Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help ok Jarve loves to bike. In fact, he has always tumed down better-paying jobs to work in bicycle shops where he gets an

pls help

ok

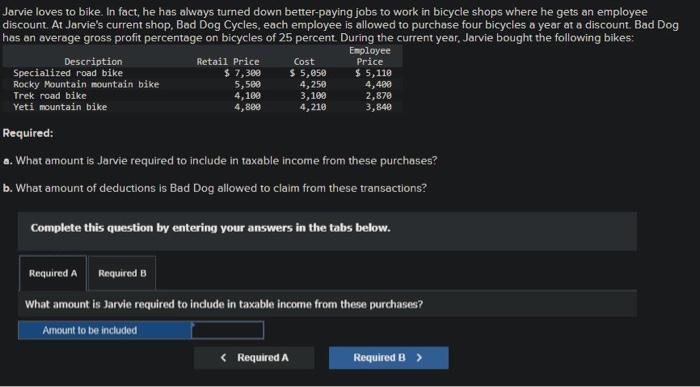

Jarve loves to bike. In fact, he has always tumed down better-paying jobs to work in bicycle shops where he gets an employee discount. At Jarvie's current shop. Bad Dog Cycles, each employee is allowed to purchase four bicycles a year at a discount. Bad Dog has an average gross profit percentage on bicycles of 25 percent. During the current year, Jarvie bought the following bikes: Required: a. What amount is Jarvie required to include in taxable income from these purchases? b. What amount of deductions is Bad Dog allowed to claim from these transactions? Complete this question by entering your answers in the tabs below. What amount is Jarvie required to indude in taxable income from these purchases? What amount of deductions is Bad Dog allowed to daim from these transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started