Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls hurryyy thankss Which statement is INCORRECT? If a bond sells at discount then coupon rate > current yield and current yield > yield-to-Maturity. If

pls hurryyy thankss

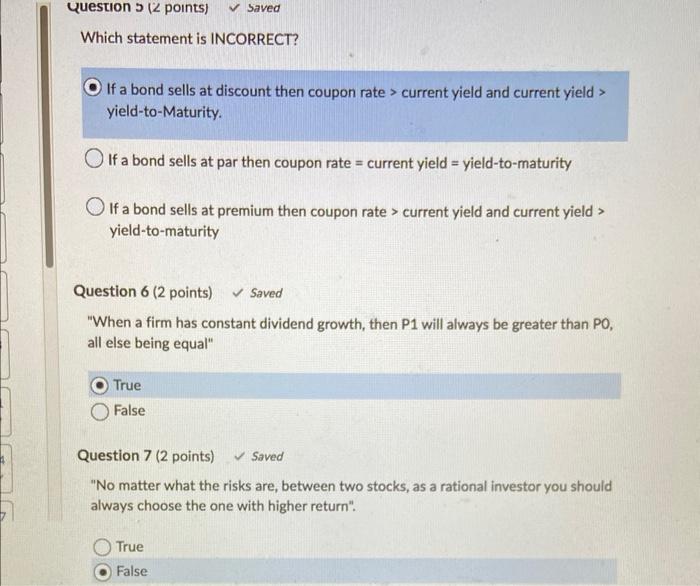

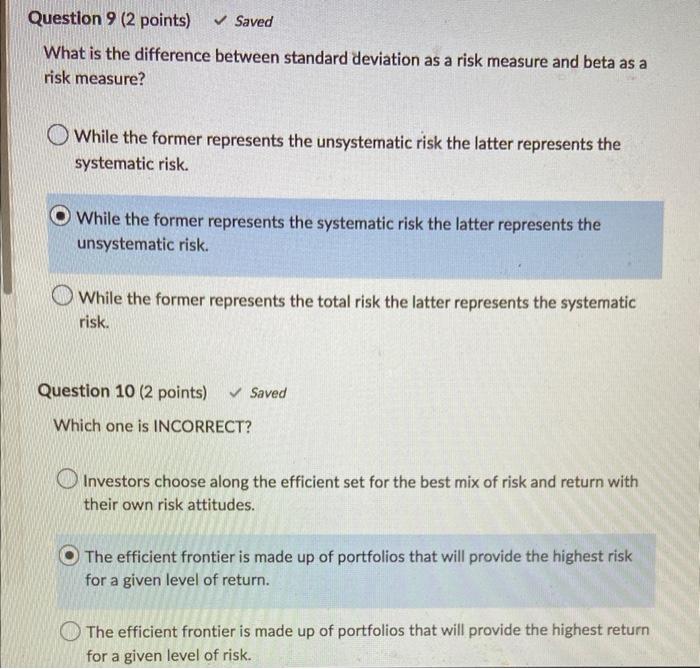

Which statement is INCORRECT? If a bond sells at discount then coupon rate > current yield and current yield > yield-to-Maturity. If a bond sells at par then coupon rate = current yield = yield-to-maturity If a bond sells at premium then coupon rate > current yield and current yield > yield-to-maturity Question 6 (2 points) Saved "When a firm has constant dividend growth, then P1 will always be greater than PO, all else being equal" True False Question 7 (2 points) Saved "No matter what the risks are, between two stocks, as a rational investor you should always choose the one with higher return". True False What is the difference between standard deviation as a risk measure and beta as a risk measure? While the former represents the unsystematic risk the latter represents the systematic risk. While the former represents the systematic risk the latter represents the unsystematic risk. While the former represents the total risk the latter represents the systematic risk. Question 10 (2 points) Saved Which one is INCORRECT? Investors choose along the efficient set for the best mix of risk and return with their own risk attitudes. The efficient frontier is made up of portfolios that will provide the highest risk for a given level of return. The efficient frontier is made up of portfolios that will provide the highest return for a given level of risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started