Answered step by step

Verified Expert Solution

Question

1 Approved Answer

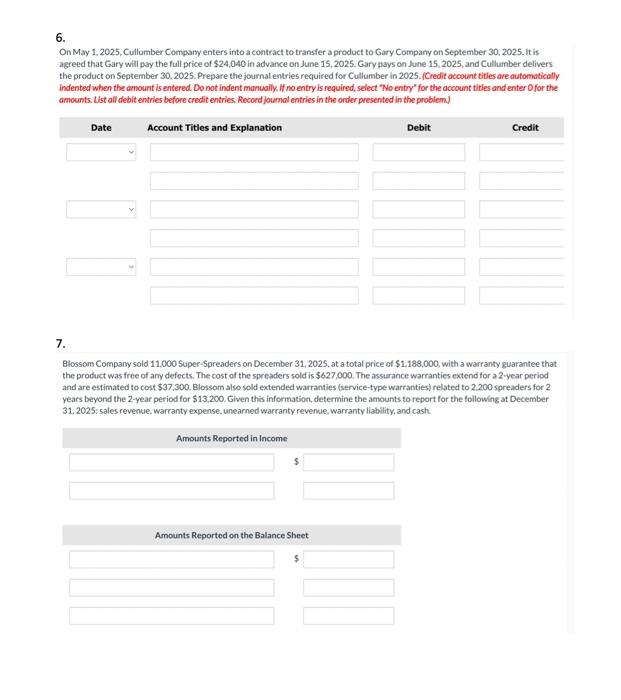

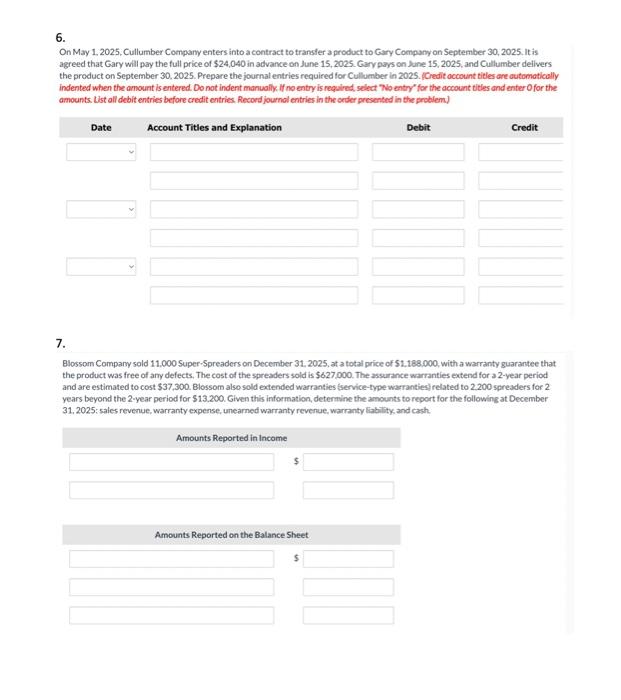

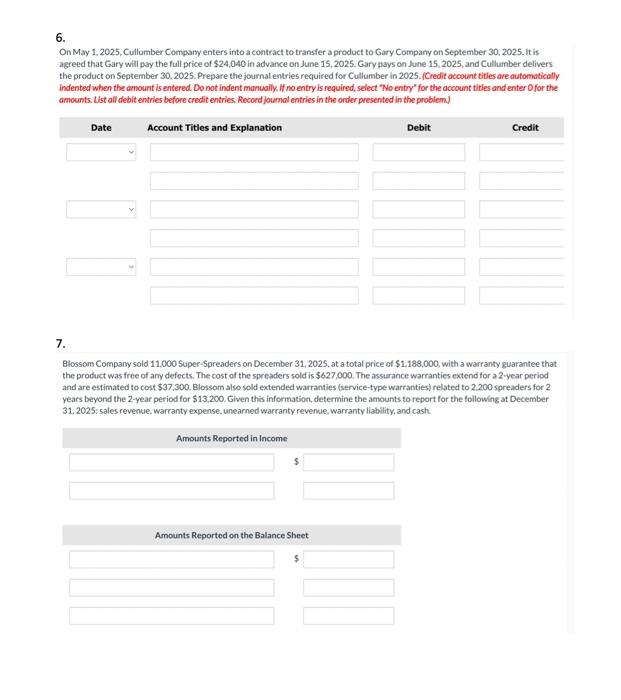

pls helps 6. On May 1, 2025, Cullumber Company enters into a contract to transfer a product to Gary Company on September 30, 2025. It

