board of Directors has approved a quarterly cash dividend of $0.20 per share... . This represents an increase of 11 percent versus the prior quarterly dividend rate of $0.18 per share. The dividend declared today is payable on January 2, to shareholders of record at the close of business December 4. "Today's announcement, combined with the four-year $12 billion share repurchase program we announced ...., demonstrates our continued confidence in generating strong cash flow and returns for shareholders through our new Consumer Direct Offense as we continue to invest in fueling sustainable, long-term growth and profitability." When the share repurchase program was announced the company also declared a stock split distributed in the form of a 100% stock dividend. At that time Nike's 1,200 million shares were trading at $130 per share. Nike's shares have a stated value of $0.001 per share. Required: 1. Prepare the journal entry that Nike recorded to account for the stock split. 2. Assume Nike repurchased 50 million shares after the stock split at an average price of $59 per share. The original issue price of the shares, after adjusting for the six stock splits since the shares were issued, was $0.15 per share. What entry would Nike have recorded to account for the repurchase? Nike views the repurchase of stock as a formal retirement of shares. 3. Suppose Nike views the repurchase of stock as an acquisition of treasury stock. What entry would Nike have recorded to account for the repurchase? 4. Prepare the entries for the declaration and for the payment of the cash dividend announced in the press release. Assume Nike repurchased 50 million shares after the stock split at an average price of $59 per share. The original issue price of the shares, after adjusting for the six stock splits since the shares were issued, was $0.15 per share. What entry would Nike have recorded to account for the repurchase? Nike views the repurchase of stock as a formal retirement of shares. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars and not in millions