Answered step by step

Verified Expert Solution

Question

1 Approved Answer

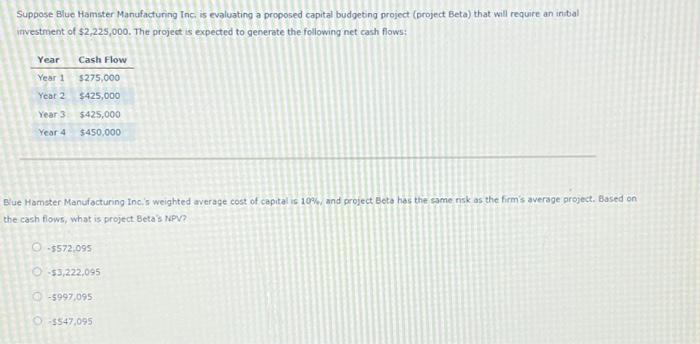

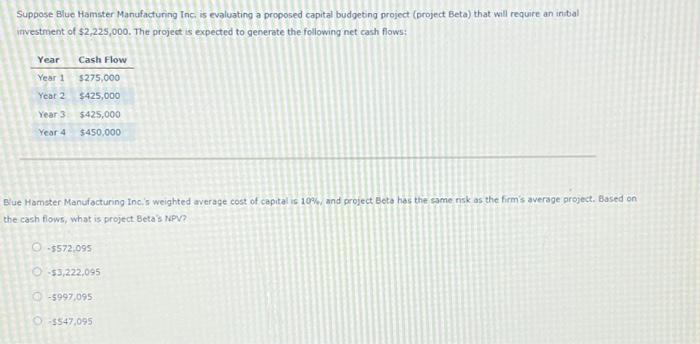

pls help Suppose Blue Hamster Manufacturing Inc is evaluating a proposed capital budgeting project (project Beta) that will require an intibl investment of $2,225,000. The

pls help

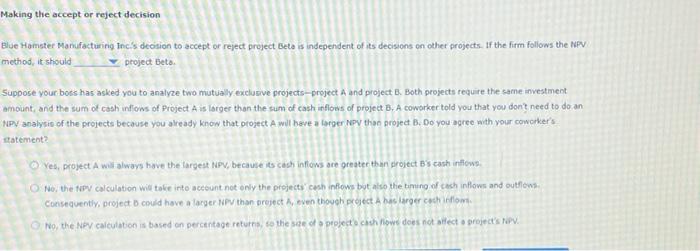

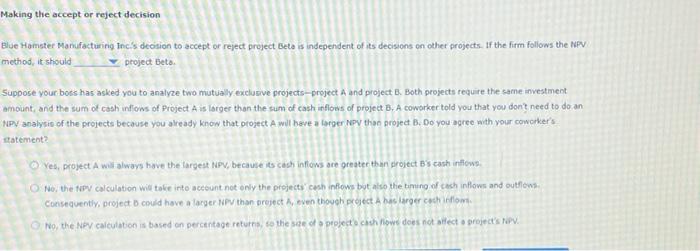

Suppose Blue Hamster Manufacturing Inc is evaluating a proposed capital budgeting project (project Beta) that will require an intibl investment of $2,225,000. The project is expected to generate the following net cash flows: We Hamster Manufacturing Incis weighted average cost of capital is 10% and project Beto has the same nisk as the firm's average project. Based on he cash flows, what is project Beta's nev? 5572,09553,222,0955997,0955547,095 aking the accept or reject decision ye Hamster Mamufacturing Inci's deoision to accept or reject project Leta is independent of its decisions on other projects. If the firm follows the MPN ecthod, it shouid ptoject bets. uppose your bods has asked you to analyze two mistually exclusve projects-project A and project B. Both projects require the carne anestinent mount, and the sum of cash inflows of Project A is larger than the sum of cash inflows of project B. A coworker told you that you don't need to do an Py analysis of the projects because you already know that project A wil here a larger Noy than project B. Do you:agree nith your cowcrker's tatement? Yes, project A will always have the Largest Rpv, becavie its cach infiows are greater than groject Bis cash inflows. No. the forv calculation wie take into acceunt not only the projects' cesh inflows bot also the timing of cech inflows and outflows Consequently project b could have a larger Wfy than preject d, even thouch preject a has larger costh inflomis. Woy the Ney calculation is based on percentage returns, se the sie of a pepject cuth fipwe dees not anect a project's forv. Suppose Blue Hamster Manufacturing Inc is evaluating a proposed capital budgeting project (project Beta) that will require an intibl investment of $2,225,000. The project is expected to generate the following net cash flows: We Hamster Manufacturing Incis weighted average cost of capital is 10% and project Beto has the same nisk as the firm's average project. Based on he cash flows, what is project Beta's nev? 5572,09553,222,0955997,0955547,095 aking the accept or reject decision ye Hamster Mamufacturing Inci's deoision to accept or reject project Leta is independent of its decisions on other projects. If the firm follows the MPN ecthod, it shouid ptoject bets. uppose your bods has asked you to analyze two mistually exclusve projects-project A and project B. Both projects require the carne anestinent mount, and the sum of cash inflows of Project A is larger than the sum of cash inflows of project B. A coworker told you that you don't need to do an Py analysis of the projects because you already know that project A wil here a larger Noy than project B. Do you:agree nith your cowcrker's tatement? Yes, project A will always have the Largest Rpv, becavie its cach infiows are greater than groject Bis cash inflows. No. the forv calculation wie take into acceunt not only the projects' cesh inflows bot also the timing of cech inflows and outflows Consequently project b could have a larger Wfy than preject d, even thouch preject a has larger costh inflomis. Woy the Ney calculation is based on percentage returns, se the sie of a pepject cuth fipwe dees not anect a project's forv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started