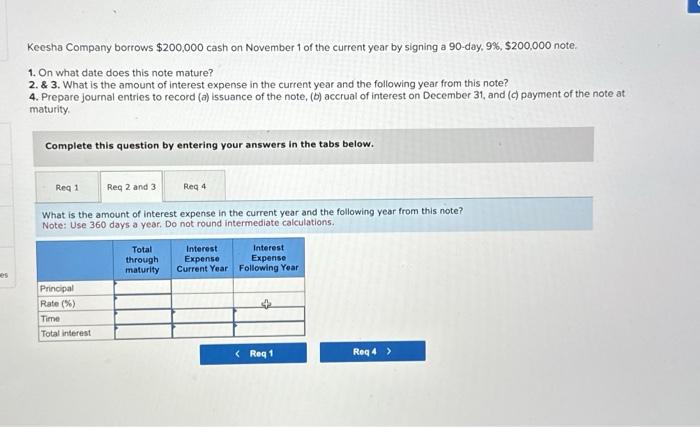

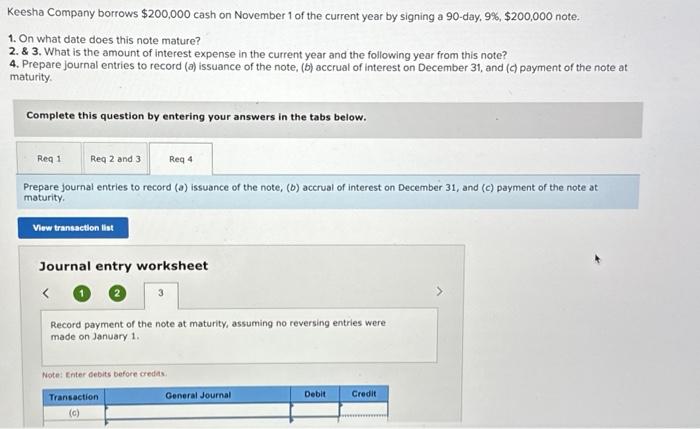

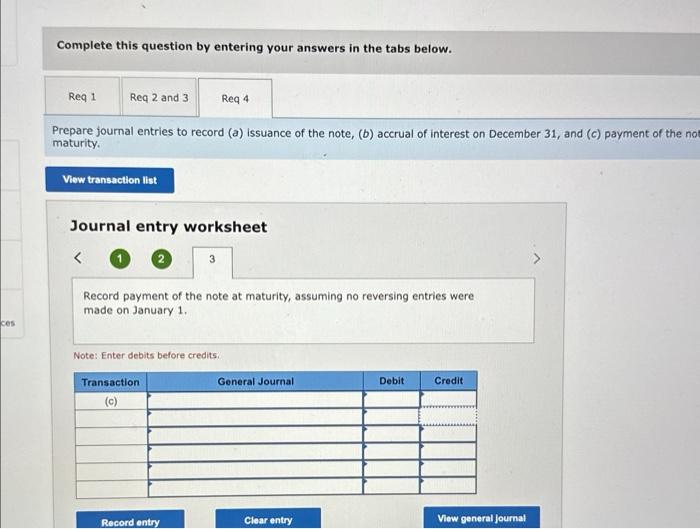

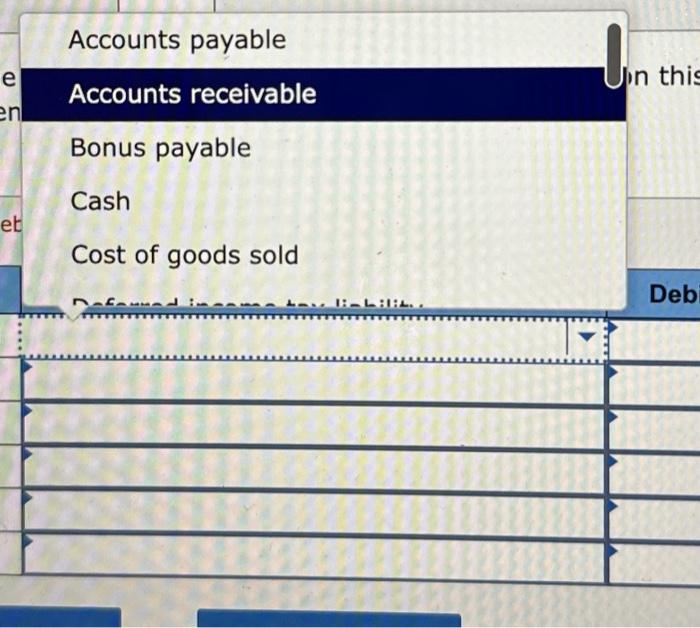

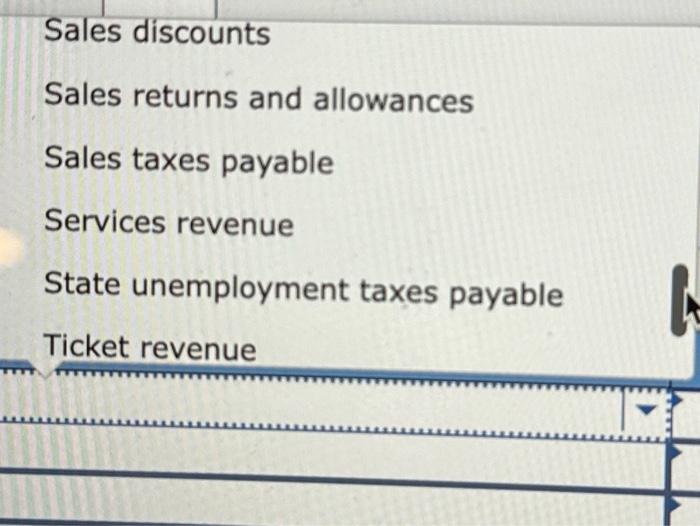

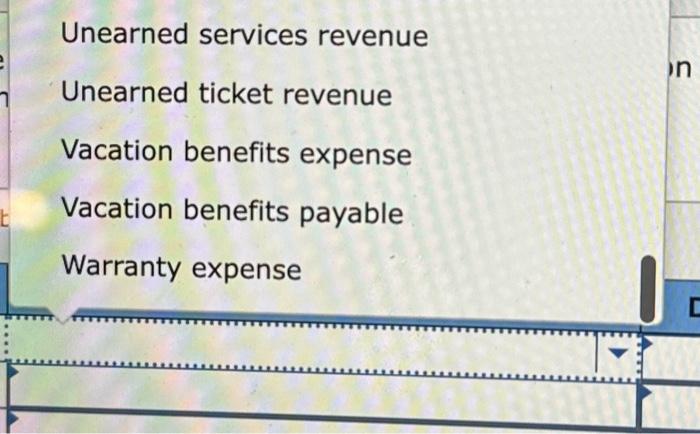

Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90 -day, 9%,$200,000 note. 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note a maturity. Complete this question by entering your answers in the tabs below. What is the amount of interest expense in the current year and the following year from this note? Note: Use 360 days a year, Do not round intermediate calculations. Keesha Company borrows $200,000 cash on November 1 of the current year by signing a 90 -day, 9%,$200,000 note. 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at maturity. Journal entry worksheet Record payment of the note at maturity, assuming no reversing entries were made on January 1. Note: Cnter Gebits before credas. Complete this question by entering your answers in the tabs below. Prepare journal entries to record (a) issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the no maturity. Journal entry worksheet Record payment of the note at maturity, assuming no reversing entries were made on January 1. Note: Enter debits before credits. Accounts payable Accounts receivable Bonus payable Cash Cost of goods sold Deferred income tax liability Employee benefits plan payable Employee bonus expense Employee federal income taxes payable Employee life insurance payable Emnlovee medical insurance navable Employee union dues payable Estimated warranty liability Federal unemployment taxes payable FICA-Medicare taxes payable Income taxes expense Income taxes payable Interest expense Interest payable Interest receivable Interest revenue Merchandise inventory Notes payable Notes receivable Parts inventory Payroll taxes expense Salaries expense Salaries payable Sales Sales discounts Sales returns and allowances Sales taxes payable Services revenue State unemployment taxes payable Ticket revenue Unearned services revenue Unearned ticket revenue Vacation benefits expense Vacation benefits payable Warranty expense