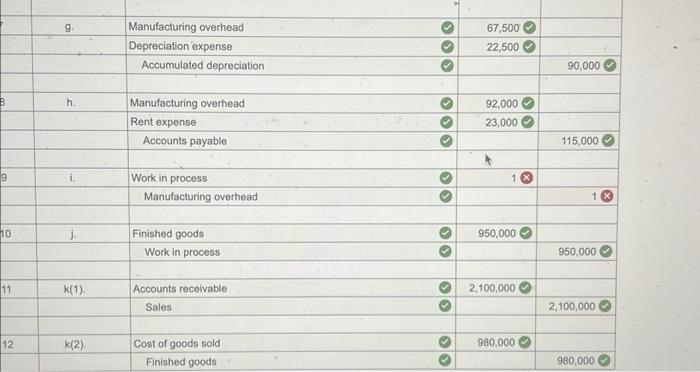

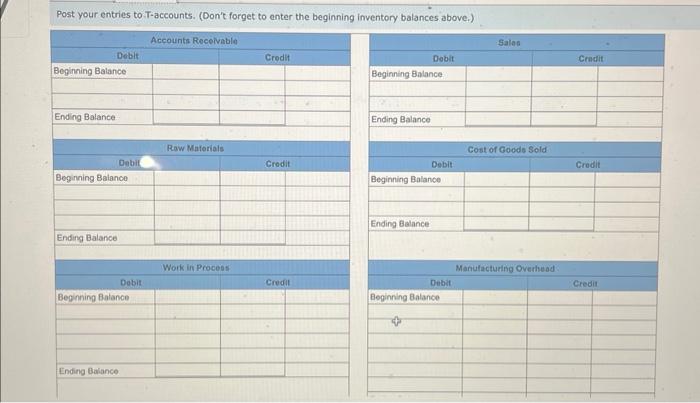

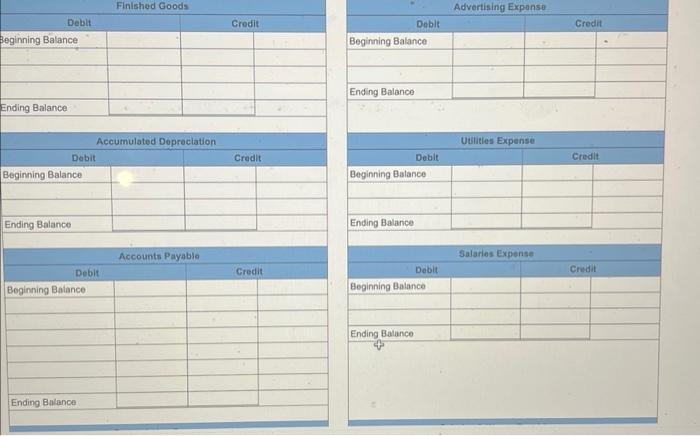

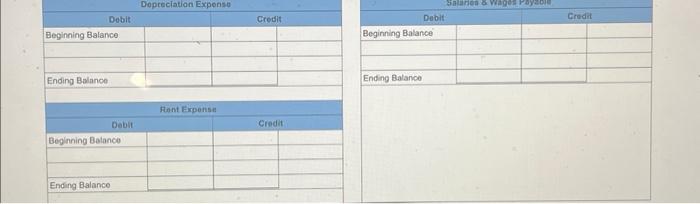

pls help with the t-charts and everything that is marked in red

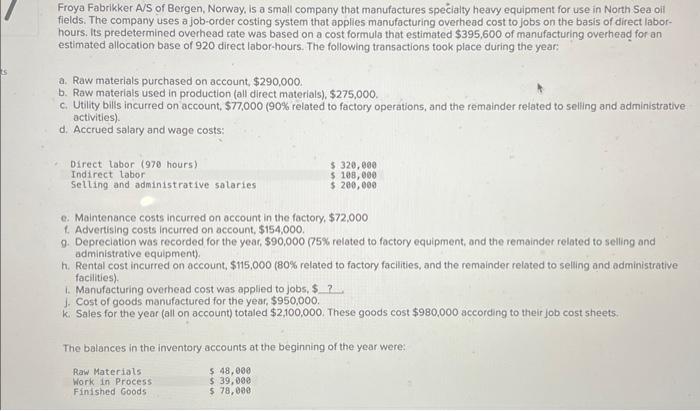

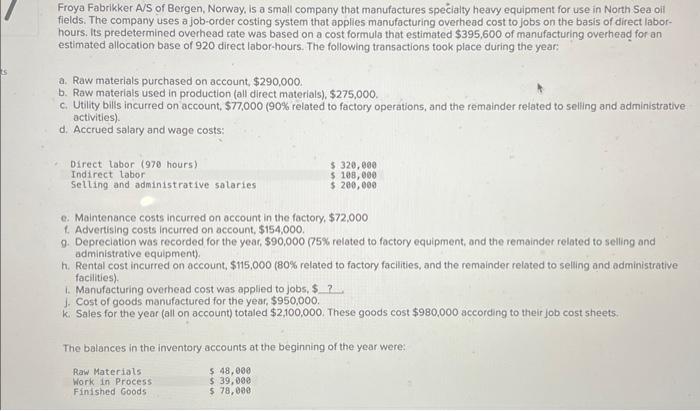

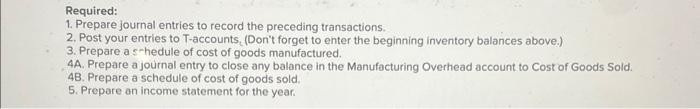

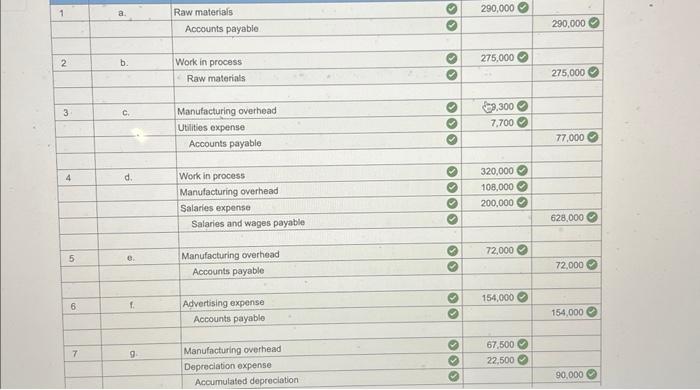

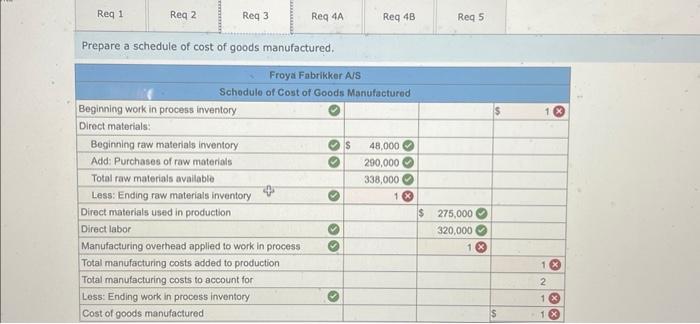

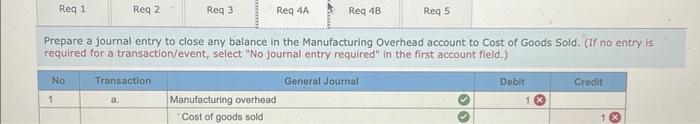

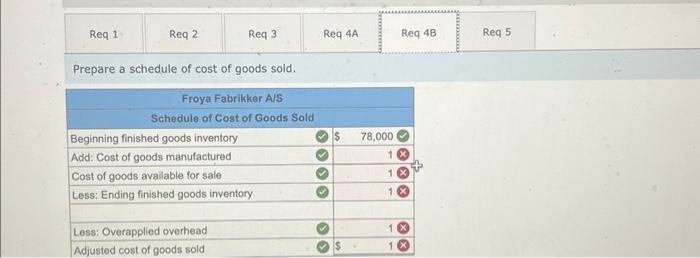

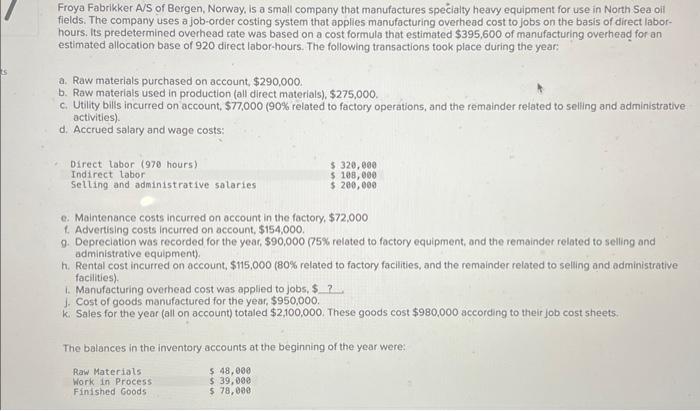

Froya Fabrikker A/S of Bergen, Norway, is a small company that manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct laborhours. its predetermined overhead rate was based on a cost formula that estimated $395,600 of manufacturing overhead for an estimated allocation base of 920 direct labor-hours. The following transactions took place during the year: a. Raw materials purchased on account, $290,000. b. Raw materials used in production (all direct materials), $275,000. c. Utility bilts incurred on account, $77,000 ( 90% related to factory operations, and the remainder related to selling and administrative activities). d. Accrued salary and wage costs: e. Maintenance costs incurred on account in the factory, $72,000 f. Advertising costs incurred on account, $154,000. 9. Depreciation was recorded for the year, $90,000(75% related to factory equipment, and the remainder related to selling and administrative equipment). h. Rental cost incurred on account, $115,000(80% related to factory facilities, and the remainder related to selling and administrative facilities). 1. Manufacturing overhead cost was applied to jobs, $ ? 1. Cost of goods manufactured for the year, $950,000. k. Sales for the year (all on account) totaled $2,100,000. These goods cost $980,000 according to their job cost sheets. Required: 1. Prepare journal entries to record the preceding transactions. 2. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) 3. Prepare a sthedule of cost of goods manufactured. 4A. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4B. Prepare a schedule of cost of goods sold. 5. Prepare an income statement for the year. Post your entries to T-accounts. (Don't forget to enter the beginning inventory balances above.) Flnished Goods Advertising Exponse \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Deblt } & \multicolumn{2}{|c|}{ Credit } \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Endinning Balance * Balance & & & \\ \hline & & & \\ \hline \end{tabular} Accumulated Depreciation \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & & \multicolumn{1}{|c|}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Doblt } & \multicolumn{2}{c|}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & \\ \hline \multirow{2}{*}{c} & & \\ \hline \end{tabular} Prepare a schedule of cost of goods manufactured. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. (If no entr. required for a transaction/event, select "No journal entry required" in the first account field.) Prepare a schedule of cost of goods sold