Answered step by step

Verified Expert Solution

Question

1 Approved Answer

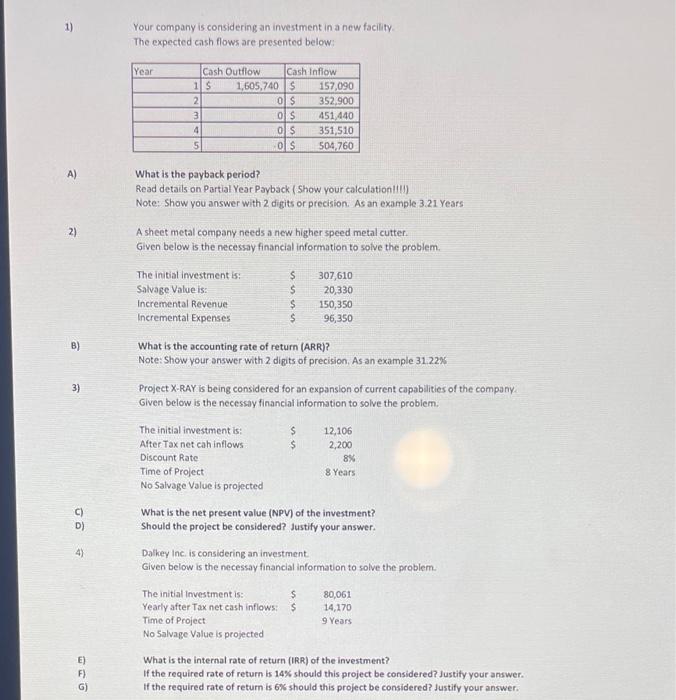

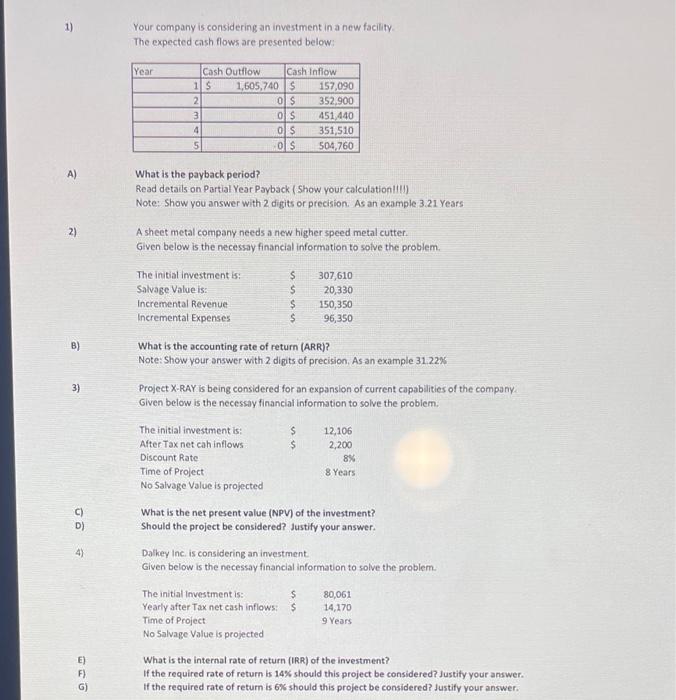

pls help solve all parts Your company is considering an investment in a new facility. The expected cash flows are presented below: What is the

pls help

solve all parts

Your company is considering an investment in a new facility. The expected cash flows are presented below: What is the payback period? Read details on Partial Year Payback (Show your calculationllil) Note: Show you answer with 2 digits or precision. As an example 3.21 Years A sheet metal company needs a new higher speed metal cutter. Given below is the necessay financial information to solve the problem. What is the accounting rate of return (ARR)? Note: Show your answer with 2 digits of precision. As an example 31.22% Project X-RAY is being considered for an expansion of current capabilities of the company. Given below is the necessiy financial information to solve the problem. What is the net present value (NPV) of the investment? Should the project be considered? Justify your answer. Dalkey inc. is considering an imvestment Given below is the necessay financial information to solve the problem. What is the internal rate of return (IRR) of the investment? If the required rate of return is 14% should this project be considered? Justity your answer. If the required rate of return is 6% should this project be considered? Justify your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started