Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help on this in excel format thanks PORTFOLIO QUESTIONS Question Two AEF makes and sells three different food processor models, FP101, FP202 and FP303.

pls help on this in excel format thanks

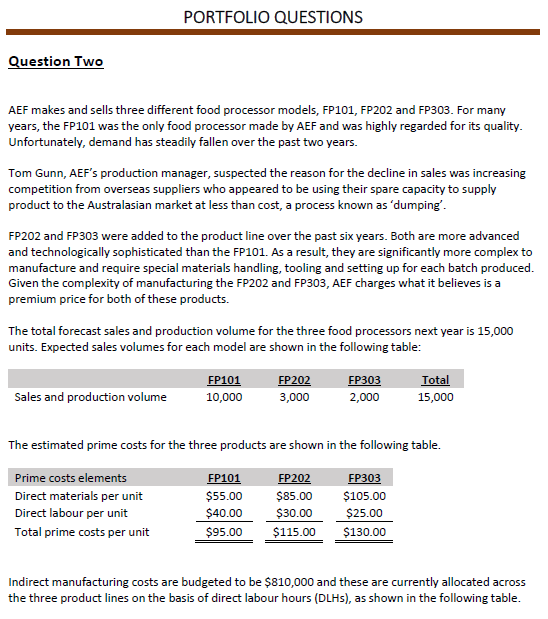

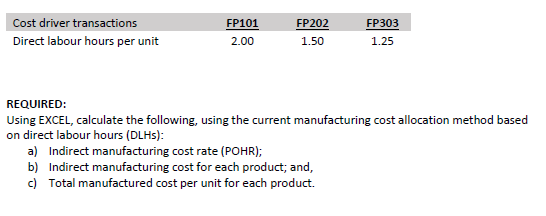

PORTFOLIO QUESTIONS Question Two AEF makes and sells three different food processor models, FP101, FP202 and FP303. For many years, the FP101 was the only food processor made by AEF and was highly regarded for its quality. Unfortunately, demand has steadily fallen over the past two years. Tom Gunn, AEF's production manager, suspected the reason for the decline in sales was increasing competition from overseas suppliers who appeared to be using their spare capacity to supply product to the Australasian market at less than cost, a process known as 'dumping'. FP202 and FP303 were added to the product line over the past six years. Both are more advanced and technologically sophisticated than the FP101. As a result, they are significantly more complex to manufacture and require special materials handling, tooling and setting up for each batch produced. Given the complexity of manufacturing the FP202 and FP303, AEF charges what it believes is a premium price for both of these products. The total forecast sales and production volume for the three food processors next year is 15,000 units. Expected sales volumes for each model are shown in the following table: Sales and production volume FP101 10,000 FP202 3,000 FP303 2,000 Total 15,000 The estimated prime costs for the three products are shown in the following table. Prime costs elements Direct materials per unit Direct labour per unit Total prime costs per unit FP101 $55.00 $40.00 $95.00 FP202 $85.00 $30.00 $115.00 FP303 $105.00 $25.00 $130.00 Indirect manufacturing costs are budgeted to be $810,000 and these are currently allocated across the three product lines on the basis of direct labour hours (DLHs), as shown in the following table. FP101 FP202 Cost driver transactions Direct labour hours per unit FP303 1.25 2.00 1.50 REQUIRED: Using EXCEL, calculate the following, using the current manufacturing cost allocation method based on direct labour hours (DLHs): a) Indirect manufacturing cost rate (POHR); b) Indirect manufacturing cost for each product; and, c) Total manufactured cost per unit for each productStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started