Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help with both ?'s First National Bank has new loan requests of $155 million, needs to purchase $50 million in U.S. Treasury securities to

pls help with both ?'s

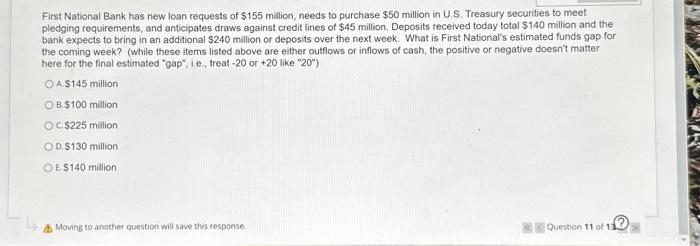

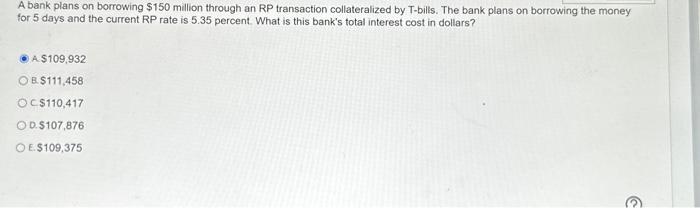

First National Bank has new loan requests of $155 million, needs to purchase $50 million in U.S. Treasury securities to meet pledging requirements, and anticipates draws against credit lines of $45 million. Deposits received today total $140 million and the bank expects to bring in an additional $240 million or deposits over the next week. What is First National's estimated funds gap for the coming week? (while these items listed above are either outflows or inflows of cash, the positive or negative doesn't matter here for the final estimated "gap", i.e., treat - 20 or +20 like " 20 ) A. $145 million B. $100 million c $225 million D. $130 million E. $140 million A Moving to another question will save this response Question 11 of 1 ? A bank plans on borrowing $150 million through an RP transaction collateralized by T-bills. The bank plans on borrowing the money for 5 days and the current RP rate is 5.35 percent. What is this bank's total interest cost in dollars? A. $109,932 B. $111,458 C. $110,417 D. $107,876 E. $109,375

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started