pls helps

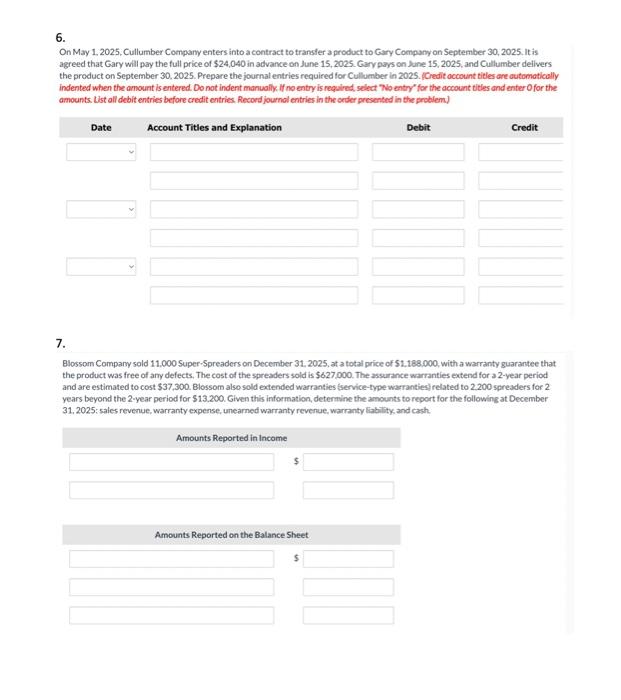

6. On May 1, 2025, Cullumber Company enters into a contract to transfer a product to Gary Company on September 30, 2025. It is agreed that Gary will pay the full price of $24,040 in advance on June 15, 2025. Gary pays on June 15, 2025, and Cullumber delivers the product on September 30, 2025. Prepare the journal entries required for Cullumber in 2025. (Credit account tities are automatically indented when the amount is entered. Do not indent manually if no entry is required, select "No entry" for the account titles and enter Ofor the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem. 7. Blossom Company sold 11,000 Super-Spreaders on December 31,2025, at a total price of $1,188,000, with a warranty guarantee that the product was free of any defects. The cost of the spreaders sold is $627,000. The assurance warranties extend for a 2 -year period and are estimated to cost $37,300. Blossom also sold extended warranties (service-type warranties) related to 2.200 spreaders for 2 years beyond the 2 -year period for $13,200. Given this information, determine the amounts to report for the following at December 31, 2025: sales revenue, warranty expense, unearned warranty revenue, warranty liahlity, and cash. 6. On May 1. 2025. Cullumber Company enters into a contract to transfer a product to Gary Company on September 30, 2025, it is agreed that Gary will pay the full price of $24,040 in advance on June 15, 2025. Gary pays on June 15, 2025, and Cullumber dellvers the product on September 30, 2025. Prepare the journal entries required for Cullumber in 2025. (Credit occount tieles are cutomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter Ofor the amounts. List ali debit entries before credit entries. Record journal entries in the order presented in the problem.) 7. Blossom Company sold 11,000 Super-Spreaders on December 31, 2025, at a total price of 51,188,000, with a warranty guarantee that the product was free of any defects. The cost of the spreaders sold is $6,27,000. The assurance warranties extend for a 2-year period and are estimated to cost $37,300. Blossom also sold extended warranties (service-type warranties) related to 2.200 spreaders for 2 years beyond the 2 -year period for $13.200. Given this information, deternine the amounts to report for the following at December 31, 2025: sales revenue, warranty expense, unearned warranty revenue, warranty liability and cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started